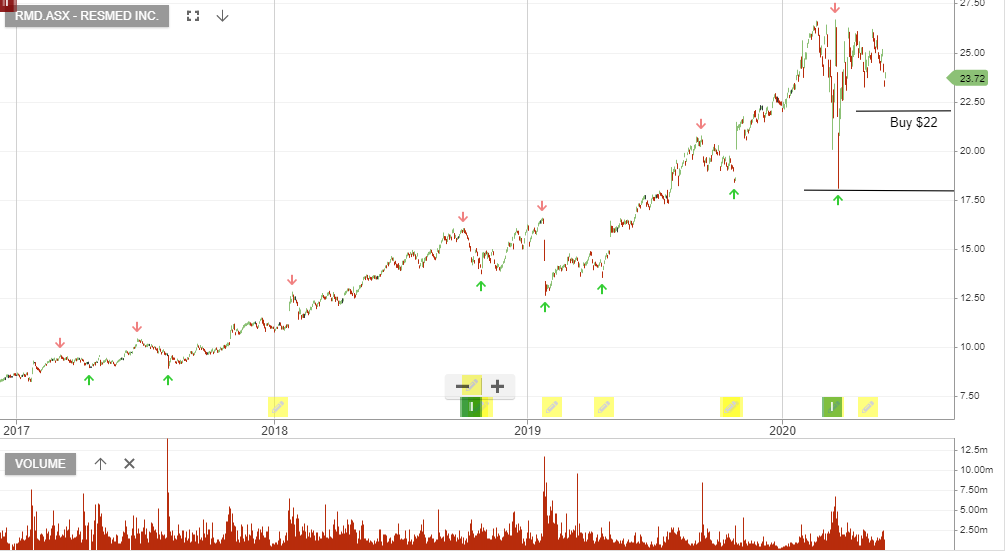

Resmed

ResMed short term traders may wish to take profit on RMD, following the 6% rally.

ResMed short term traders may wish to take profit on RMD, following the 6% rally.

Did you miss last night’s webinar? Catch up by watching it below:

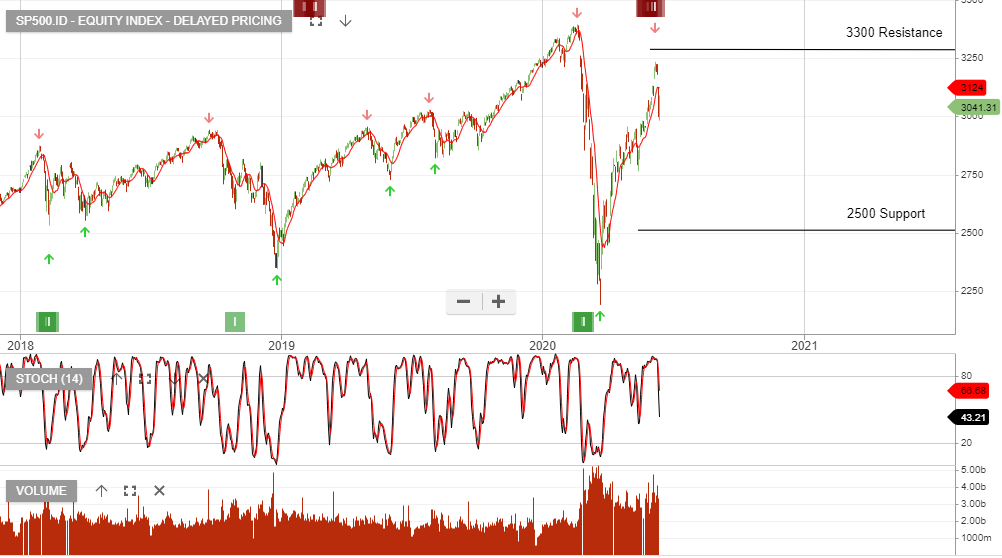

For regular readers of our blog and viewers of the Monday night webinars, you would be very familiar with the earnings table below.

