Next Dc – FY20 Result

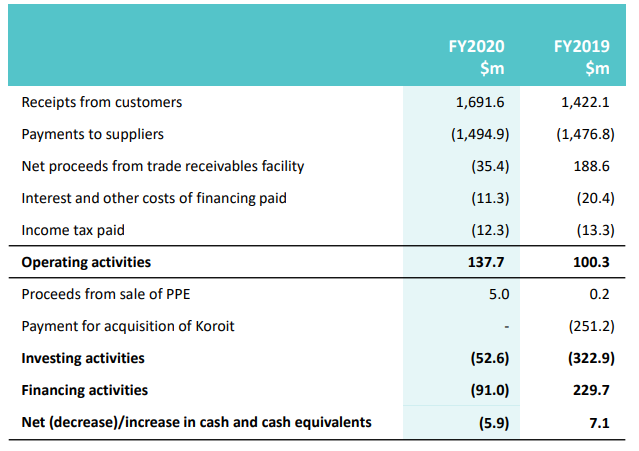

Nextdc FY20 revenue $200m, EBITDA $104m and EPS negative $0.12. Nil dividend.

Excluding depreciation and amortization add-backs, NXT operates at a loss. We continue to monitor the recent claim made by a fund manager, regarding the questionable accounting standards adopted by the company.

NXT is now guiding to FY21 revenue to be in the range of $240m – $250m.