Amcor – Buy Write

We continue to see Amcor as a solid contributor to portfolio returns, especially when complimented with a slightly out-of-the-money call option into November or December.

A combination of the dividend and call option premium produces 10 – 12% annualised cash-flow.

FY18 forecast revenue US$9.6b, EBITDA US$1.5b, Net Profit US$790m, EPS US$0.66 and DPS US$0.49 places the stock on a forward yield of 4%.

Buy on any marginal price retracement.

CYB

CYB

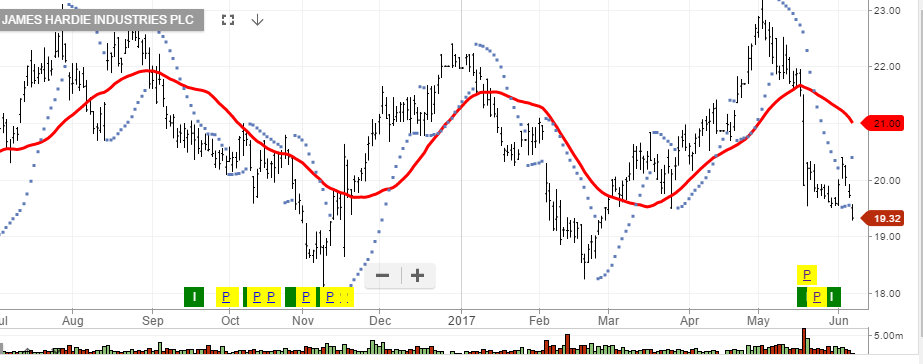

James Hardie

James Hardie

Bendigo and Adelaide Bank

Bendigo and Adelaide Bank