Register for Monday’s Webinar

Monday’s webinar will begin at 7pm NSW Time. Use the registration link below to not miss out.

Monday’s webinar will begin at 7pm NSW Time. Use the registration link below to not miss out.

Rio Tinto is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Iron Ore prices have held up well in the recent market sell-off, with spot prices remaining around USD$80 p/t.

Buy RIO at current levels.

Newcrest Mining has moved to bolster their balance after raising $1.1bn which will be used for growth.

Newcrest’s balance sheet is in good shape with over $1.5bn in cash and about the same in undrawn facilities. Gearing remains low at 15%.

NCM has now rallied to $30+ and we will consider taking profit within the $31 – $32 price range.

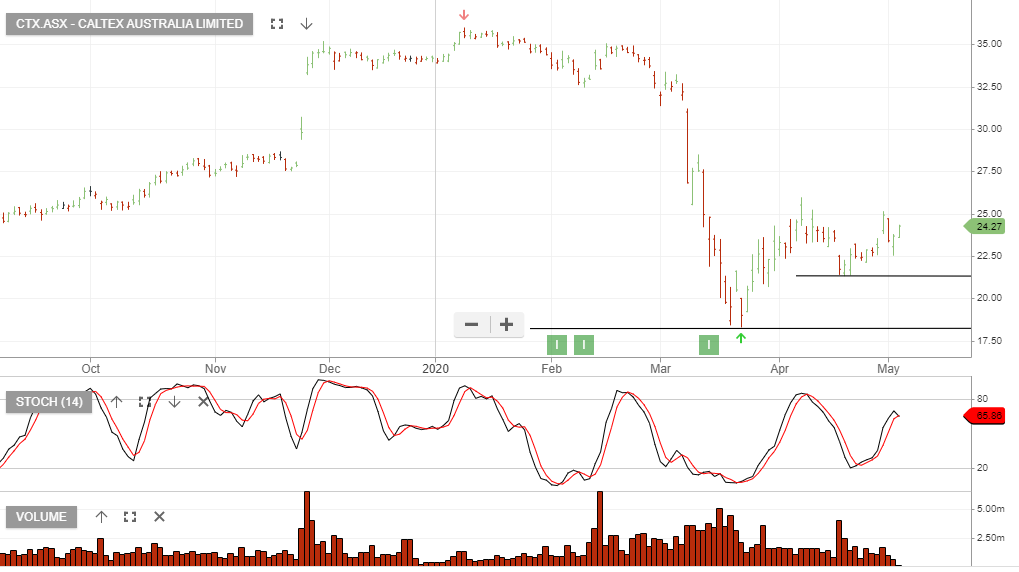

We expect investor sentiment to improve towards Caltex and consider the current price range as an opportunity to accumulate the stock.

Buy CTX at $24 and look for a move back to $26.50

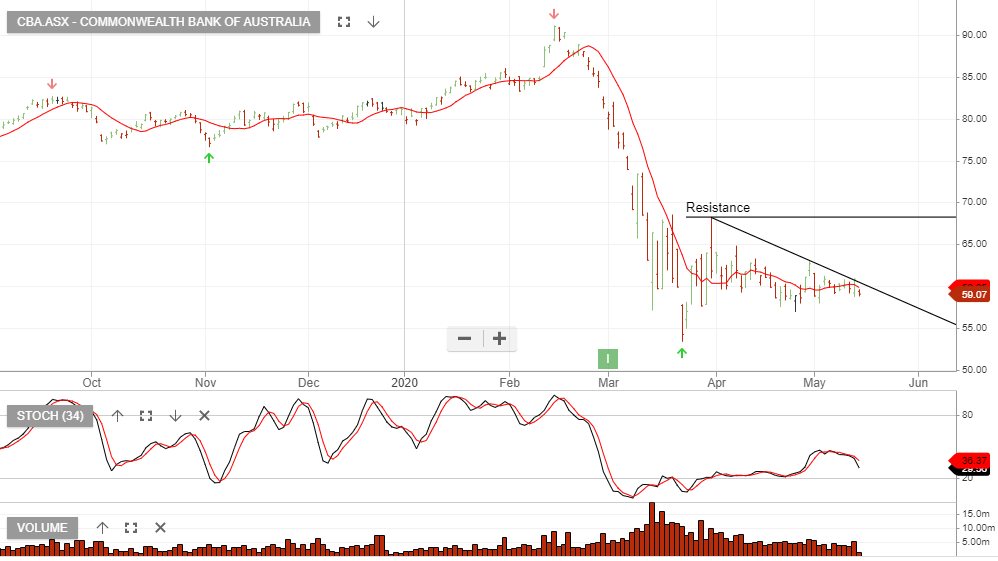

Commonwealth Bank of Australia – unaudited cash profit fell 23% in the three months ended March 31 to $1.3 billion from $1.7 billion in the year-earlier.

CBA has provisioned $1.5 billion for COVID-19 provisions.

The below graph provides a picture of the trend that short-term traders may be interested in.

Computershare is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see buying support at $11.00.

Incitec Pivot is under Algo Engine sell conditions.

IPL is raising A$600mn via an underwritten placement and A$75mn via a share purchase plan at a 9% discount to the closing price on 8 May.

IPL’s capital raising is likely to be a positive near-term catalyst as a result of removing the funding risk. Although, we expect downward pressure on commodities to make the near-term operating conditions difficult for both IPL and ORI.

If you missed last night’s webinar, then the replay video is available below.

InvoCare is under Algo Engine buy conditions.

In mid-April IVC announced up to $250m equity raising

at $10.40/share.

April revenue was down 13% and we’re seeing costs higher than

anticipated. Improvement in trading conditions should occur as the partial easing of restrictions take place.

We assume 2020 earnings will be down 10% and see a recovery into 2021 & 2022.

We’ll revisit IVC if it trades back below $10.00

Tonight’s webinar starts at 7pm NSW time. Click here to register, so that you don’t miss out! If you can’t make it in time, then we’ll email through the recording for you to watch later.

Or start a free thirty day trial for our full service, which includes our ASX Research.