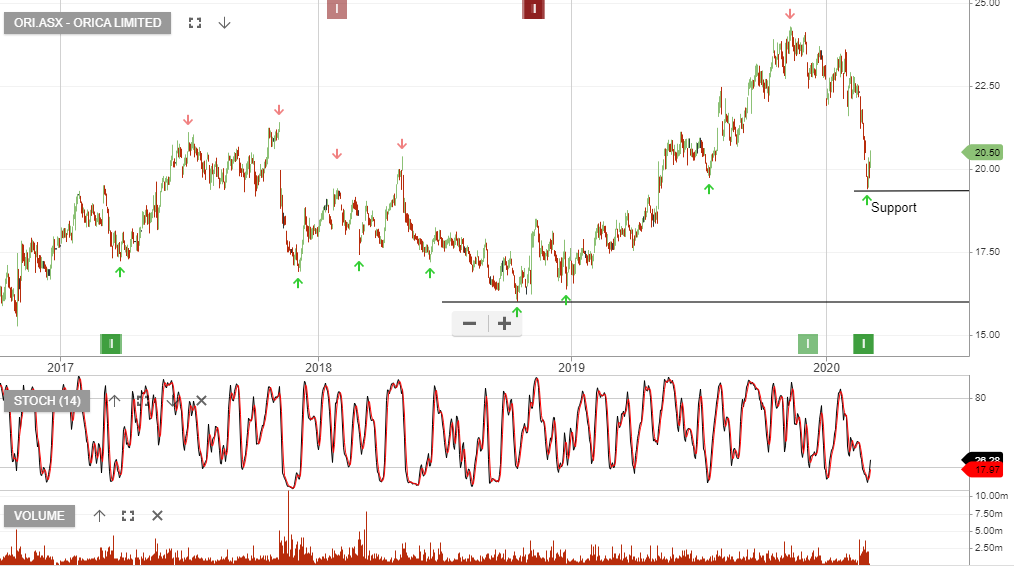

Orica – Buy Signal

Orica is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Goldman Sachs raised $500 million in acquisition funding for ORI via an institutional placement.

The funds will be used for the acquisition of Exsa, Peru’s No. 1 manufacturer and distributor of industrial explosives and provide greater balance sheet flexibility.

We see strong buying support at $20.