Treasury Wines – Earnings

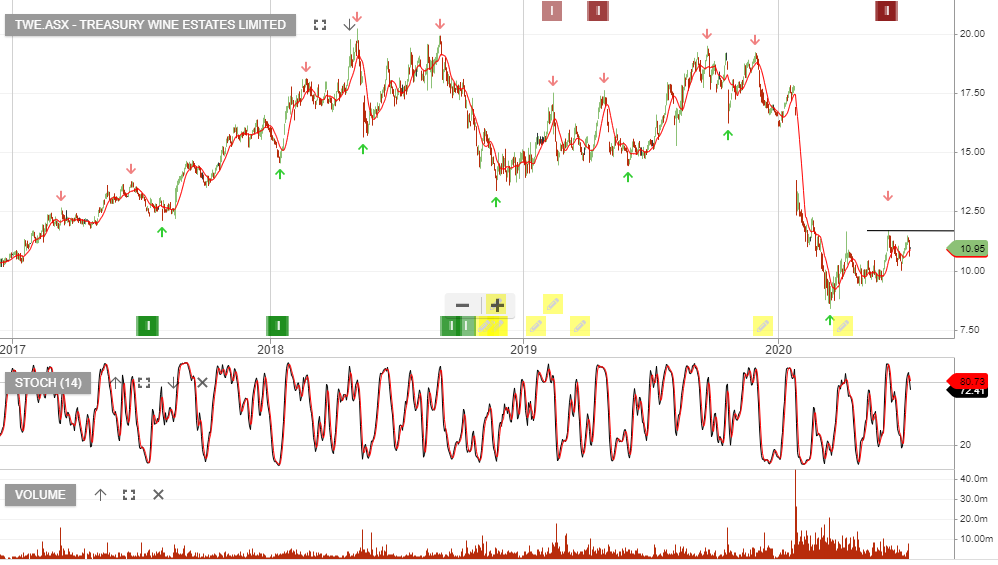

Treasury Wine Estates remains under Algo Engine sell conditions.

FY20 EBIT guidance of $530-540 million is below consensus. The outlook for FY21 earnings has deteriorated, which is likely to weigh on the share price.

Treasury Wine Estates remains under Algo Engine sell conditions.

FY20 EBIT guidance of $530-540 million is below consensus. The outlook for FY21 earnings has deteriorated, which is likely to weigh on the share price.

Northern Star Resources provided 4QFY20 trading update with production at 267 k/oz and sales 263 k/oz. Kalgoorlie and Jundee offset weaker results at Super Pit.

NST will resume dividend payments and the balance sheet improves following the paydown of $200m of debt.

FY21 dividend yield increases to 2% with forecast EBIT of $1.2bn

We have a price target on NST of $15.50

Alumina has run into issues with the Australian Tax Office following a review of transfer pricing arrangements with the AWAC JV.

The claim relates to a 20 year period and the ATO is claiming an additional tax of $200M plus interest. Other penalties may also be due and will be further communicated to the JV next month.

We forecast FY21 EBIT to increase to $350m, supporting a forward yield of 6%.

