ETF UPDATE: When Will BBUS Take Off Again?

Since December of 2105, there have been three distinct periods of high volatility in the SP 500 which triggered sharp rallies in the BetaShare ETF with the symbol: BBUS.

BBUS is an inverse ETF, which means the share price will rise when the SP 500 trades lower. It’s also weighted, which means that a 1% move in the SP 500 Index will correspond to a 2.5% move in share price.

From December 17th, 2015 to January 19th, 2016, the SP 500 fell from 2077.50 to 1856.25.

This 10% sell off pushed the price of BBUS from $11.85 to $15.20, roughly a 28% gain.

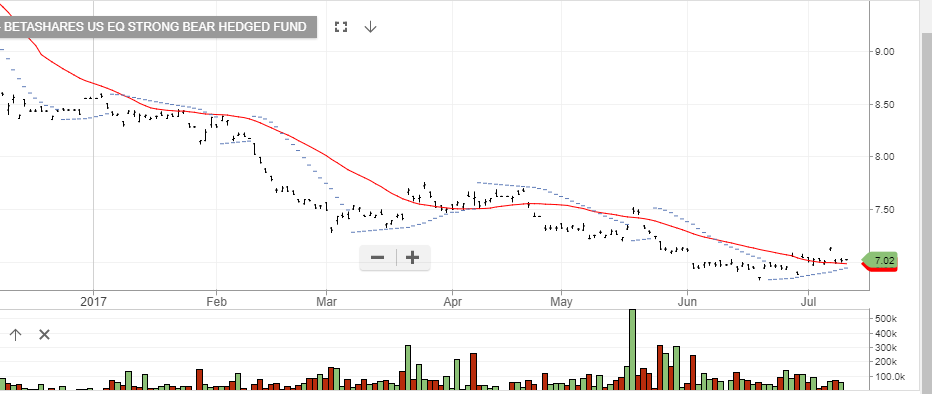

As the chart below illustrates, over the course of 2016 there were two other periods when the BBUS saw sharp moves higher of over 15%.

BBUS

BBUS

The general point is that the listless drift continues for the SP 500, which hasn’t gained 1% or more in a single day for the last 70 trading sessions, the longest streak since 2007.

The price of BBUS is currently $6.70.