BUY – Link Holdings

We recommend buying Link Holdings and placing a stop- loss below the recent $8.25 support level.

Link goes ex-div $0.07 on the 27th of March.

We recommend buying Link Holdings and placing a stop- loss below the recent $8.25 support level.

Link goes ex-div $0.07 on the 27th of March.

Our ALGO engine triggered a buy signal for BHP into the ASX close at $28.35.

The “higher low” price structure is referenced to the $26.90 low posted on December 8th.

BHP’s share price has dropped 10% over the last 8 trading sessions as concerns about the company’s proposed sale of shale assets has somewhat clouded their future earnings outlook.

During a webcast on Friday, CFO Peter Beaven reminded investors that BHP has a policy of paying out at least 50% of profits in dividends and increased that to 72% in the December half.

With respect to the shale assets, one analyst report suggested that for every $1 billion of proceeds from the sale, BHP can return 24 cents per share.

Technically, we see good price support at the $27.85 level and an area of initial resistance at $30.15.

BHP

BHP

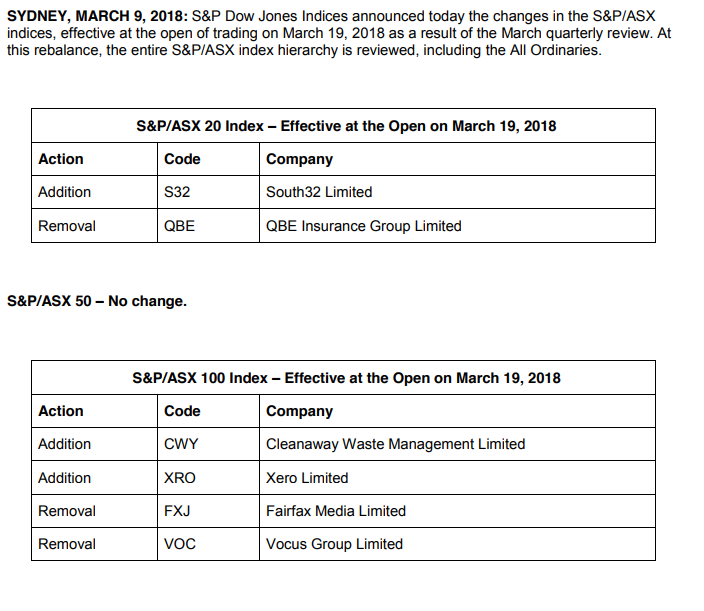

It’s always interesting to look at the index re-balancing and think about the names that have been removed or added in the index rankings.

QBE has a negative price structure and an Algo Engine sell signal.

S32 has an Algo Engine buy signal and is a core holding in our ASX Top 50 model Portfolio. As of March 19th, S32 will now move into the ASX Top 20 model.

We suggest readers look at the charts of the two new additions to the ASX100 index, CWY and XRO.

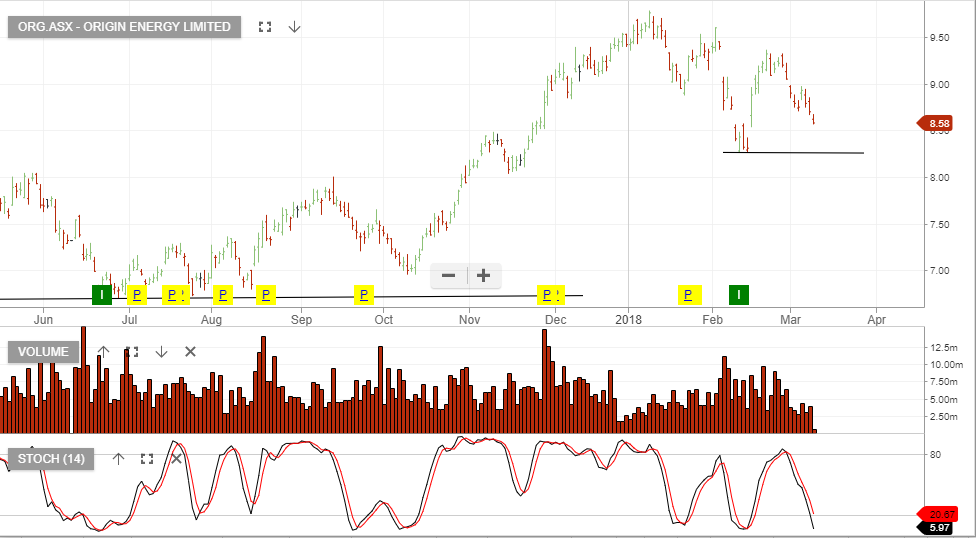

We recommend buying ORG Energy when the short-term indicators turn positive. We expect the entry level will be confirmed early next week.

