Housing and Construction – Oversold Stocks Begin Recovery

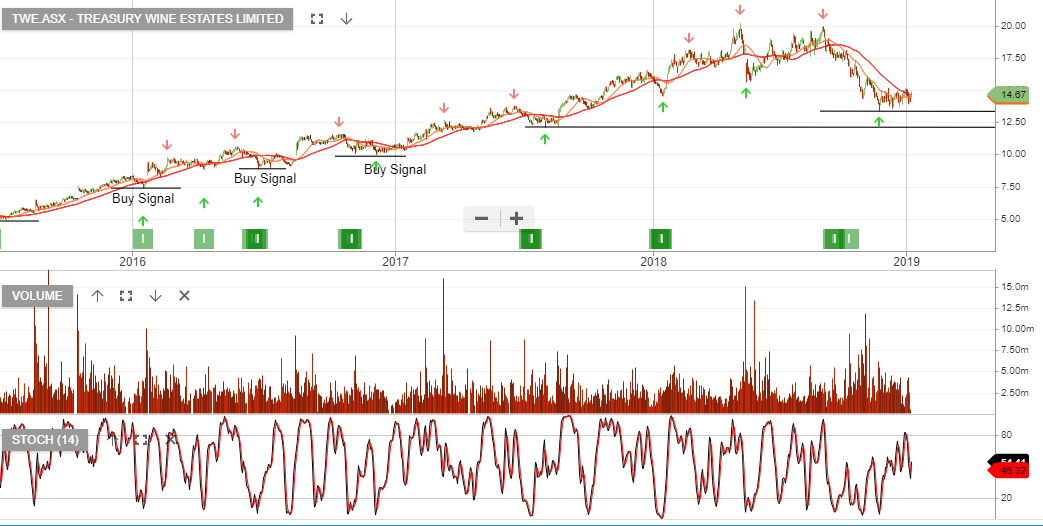

The post below is from December last year and we’re now seeing buying interest pick up in the oversold building names. James Hardie is leading the recovery in percentage terms and remains our preferred exposure. Please check your charts for a real-time update.

James Hardie is under Algo Engine buy conditions and is our preferred consideration for the sector.

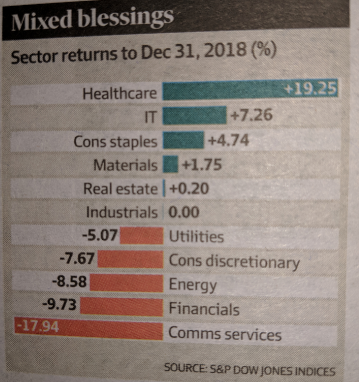

Building stocks have been sold off following this year’s rate increases in the US and weaker construction data both in the US and Australia. There is no doubt that weaker earnings trends are due, however, the question is… how much bad news is priced in?

James Hardie is finding buying support at $15.00

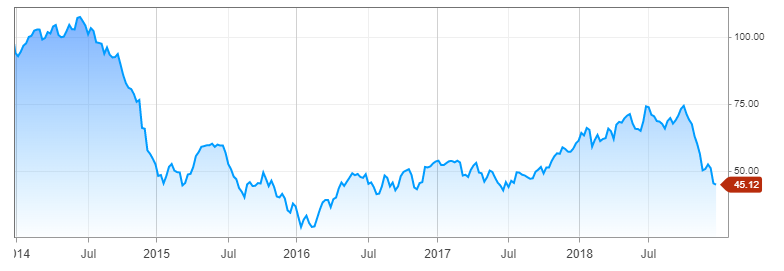

Boral has now sold off by 45% following the $8.20 high created in February.

QBE chart from the 10th Dec.

QBE chart from the 10th Dec.