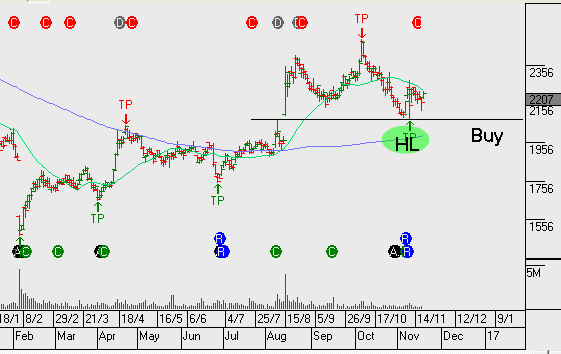

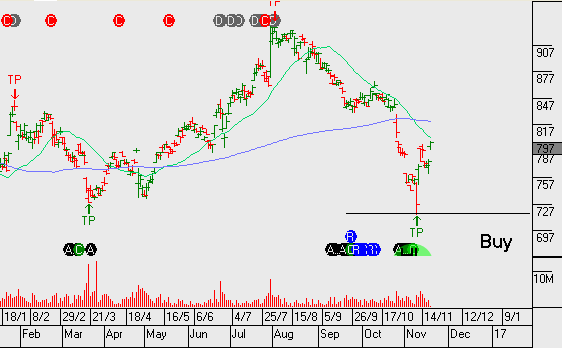

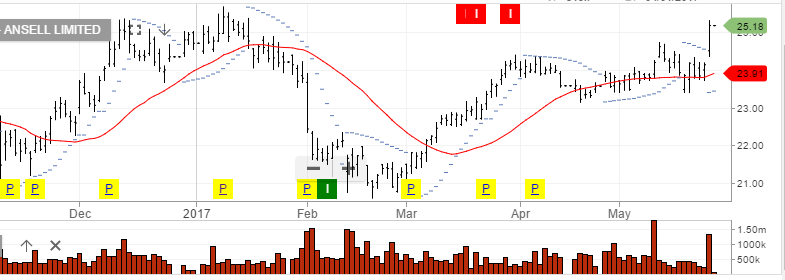

Ansell – Buy Now

Our Algo Engine triggered a buy signal in Ansell on the 7th February at $21.50 and the stock is now trading $23.22.

The recent selling weakness, where price has retraced from $25 back to $23, provides another buy side entry opportunity. The company will commence a $400m share buyback program later this month which should help to underpin the share price.

Stop-loss orders should be applied on a break back below $22.50. Buy and hold investors seeking added yield, may prefer to take a slightly longer-term view and sell-out-of-the-money calls at $25 into November.

Chart – ANN

Chart – ANN