Algo Signal – Buy Graincorp

Our Algo Engine has triggered a buy signal in GNC. The price action has now retraced back to $9.00 and filled the price gap from mid-May.

Our Algo Engine has triggered a buy signal in GNC. The price action has now retraced back to $9.00 and filled the price gap from mid-May.

The S&P/ASX 200 Index finished the week up 1.08%.

The best performer was the Energy sector, up 2.7% & the worst performer was the Health Care sector, down 1.1%.

The XJO continues to trade below the recent 5850 “lower high” formation.

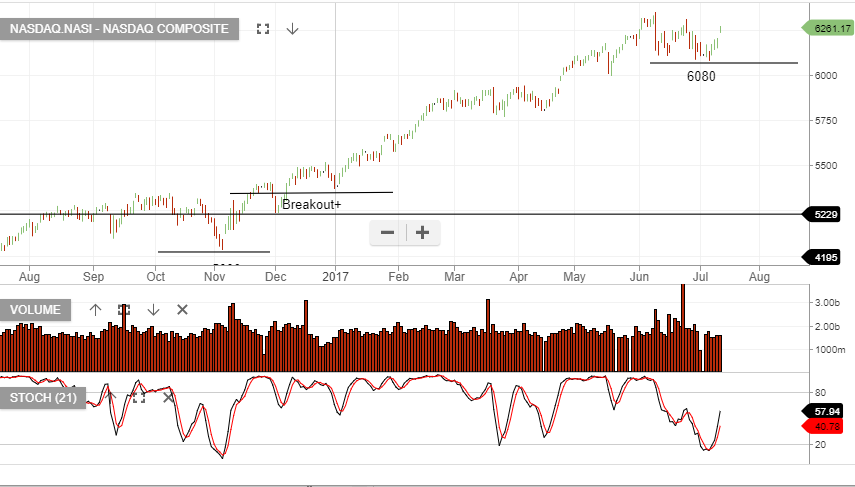

As both the Dow Jones 30 and the S&P 500 rose to new all-time highs this week, daily trading volume was 20% lower than the 3-month average and “short interest” in stocks fell to the 2007 lows.

Short interest is defined as the total Dollar value of stocks which investors have “sold short”, which they don’t own, with the idea of making a profit after buying them back at a lower price.

The combination of seeing the Dow and SP 500 rise to new highs on lower volume, and contracting short interest, is an illustration of a technical “short covering” rally.

Seeing index prices at new highs on lower volume suggests that “new money” is not coming into the market and that stock prices will revert lower after “short sellers” have taken their losses.

This technical combination doesn’t always trigger an immediate sell off in stocks. However, the market condition of “higher highs on lower volume” is often cited after a material correction in the market occurs.

As US earnings season goes into full swing next week, we’ll continue to watch the price/volume correlation and the potential impact on the market.

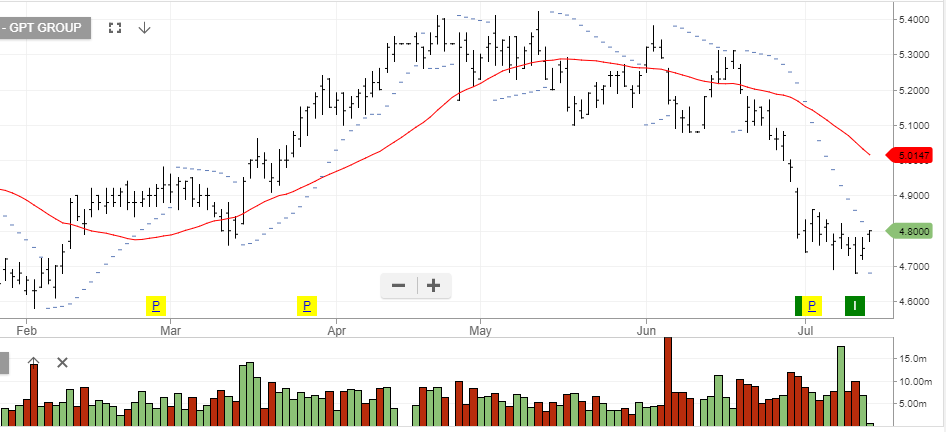

Over the last two weeks, yield sensitive names like SYD, TCL and GPT have all dropped over 10% from recent highs.

One of the main drivers has been the change in interest rate expectations from G-7 central bankers and the subsequent rise in short-term paper.

Moving forward, we see more likelihood of G-7 rates reverting lower within the year’s range and providing upside potential in the stocks above.