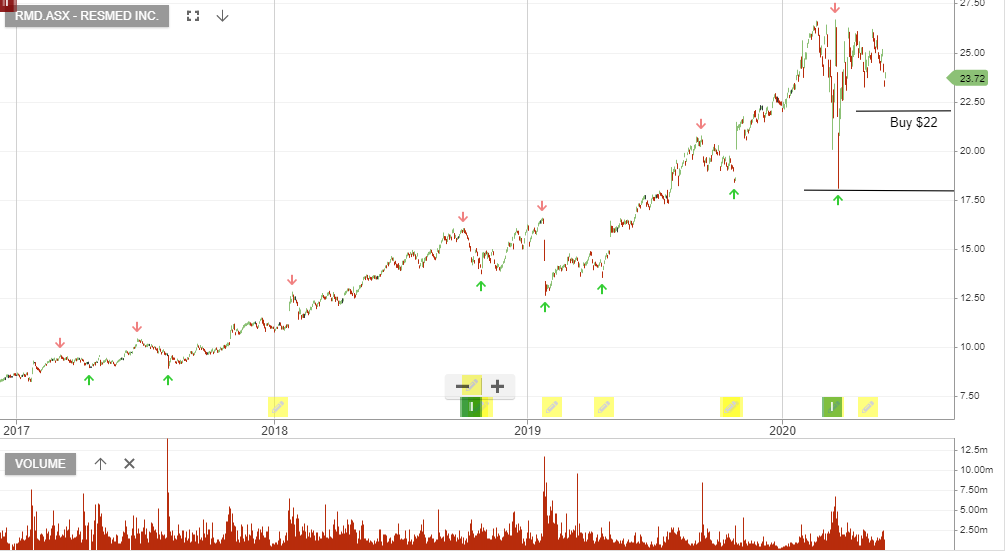

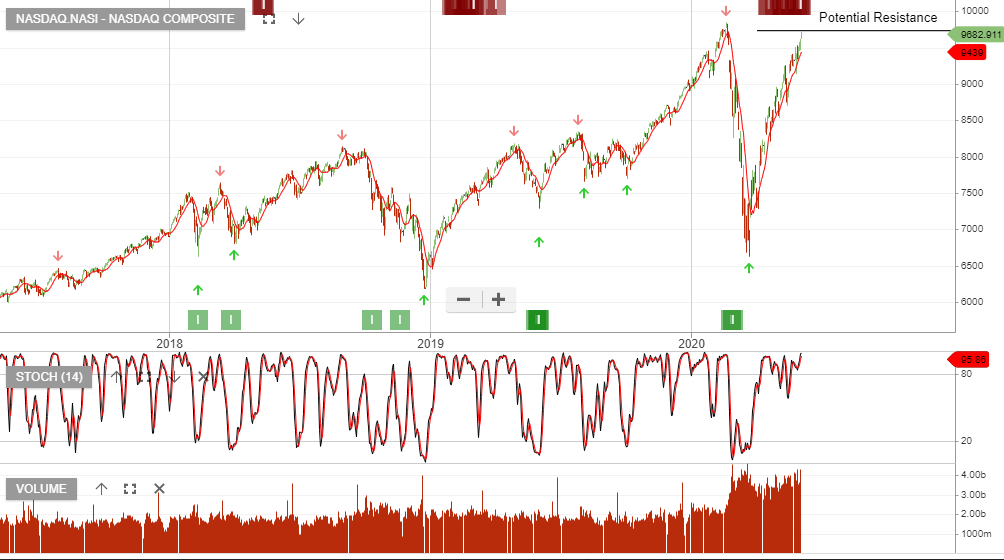

The S&P500 index is trading at an assumed $170 of earnings per share for FY21 and $180 of EPS for FY22. We feel these targets are too optimistic and the range could be more like $125 to $150, with a slower rate of recovery into 2022.

