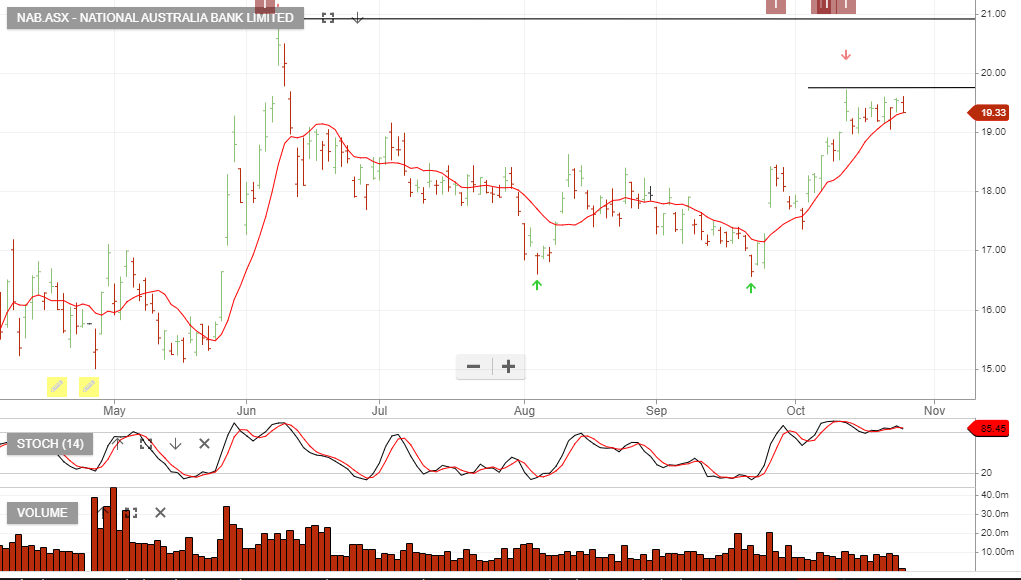

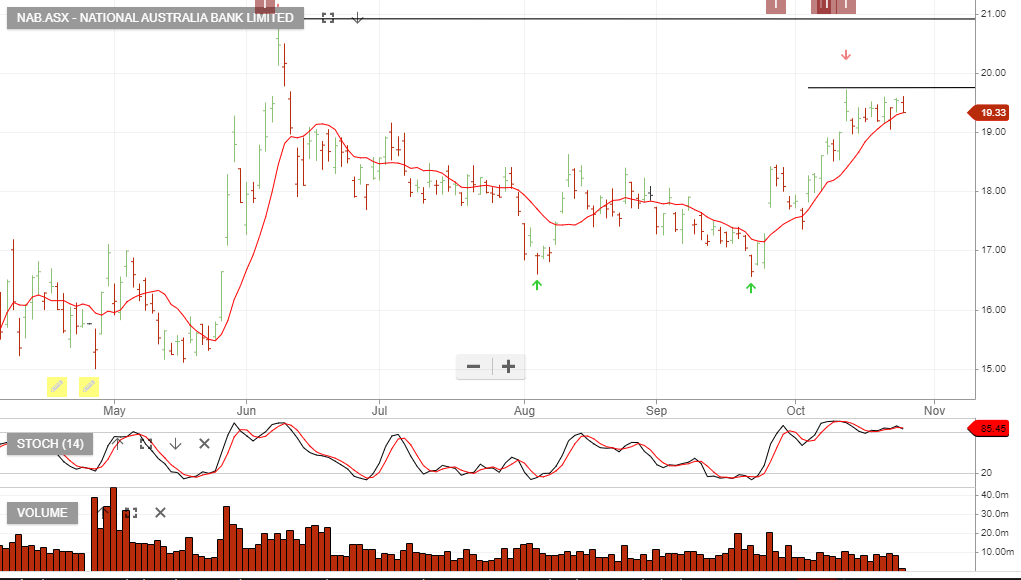

NAB – Sell

National Australia Bank is under Algo Engine sell conditions and we expect selling pressure to build at the $19.50 resistance level.

National Australia Bank is under Algo Engine sell conditions and we expect selling pressure to build at the $19.50 resistance level.

National Australia Bank 1H2020 profit falls by 51%.

The company also moved quickly to shore its balance sheet following the initial impact of COVID-19 related business provisions. NAB will raise $3.5bn via an institutional placement at $14.15 per share.

The placement will be done at a 10.5% discount.

Our bearish warnings on NAB are still yet to play out completely, as we see further raisings likely in the Sept quarter.

We expect National Australia Bank to run into selling pressure at $16.50. We favour the short side of this trade.