Other stocks we like on the basis of lower local rates are: AMC, WOW and MPL.

We see reasonable upside potential in the names and will employ the derivative overlay strategy (selling covered calls) to enhance the portfolios returns.

Transurban

Sydney Airport

General Property Trust

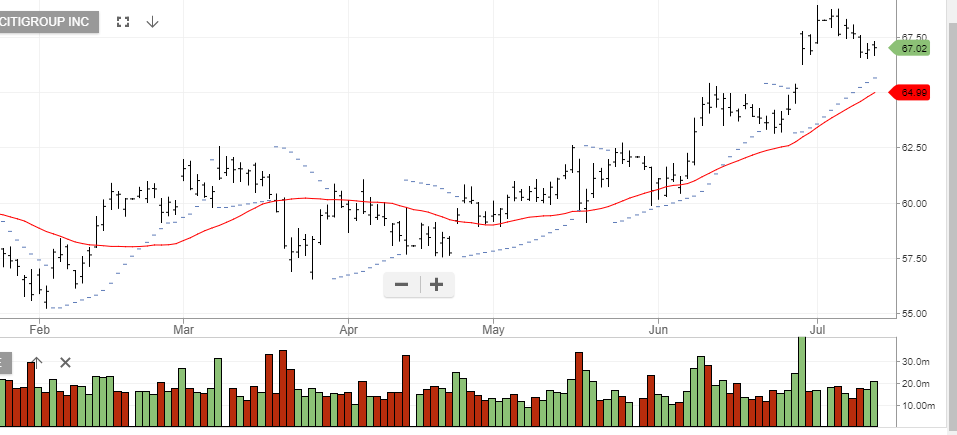

Before the US market opens later today, JP Morgan, Citigroup and Wells Fargo will report their Q2 results.

After last year’s post-election rally, these stocks and others in the financial sector have been trading in wide ranges.

However, over the last few weeks, bank stocks have rallied after the results of the FED’s “stress tests”, a push higher in short-term rates and hopes of further government de-regulation.

For Q2, JP Morgan is expected to report earnings of $1.57 per share, up 2 cents from last year on revenue of $24.8 billion. Wells Fargo is expected to report earnings of $1.02 per share, which is up 1 cent from last year on revenue of $22.3 billion. Citigroup is expected to report earnings of $1.21 per share, which is 3 cents below last year on lower revenue of $17.3 billion.

Our base case for the US banks is that trading revenues will be trending lower for the remainder of the year and the current levels look fully-valued with risk to the downside.

JP Morgan

Citigroup

Wells Fargo

Our Algo Engine flagged a recent buy signal in TWE at or near $12.30.

The recent share pullback creates an attractive entry point. Asia demand looks strong and FY18 earnings should see underlying profit increase over 20% to $360 million.

We believe TWE is still in the early stages of building a significant business across Asia, which will help to support the “buy on the dip” approach.

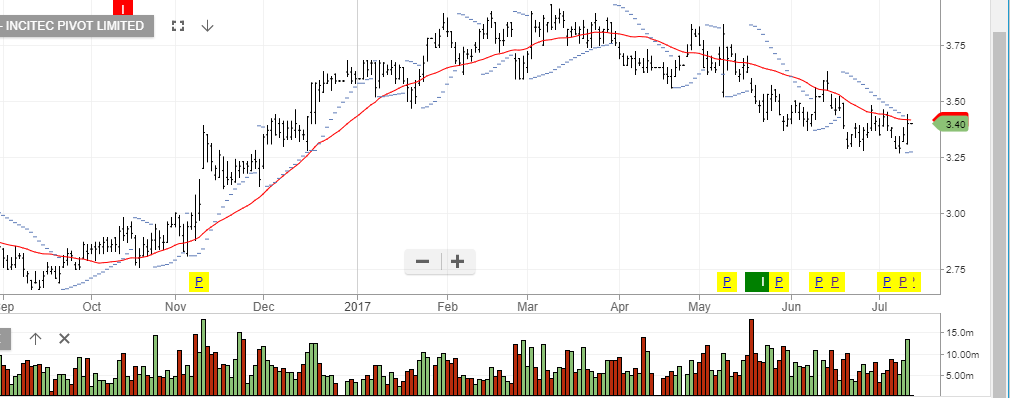

On 11th of July we reminded readers of the blog that we viewed the recent Algo Engine signal on IPL, as one our preferred buy-side signals.

IPL today has opened up 6.5% higher and is now up over 10% from the recent low.

Considering the recent volatility in fertiliser prices, we suggest taking profits in the current $3.55/60 price range.

