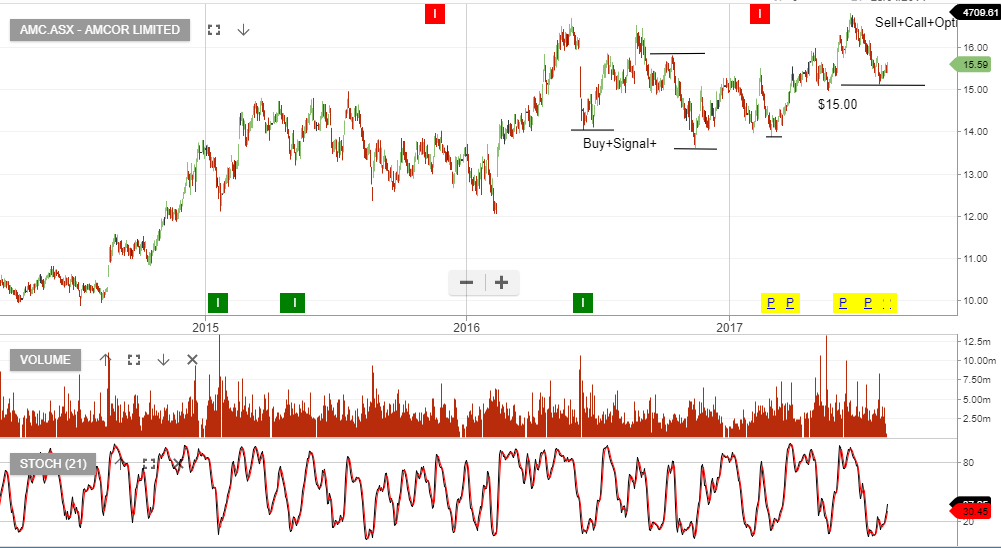

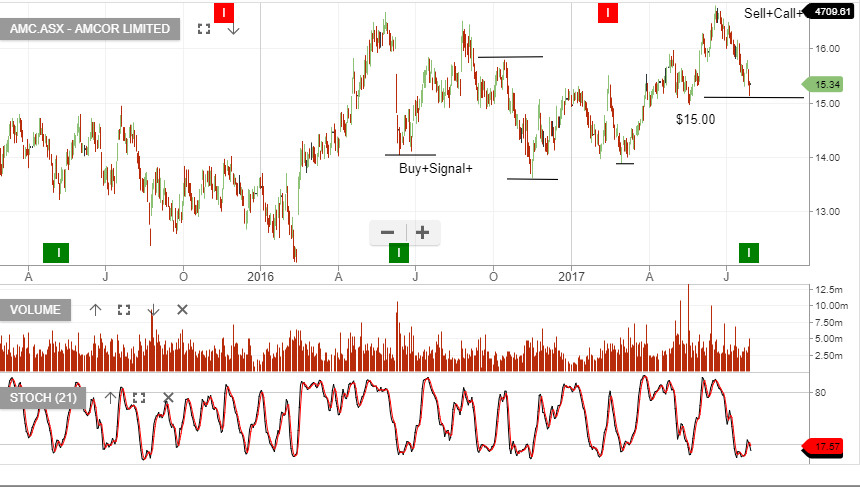

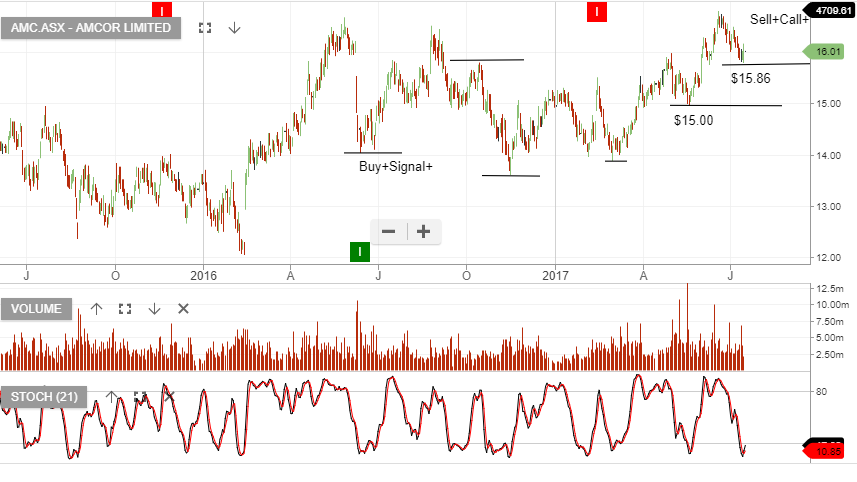

AMC 1Q18 Update

AMC has identified challenging conditions going into 1H18 at its 1Q trading

update and AGM.

Profit headwinds relate largely to Asia and Latin America, along with rising raw material costs. AMC has guided to flat 1H EBIT, yet maintained FY18 guidance of around 5% EPS growth.

AMC trades on a forward yield of 3.6%, based on FY18 EBITDA of $1.6b.

We see the current sell-off as a buying opportunity and recommend investors cover with a $15.50 call option into June 2017, whilst keeping exposure to the February dividend.