Keep this one on your watch list.

Origin

Despite the 3% drop in Iron Ore prices overnight, shares of FMG have firmed to $4.83 in early trade.

Comments from commodity traders suggest that the recent dip in Iron Ore prices may be more of a seasonal cycle than a fundamental shift to lower demand.

The technical outlook has improved this week as the price action remains above the $4.60 consolidation area from mid-December, and internal momentum indicators are pointing higher.

FMG is part of our Top 50 Model portfolio and we suggest that investors can buy the stock at current levels for a move back into the $5.40 area over the medium-term.

Fortescue Metals

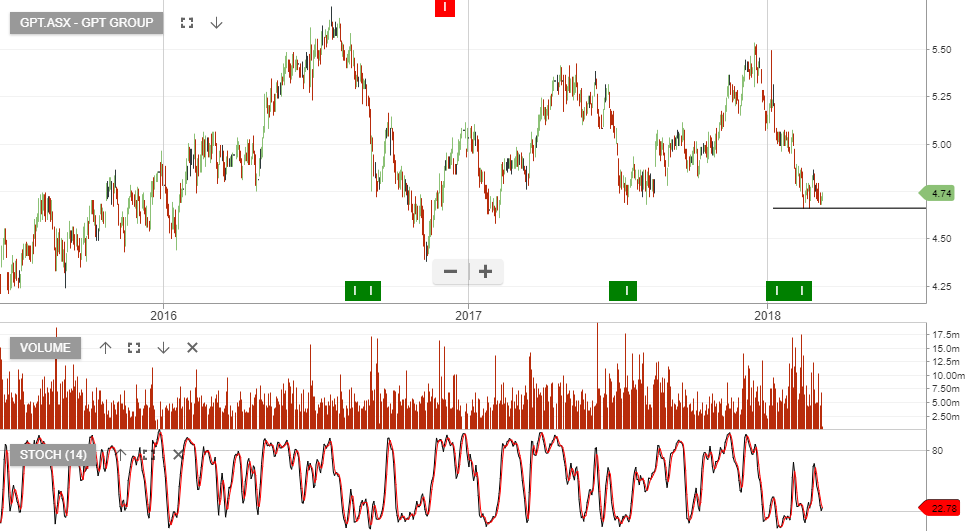

We recommend buying GPT Group and placing a stop loss below the recent $4.65 low.

Investors may prefer to hold the stock and sell September $5.00 call options to enhance the cash flow, whilst staying exposed to the June dividend.

GPT will pay $0.123 dividend on June 29th.

Shares of SUN are down 1% in early trade at $13.76.

A research note from a local investment bank has lowered the guidance on SUN to “under-perform” and adjusted their price target to $12.45.

The report cites higher operating costs and lower margins to rationalize the lower price.

Our ALGO engine triggered a sell signal in SUN at $14.05 on November 10th; we agree with the downside target of $12.45.

SunCorp

Invocare has under performed following their recent earnings report, in which the company indicated flat forward earnings and an increase in capital expenditure.

Technically, a “higher low” formation remains in place and we flag to our readers the strength in today’s price action.

IVC

We recommend buying Transurban Group and selling covered call options to enhance the income.

TCL will pay a $0.27 dividend on June 29th.

TCL

Since posting an all-time high of $18.09 on February 22nd, shares of TWE have slipped over 6% lower and touched the $16.84 level yesterday.

We consider TWE one of the best growth stocks on the ASX, but with a P/E of over 35X we prefer to buy it at lower levels.

From a technical perspective, we see good support in the $16.35/40 area and will advise on entry levels in subsequent postings.

Treasury Wine Estates

Treasury Wine Estates