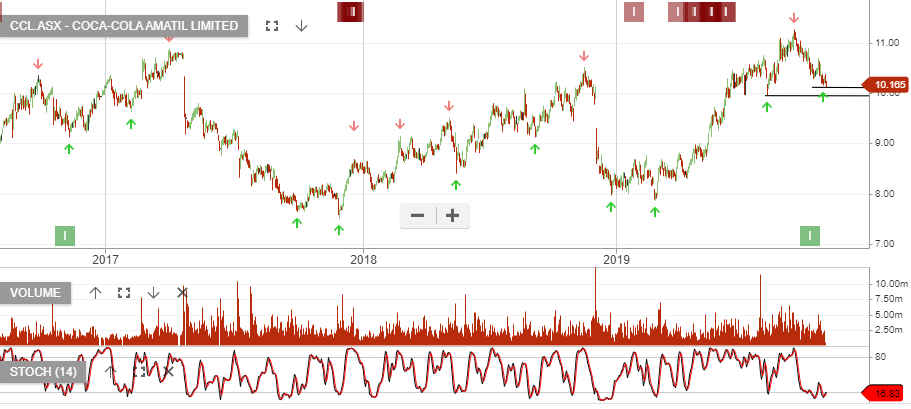

Coca-Cola – Buy

Coca-Cola Amatil is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support developing near the $10 level, supported by 4 – 5% EPS growth and a 4.8% dividend yield.

Look for a move back towards $10.75 and then sell call options to enhance the income return. For more information on the derivative strategy, please call our office on 1300 614 002.