Ansell & Tabcorp

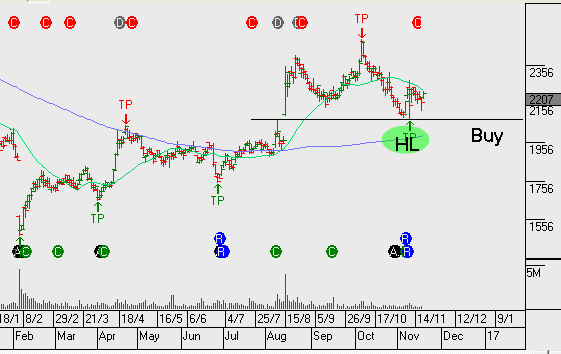

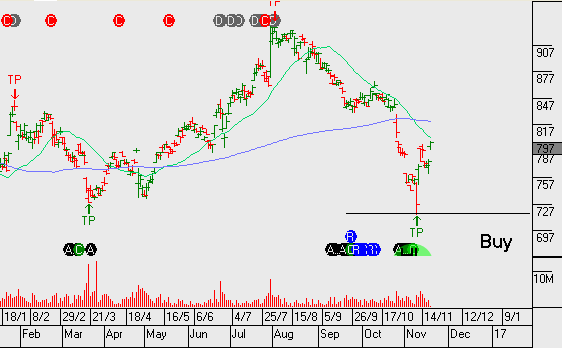

We’ve been recent buyers of TAH and ANN and now look to sell covered call options.

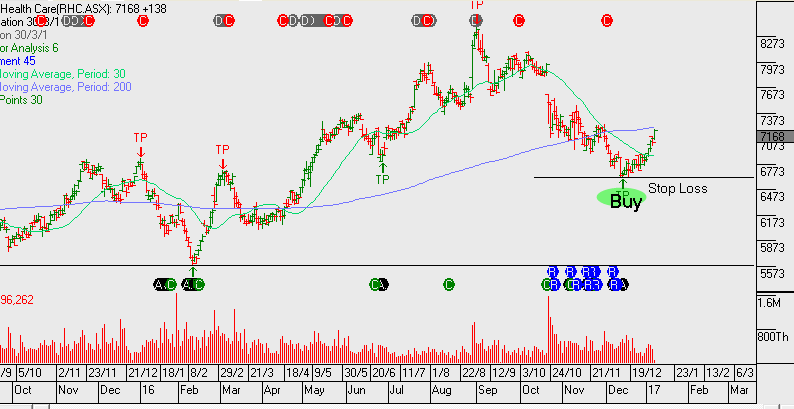

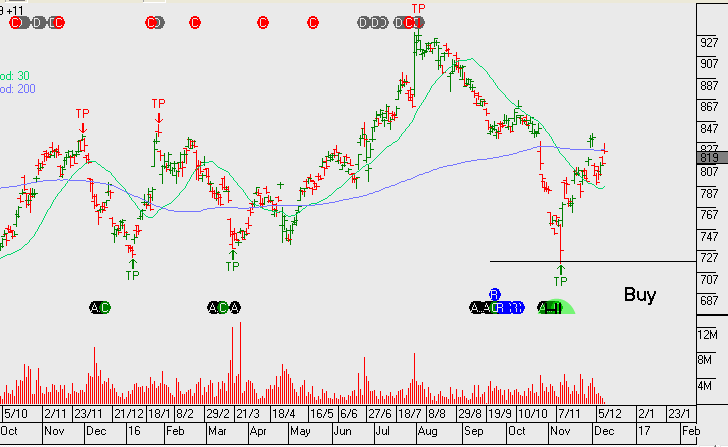

Chart – ANN

Chart – ANN

Chart – TAH

We’ve been recent buyers of TAH and ANN and now look to sell covered call options.

Chart – ANN

Chart – ANN

Chart – TAH

The Algo engine generated a sell signal for Ansell at the close of trade yesterday.

From a technical perspective, Ansell’s closing price of just under $23.00 is very close to the 50% retracement of the high of $25.65 traded on January 9th and the low price of $20.60 posted on February 20th.

While we still like the longer-term growth prospects of the company, we are seeing signs that the general market may be rotating lower over the medium term.

As such, we believe its reasonable to expect that investors will be able to buy Ansell back below the $22.00 handle.

The current price of $23.35 offers a good opportunity to sell close-to-the-money call options to enhance portfolio returns.

Our Algo Engine triggered a buy signal on ANN a few months back when the stock was last on the $21 support level.

With the stock retesting this level and increased buying interest occurring, we again are willing to look at ANN with a tight stop-loss under the $21 support.

Ansell has purchased Nitritex, a UK-based manufacturer of premium clean-room and healthcare Life Sciences consumables. The deal is relatively small at US$60m and will be near-term earnings accretive.

The transaction adds to income generated outside the US and extends to the Ansell’s expertise across the Life Sciences segment.

We’re buyers of Ansell on the current price pullback. Value exists in the $22.50 – $23.50 range.

FY17 revenue $1.65b, EBITDA of $285m, net profit $170m, EPS $1.10 and DPS $0.46 places the stock on 2.5% forward yield.

We expect underlying business growth into FY18 and FY19 of 6% – 9%.

At this point in the market we prefer healthcare names as a sector allocation for new money. Here are the recent buy signals generated by our Algo Engine.

With SHL, CSL and ANN we’ve added covered calls to boost the annualised cash flow to over 10%, whilst still allowing for capital growth if exercised at the strike price of the sold call.

The below names are performing well, following the recent buy signals from our algo engine.

We continue to track the following names as preferred recent buy signals from our algorithm engine.

The following group of stocks are in either established uptrends or, in recent months they’ve broken downtrends to begin building the early stages of a bullish “higher low” formation.

Many of these names have been mentioned previously in the blog and/or the monthly strategy video report. It’s worth loading these codes into your watch list and considering rebalancing your portfolio to include allocations towards some, or all of these names:

JHX, LLC, MQG, SHL, TWE, ANN, ANZ, ASX, CCL, CIM, COH, QUB, TAH, WOW & WPL.

With the lower growth names within the above basket, such as WOW & CCL, we compliment the position now with tight covered calls to enhance the yield to 10%+ per annum. With some of the other names, we give a little more breathing space as we expect 5 to 10% price appreciation before selling the call option overlay.