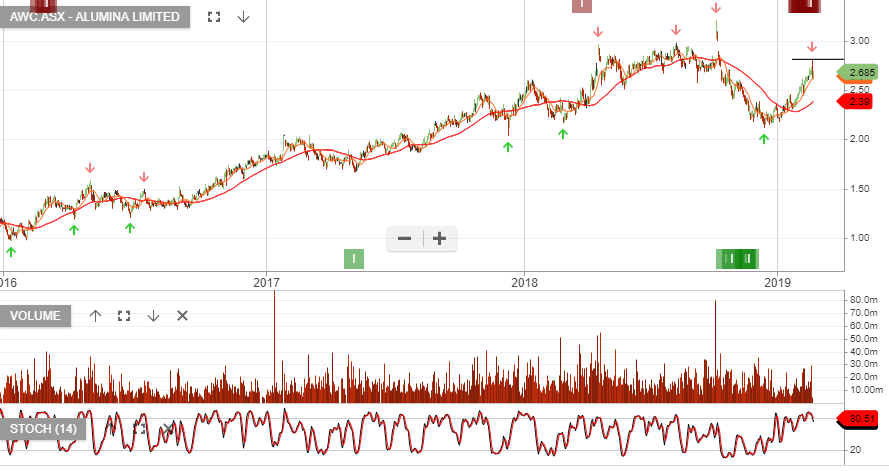

Alumina – Algo Sell Signal

Alumina is now under Algo Engine sell conditions and we expect the share price to struggle below the $2.80 level.

Alumina prices are likely to weaken over the next 12 months which will weigh on the cash receipts from the AWAC joint venture.

2018 net profit after tax was reported at US$690m. AWC declared a total dividend for the year of US$0.227, which was ahead of market expectations.

Stay short AWC with a stop loss above the $2.80 resistance.