Ramsay Healthcare – Buy

Buy Ramsay Health Care within the $61 – $65 price range.

Buy Ramsay Health Care within the $61 – $65 price range.

1H20 earnings are lower due to a reduction in sales of petrol and jet fuel.

Look for buying interest to rebuild within the $25 – $26.50 price range.

Despite disruptions from COVID-19 Cleanaway reported an underlying EBITDA of $516m, up 12% on the same time last year.

FY21 EPS growth is forecast to increase by 2 – 3%, placing the stock on a forward yield of 1.8%.

The valuation is looking expensive at 30x earnings, however, the defensive exposure remains attractive in a low yield environment and the balance sheet is in good shape.

Afterpay is under Algo Engine buy conditions after generating the first of a series of buy signals starting in November 2019.

FY20 sales $11bn, income $519m, EBITDA $44m and the net loss after tax $23m.

Momentum continued into 1H21 as expected and active customers increased to 10m.

Market cap now stands at more than 30x forward revenue.

ASX200 valuations remain stretched at 20x earnings. The All Industrials Ex-Financials is now trading 30x. Meanwhile, earnings still lack growth.

EPS growth for FY20 is negative 20% and FY21 EPS growth is likely to be flat.

Alumina is under Algo Engine buy conditions and is a current holding in our ASX 100 model.

We recently focused on adding AWC to portfolios at $1.50 per share and have become somewhat concerned regarding the implications of the ATO back tax issues the company now faces.

Taking a closer look at 1H20 earnings, underlying NPAT was above consensus at $US88.

China’s recovery continues to support pricing momentum and AWC has lagged the alumina price rebound. Over the next 1 – 2 years, China is expected to have a metallurgical alumina deficit.

With the above in mind, we expect the $1.50 support level to hold but suggest a stop-loss on a break below.

The stock remains under review although we acknowledge the bullish outlook among institutional analysts.

FY21 dividend yield is 2.2%.

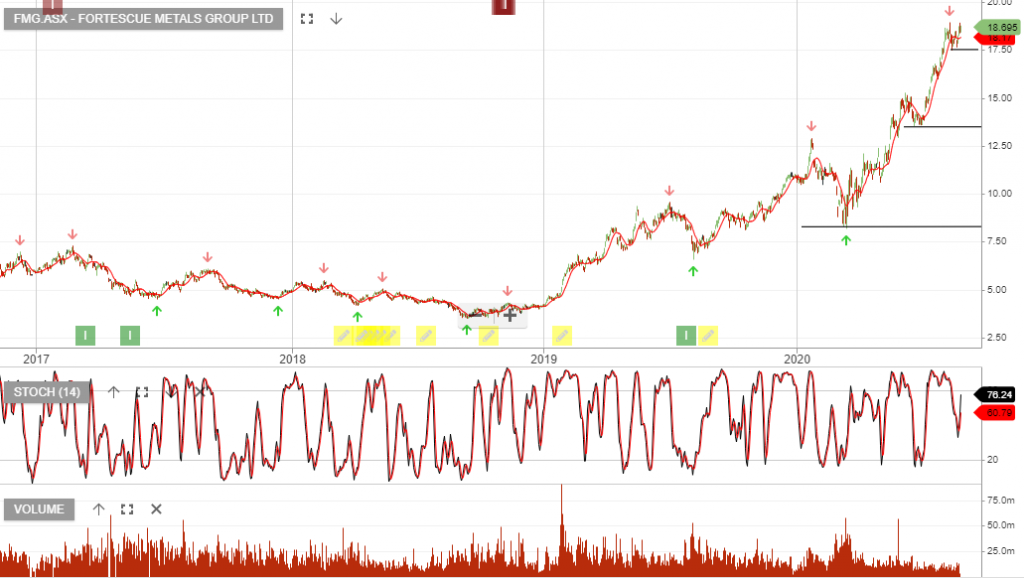

Fortescue Metals Group is under Algo Engine buy conditions and is among the best-performing holdings within our ASX 100 model portfolio.

FY20 revenue was up 27% to $13bn and EBIT was in line with consensus at US$8.3bn, up 38% on the same time last year.

Forward dividend yield is 4.8%, plus any special dividends announced in FY21.

Spark Infrastructure is under Algo Engine buy conditions following the higher low support at $2.10.

1H20 earnings delivered slightly better growth than expected with full-year DPS guidance unchanged at $0.135. EBITDA increased 4% to $430m.

Cash flow was weaker than expected and we see slight downside pressure on the dividend in FY21 & FY22.

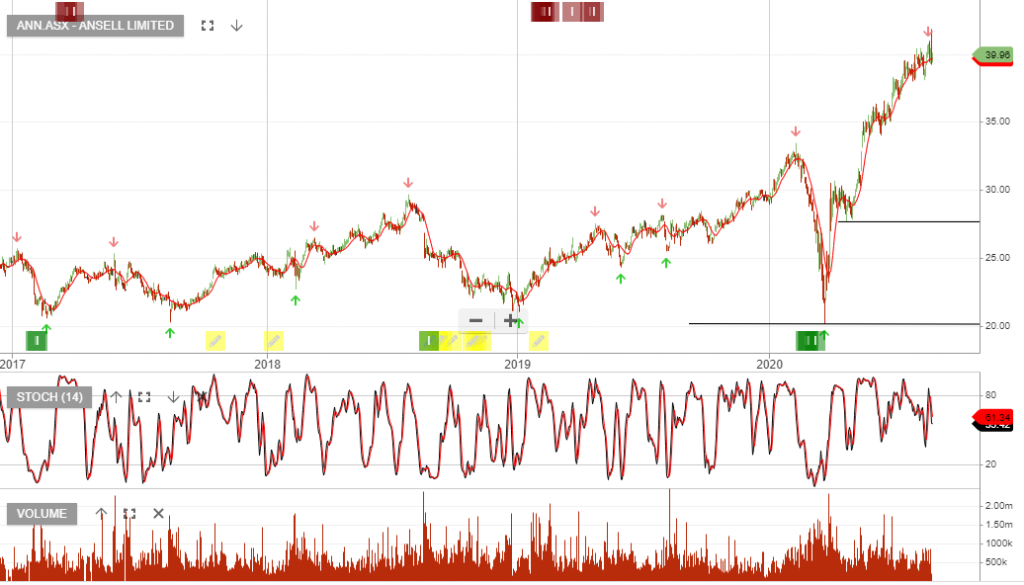

Ansell is under Algo Engine buy conditions and is a current holding in our ASX 100 model.

FY20 earnings showed revenue up 8% to US$1.64bn, and EBIT up 4% to US$220m. The company upgraded FY21 guidance for 8% underlying EPS growth.

ANN should continue to see strong top line growth and we recommend investors add to the position on the next Algo Engine buy signal.

Forward dividend yield is 2.2%.