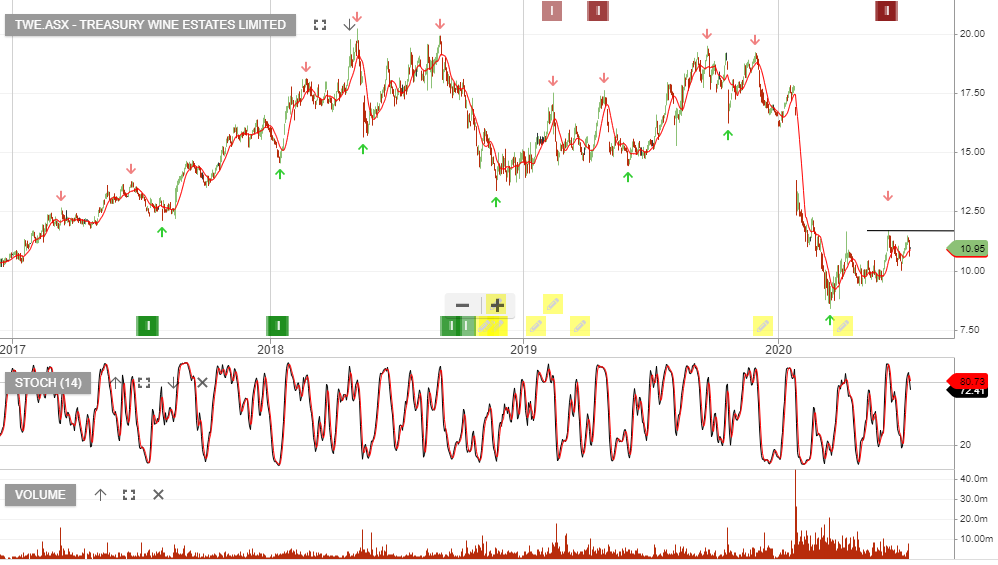

REA Group is under Algo Engine sell conditions. We expect selling pressure to increase at $109.

Seek is under Algo Engine sell conditions and we see selling pressure increasing near the $22.50 level.

iShares Global Consumer Staples is under Algo Engine buy conditions and is a current holding in our iShares ETF model portfolio.

$74 is likely to act as support as we see a defensive rotation as market flows.

The fund aims to provide investors with the performance of the S&P Global 1200 Consumer Staples Sector Index TM, before fees and expenses. The index is designed to measure the performance of global consumer staples companies and may include large-mid or small-capitalization stocks.

If you missed last night’s webinar, then catch up by watching it below.

Leon will be hosting his next webinar tonight. Click here to register, so that we can send you the webinar link before it begins.

Alumina is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support building and note the short-term momentum indicators are now trending higher.

Bega Cheese switched to Algo Engine buy conditions back on the 15/6 at $4.50. Following a retest of the initial entry level this week, Bega then rallied 15%.

We’ve seen other food-related companies report strong earnings with an increase in stay at home cooking, supporting industry fundamentals. Despite this, we traded out of BGA in Friday’s session and locked-in the gain.

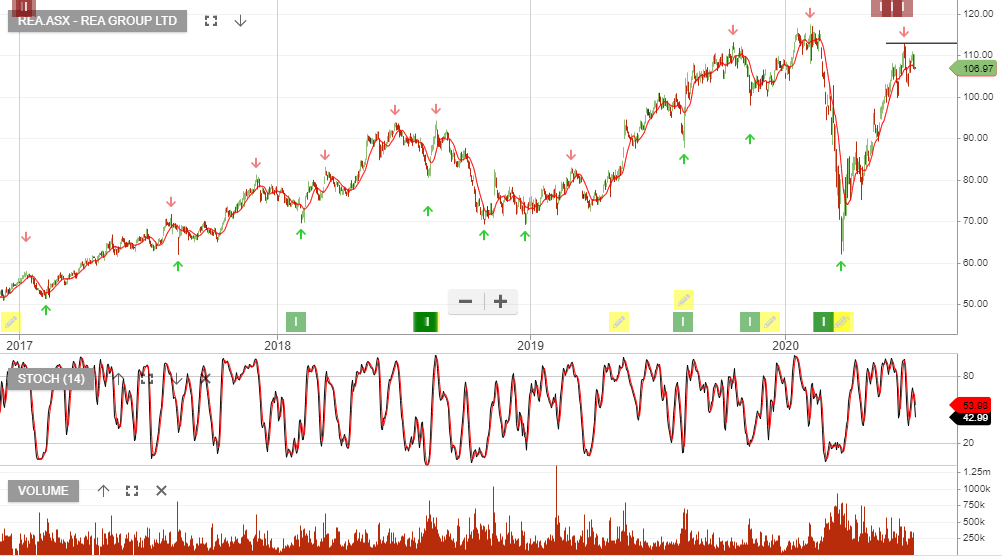

1H20 earnings showed mixed performance and we’ll be reviewing the full-year results when announced in August.

Or start a free thirty day trial for our full service, which includes our ASX Research.