Today NAB announced first-half earnings will take a $1.14 billion after-tax hit – even before the impact of the coronavirus is accounted for.

NAB said investors will have to wait until it reports its half-year numbers on May 7 to see the impact of the pandemic on its “earnings and balance sheet including provisions, combined with capital and dividend implications”.

National Australia Bank is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

NAB reported FY19 cash earnings of $5.1bn and opted to operate a discounted DRP as well as partially underwrite the DRP, instead of discounted equity raising, as was the case with WBC.

ANZ, WBC, NAB and MQG all offer yield support but little in the way of near -term earnings growth.

National Australia Bank is under Algo Engine buy conditions and was added to the ASX 100 model portfolio on Friday.

We now have ANZ, NAB and MQG under buy conditions.

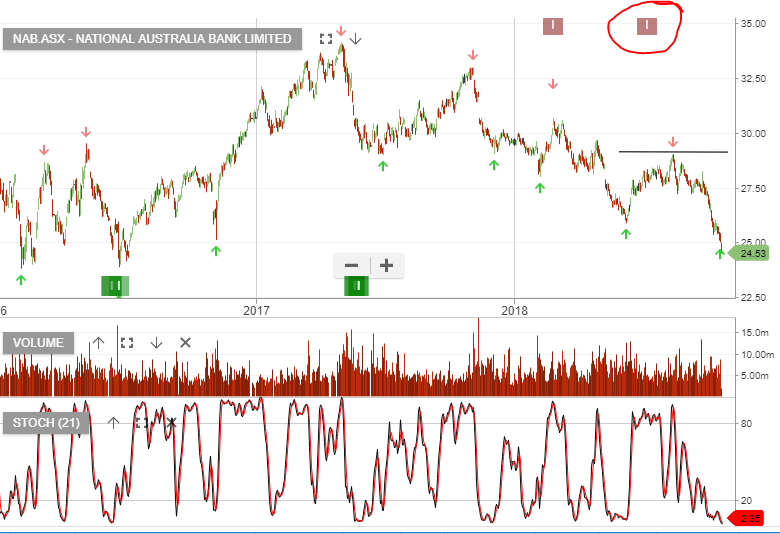

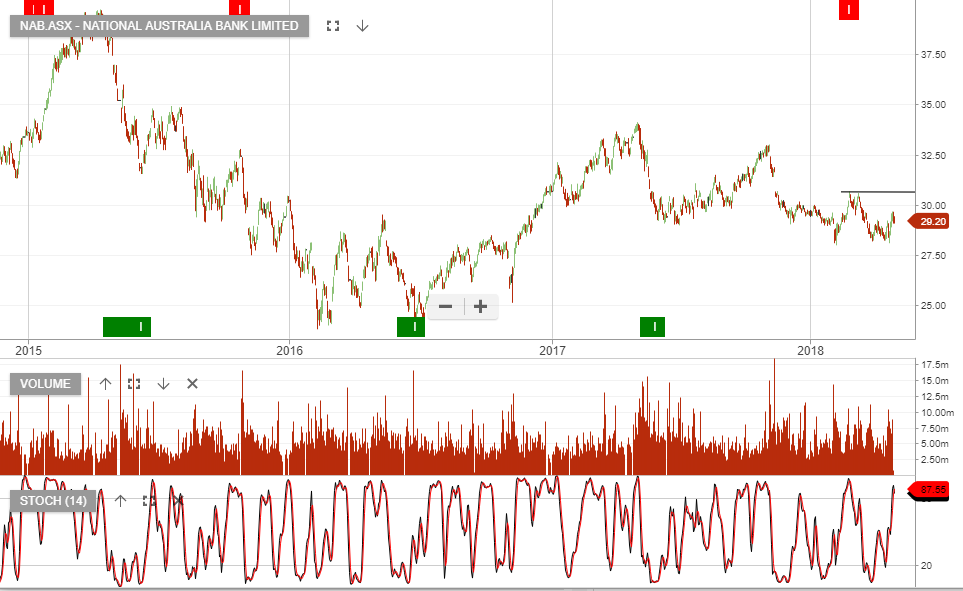

National Australia Bank is under Algo Engine sell conditions following the lower high formation at $25.50 in early March.

ANZ & MQG are the only banks under buy conditions.

The chart below shows the price action of the Betashares Global Banks ETF.

JP Morgan reports earnings Friday in the US.

