CSL – Buy

CSL is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

CSL is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Tuas Limited (Tuas) was incorporated in March 2020 as part of the TPG Telecom Limited group of companies (TPG).

TPG has demerged its TPG Singapore mobile business, TPG Telecom Pte Ltd (TPG Singapore), from the broader TPG Group by transferring all the shares in TPG Singapore to Tuas.

The demerger and separate listing of Tuas occurred on 30 June.

We see value in the new TPG Telecom business and will revisit the buy opportunity on the next higher low formation.

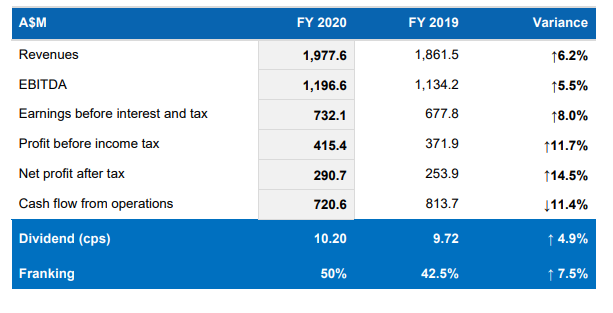

On 12 May Ausnet released the full year 2020 results.

The overall financial performance improved in FY2020, with increases in all key measures except cash flow from operations, which was impacted by several non-recurring items.

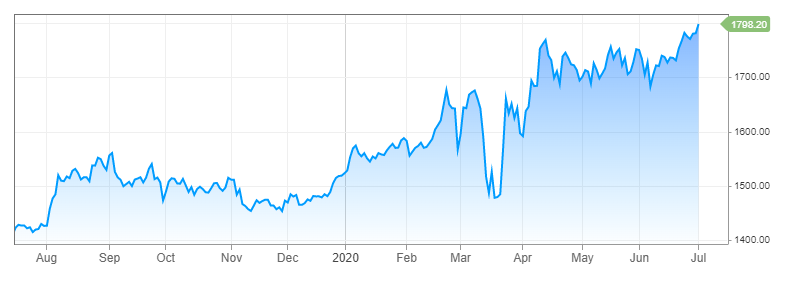

Gold surged to its highest in nearly 8 years as fears of a resurgence of new coronavirus cases kept demand strong. Gold is on path for its biggest quarterly gain since 2016.

U.S. gold futures settled up 1.1% at $1,800.5

Newcrest Mining is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Newcrest remains our preferred large cap exposure to the strong gold price.

Santos is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We highlight the buying support and suggest investors keep an eye on the short-term momentum indicators for a reversal higher.

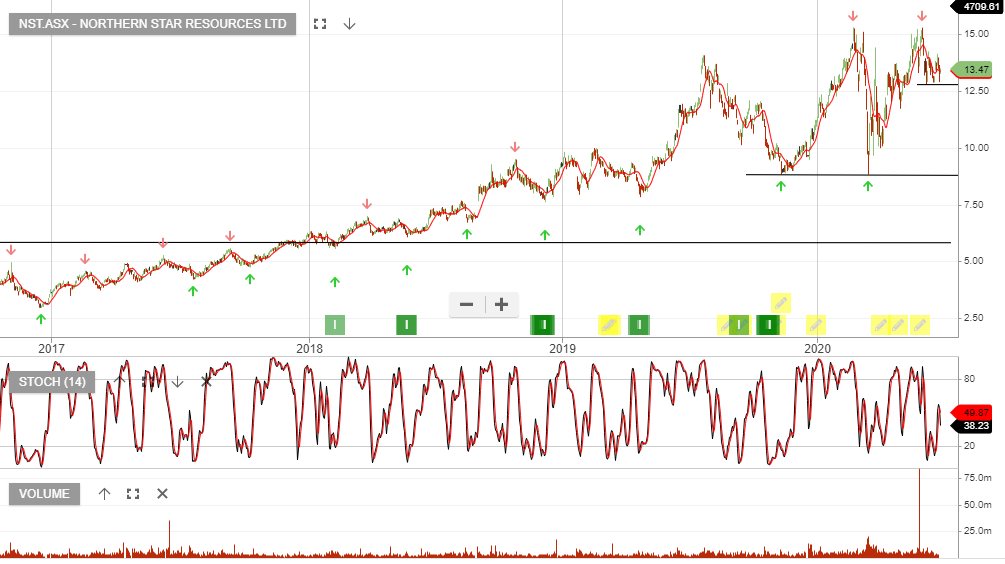

Northern Star Resources is under Algo Engine buy conditions and a current holding in our ASX 100 model portfolio.

