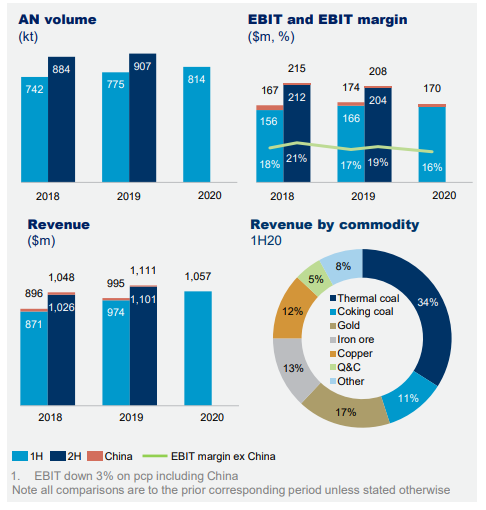

ASX – August Volumes

ASX is under Algo Engine buy conditions.

August cash equity volumes and average daily futures contract volumes were well down on the same time last year, -13% and -19% respectively.

FY21 earnings are likely to be flat at best and with the stock on a forward yield of 2.8%, we see it as “fully valued”. Owning the stock and selling an at the money covered call option is generating 8% cash flow.

We see value in buying ASX on any market weakness.