AMP

AMP is rated a buy at $1.42.

AMP is rated a buy at $1.42.

AMP remains an overweight multi-year recovery play.

AMP is growing earnings at 5%+ and delivering new product innovations that support our buy rating.

AMP is likley to deliver imroved earnings growth in FY24 & FY25.

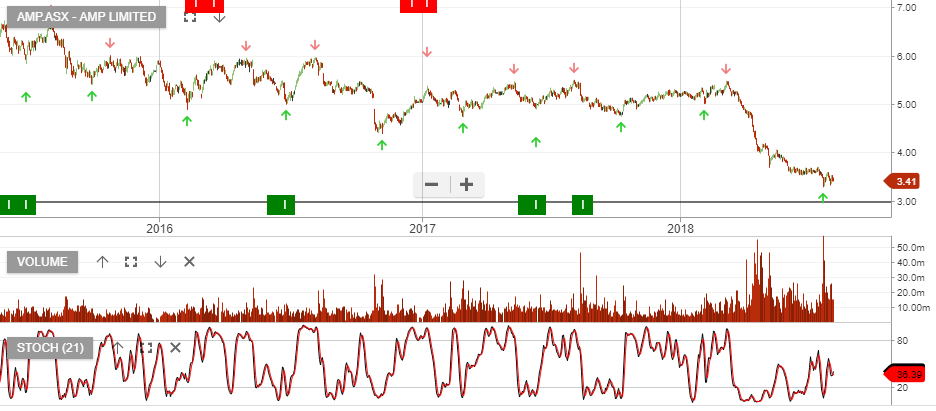

AMP has built a higher low formation with support at $0.91.

AMP is a current holding in our Trade Table.

AMP’s 1H18 result was underpinned by effective cost management offsetting

weaker revenue performance.

The Australian Wealth Management division saw net outflows of $673m in the quarter.

Going forward, we expect well managed costs to offset weaker revenue. There is longer-term value here for patient investors, who are willing to hold the stock through to the appointment of a new permanent CEO.

In 2019, AMP’s board will likely outline a plan to split the funds management business away from the traditional advice side model, unlocking value for shareholders.

We have AMP now trading on a 6.8% yield and expect FY19 reported profit to remain around $800m.

AMP

The Big four banks will be in the spotlight this week as the Banking Royal Commission commences round five today in Sydney.

The main topic for this round of examination will be the fees, charges and weak performance of bank-managed superannuation funds.

One Melbourne-based think tank has estimated that excessive fees and poor performance can cost superannuation investors up to $12 billion per year.

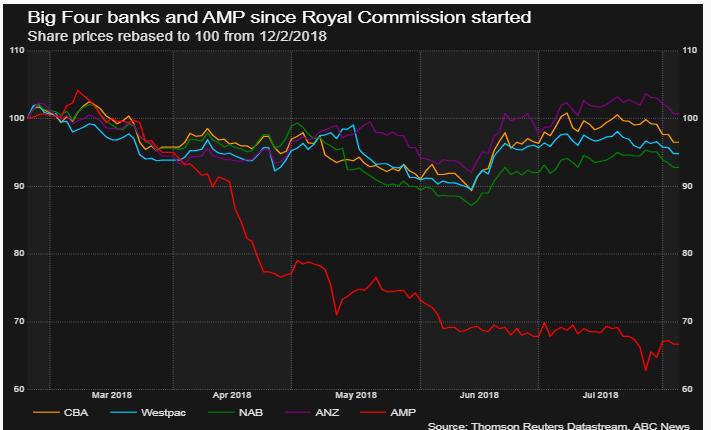

Australia’s largest superannuation provider, AMP, felt the wrath of the Royal commission during the last round of testimony, which saw their share price drop over 30% and the sacking of its chairman, CEO and three other directors.

The chart below illustrates the performance of AMP’s share price relative to the other Big 4 banks.

We don’t have ALGO buy signals for any of the domestic banks and we’re not holding any banking names in our ASX Top 100 portfolio. However, we will look for signals as the share prices approach the June lows.

AMP will need to address a wide range of issues including the Royal Commission responses, grandfathering and impact of Budget proposals in order for investors to understand AMP’s sustainable level of profitability.

Investors are also looking for the CEO to outline the longer-term group strategy. With many anticapiting some sort of restructure and the separation of the funds management business away from the advice model.

1H18E profit guidance came in lower than consensus expectations at $490-$500 million.

AMP is the worst performing stock in the ASX 50 model.

We have two under performing stocks, AMP and FMG. Both businesses face unique structural issues that have weighed on their respective share prices.

We feel investors will be rewarded for slowly accumulating AMP shares at discounted levels but it is very difficult to see when the inflection point occurs.

AMP goes ex div $0.145 on 23rd August and we have the stock trading on a forward yield of 7%.

AMP

Or start a free thirty day trial for our full service, which includes our ASX Research.