The close on Thursday and Friday now has the major US indices trading below our short-term momentum indicators.

Our target for the S&P500 is 2500 support and 3300 resistance.

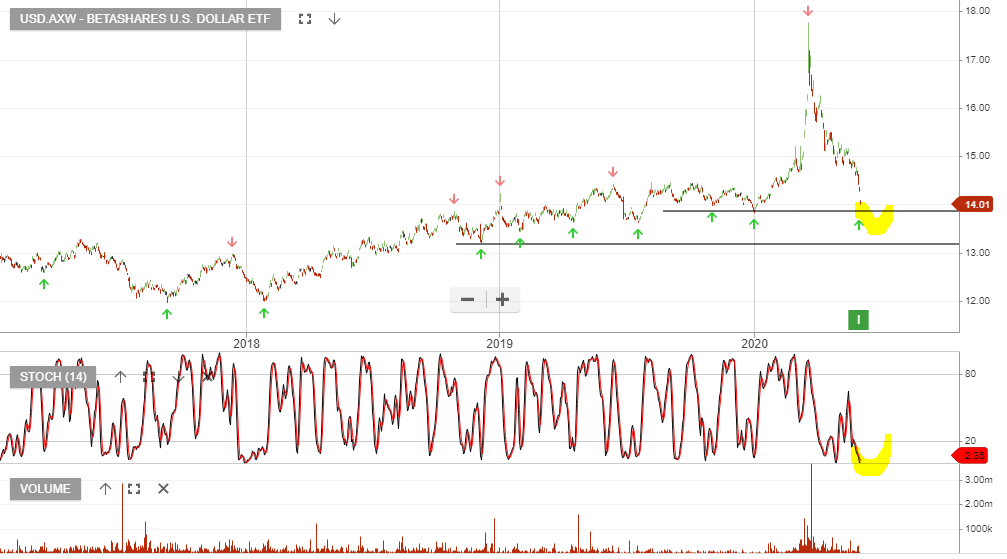

The US dollar has been trading lower over recent weeks and should we see a pick up in market volatility and risk-off sentiment builds, the US dollar may find increased buying support.

The following ETFs provide a way to capture exposure to the trade.

Betashares Strong U.S. Dollar Fund (Hedge

If you missed last night’s webinar, then you can catch up by watching it here.

Coles Group is under Algo Engine buy conditions and the recent pullback to $15.00 provides an attractive entry-level.

With the stock trading on a forward dividend yield of 3.5%, we expect the share price to remain well supported.

Investors remain overly optimistic that corporate earnings and profits will catch up with elevated asset prices.

Given the massive interventions into markets by the Federal Reserve, the added liquidity has been successful in fostering a lift in equity prices. Unfortunately, there will be little translation into higher wages, full-time employment, or corporate profits.

A broadening of the rally into industrial and financials is continuing to propel the indices higher. However, the prospect of the economy catching up to market expectations in the next 12 months, is very low.

Investors should apply the following “rule” as a form of portfolio protection.

A break below the 10 day moving average will be a sign that market momentum is stalling.

Woolworths Group is under Algo Engine buy conditions and we recommend investors look to accumulate the stock near $34.50

Alumina is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support building at $1.38 and suggest traders watch the short-term momentum indicators and stay “long” AWC whilst the indicators trend higher.

Stop loss on a break below $1.38.

Since making the above post, AWC has rallied as buying support increases.

20/5 Boral is in our focus following the price trading below our target of $2.50 and the short-term indicators now turning back up.

See highlighted support levels in the chart, a break below these levels will trigger a stop loss.

Buy BLD above $2.50.

The above post is from the 20th of May. We continue to see upside momentum in BLD.

3/6 Boral is now displaying an Algo Engine sell signal. We see overhead resistance near the $4.00 price range.

Or start a free thirty day trial for our full service, which includes our ASX Research.