Watch Last Night’s Webinar

If you missed last night’s webinar, then catch up by watching it here.

If you missed last night’s webinar, then catch up by watching it here.

Leon will be hosting our next webinar tonight at 7pm. Please register, so we can send you the link, 15 minutes before it commences.

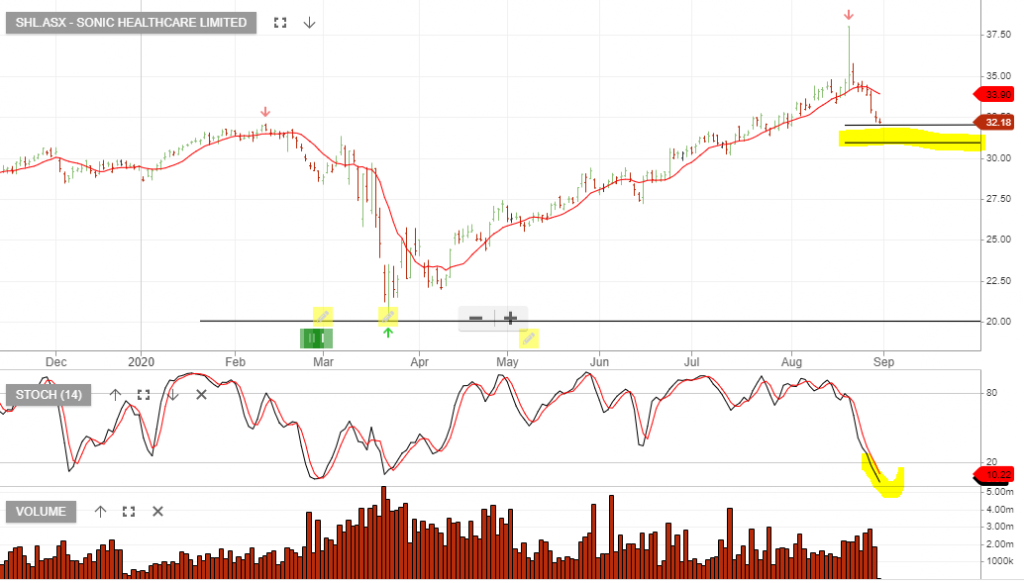

Sonic has corrected from $38 down to $32 and we expect to soon see buying interest rebuild.

Look for the short-term momentum indicators to turn higher within the price range indicated on the chart below.

Bega Cheese is under Algo Engine buy conditions following the recent signal at $4.50.

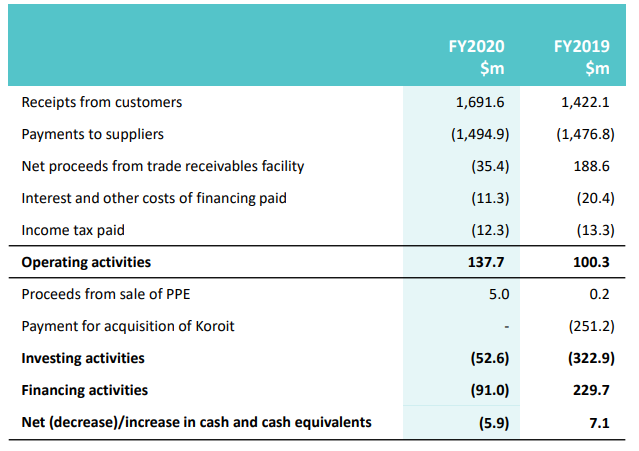

FY20 Full year earnings exceeded consensus and the key numbers are;

Revenue increased by 5% to $1.5 billion

Operating cash flow $138 million

Net debt reduction by $52 million to $236 million

Export sales increased 15% to $523 million

Inventory reduction by $15 million to $257 million

Normalised EBITDA decreased by 2% to $103.0 million

Buy Ramsay Health Care within the $61 – $65 price range.

1H20 earnings are lower due to a reduction in sales of petrol and jet fuel.

Look for buying interest to rebuild within the $25 – $26.50 price range.

Despite disruptions from COVID-19 Cleanaway reported an underlying EBITDA of $516m, up 12% on the same time last year.

FY21 EPS growth is forecast to increase by 2 – 3%, placing the stock on a forward yield of 1.8%.

The valuation is looking expensive at 30x earnings, however, the defensive exposure remains attractive in a low yield environment and the balance sheet is in good shape.

Afterpay is under Algo Engine buy conditions after generating the first of a series of buy signals starting in November 2019.

FY20 sales $11bn, income $519m, EBITDA $44m and the net loss after tax $23m.

Momentum continued into 1H21 as expected and active customers increased to 10m.

Market cap now stands at more than 30x forward revenue.

ASX200 valuations remain stretched at 20x earnings. The All Industrials Ex-Financials is now trading 30x. Meanwhile, earnings still lack growth.

EPS growth for FY20 is negative 20% and FY21 EPS growth is likely to be flat.

Or start a free thirty day trial for our full service, which includes our ASX Research.