We recommend investors buy NST.

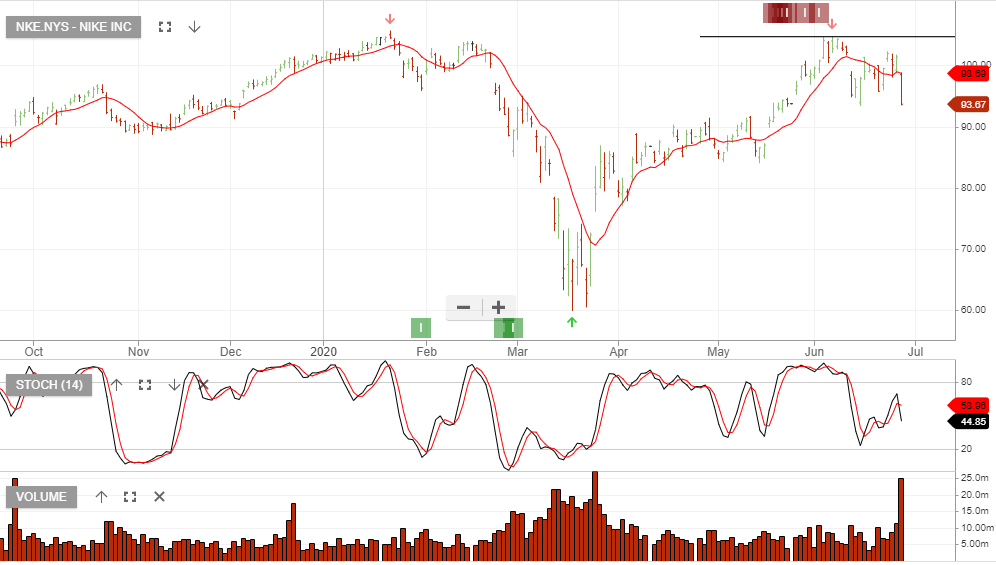

Nike reported a quarterly net loss and a sales decline of 38% year-over-year.

Business operations were hurt from stores being shut temporarily, and online revenue was not enough to make up for that.

Nike reported a loss of $790 million, or 51 cents per share during the period ended May 31, compared with net income of $989 million or earnings of 62 cents per share, a year ago.

Total revenue was down 38% to $6.31 billion from $10.18 billion a year ago.

We remain on the short side of the Nike trade.

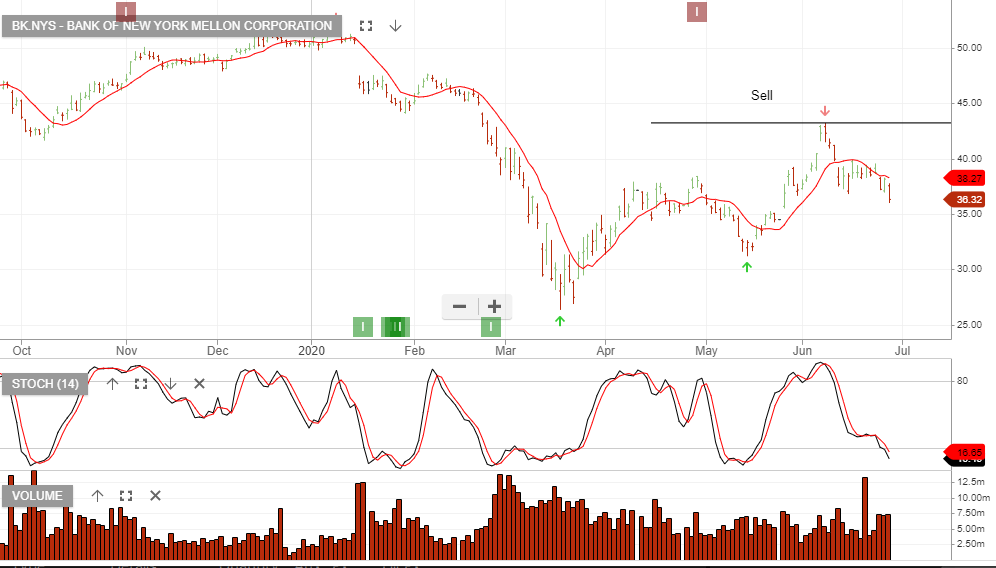

We see further downside pressure on the banking sector and remain on the short-side of the Bank of New York Mellon trade.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Or start a free thirty day trial for our full service, which includes our ASX Research.