Incitec Pivot

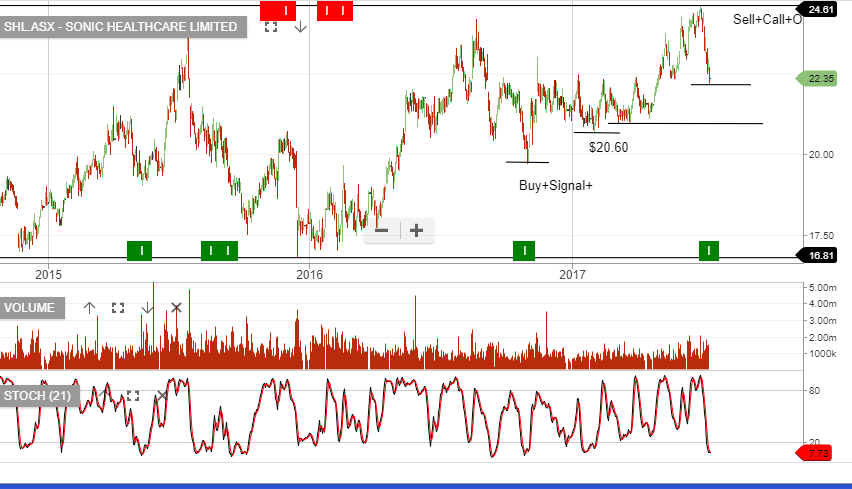

Our Algo Engine triggered a buy signal in Sonic Healthcare, following the recent sell-off from $24.60 back down to $22.30.

We continue to see Sonic delivering 6 – 8% EPS growth and a 3.7% dividend yield. The stock is fair value at or near the current price and investors can consider SHL as a suitable buy-write for enhancing portfolio cash flow.

The Dow Jones and NASDAQ charts below show the indices continuing with the “higher high and higher low” formation.

The XJO shows a slightly more bearish pattern, as our local market struggles below the recent 5850 high.

Over the last three trading sessions, volume for the Dow Jones 30 and the ASX 200 have both dropped by about 20% versus their 3-month rolling averages.

Some of the reduction in turnover is seasonal due to the Northern summer. However, many analysts are pointing to tonight’s Senate testimony from FED Chief Janet Yellen as a focal point which has kept traders on the sidelines.

At around midnight Sydney-time, Ms Yellen will address the Senate Banking Committee. She will update lawmakers on interest rate policy, the rate of balance sheet normalization and take questions.

The “cause and effect” logic is that if Ms Yellen’s comments reflect a more “hawkish” position from the FED on rate hikes and reducing the $4.5 trillion balance sheet, US equity markets will trade lower, which will likely spill over to the ASX.

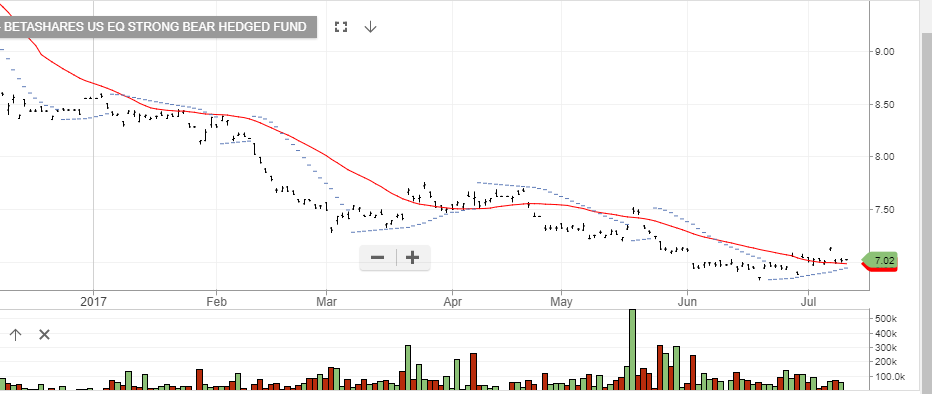

Investors looking to profit from a lower XJO 200 or SP 500 can look to buy the BetaShare ETFs with the Symbol BBOZ or BBUS.

Both of these are inverse ETFs, which means that the unit price will increase as the indexes trade lower.

In addition, both of these ETFs are weighted, which means that a 1% change in the respective index translates to a 2.5% move in the ETF.

BBOZ is currently trading at $17.80, we calculate that the price would rise to $18.60 if the XJO 200 traded back to the June 8th low of 5620.

BetaShare ETF BBOZ

BetaShare ETF BBUS