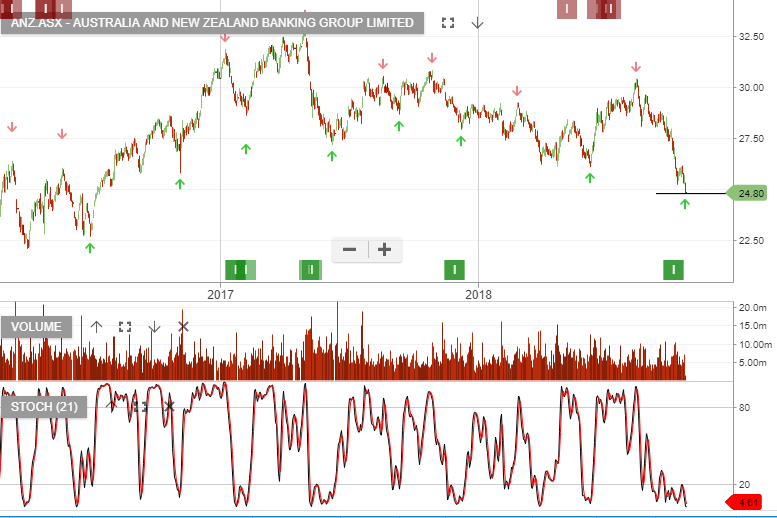

ANZ is expected to report its FY18 result on 31 October.

The share price has now broken the June low support area and looks vulnerable to more downside pressure.

NAB is scheduled to report its FY18 result on the 1st of November. The next downside target is near the $24.00 area.

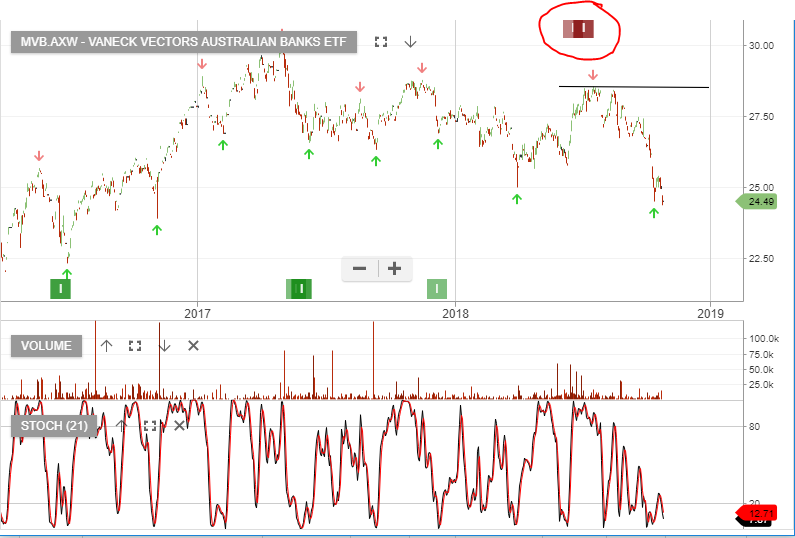

Vaneck Vestors Australian Bank ETF has been under ALGO Engine sell conditions since early July. The sell-off so far represents a 20% correction.

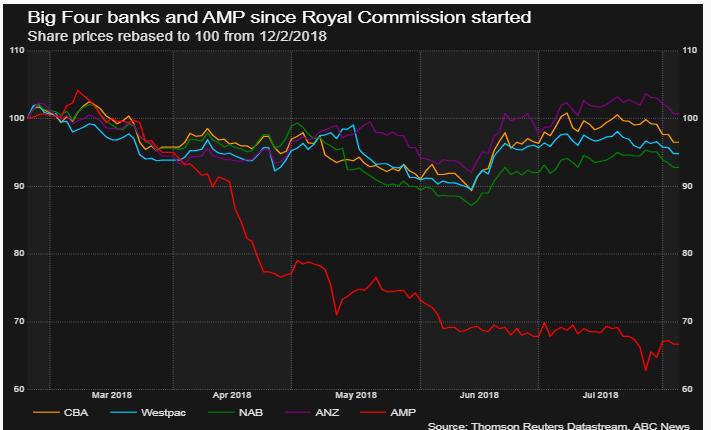

The Big four banks will be in the spotlight this week as the Banking Royal Commission commences round five today in Sydney.

The main topic for this round of examination will be the fees, charges and weak performance of bank-managed superannuation funds.

One Melbourne-based think tank has estimated that excessive fees and poor performance can cost superannuation investors up to $12 billion per year.

Australia’s largest superannuation provider, AMP, felt the wrath of the Royal commission during the last round of testimony, which saw their share price drop over 30% and the sacking of its chairman, CEO and three other directors.

The chart below illustrates the performance of AMP’s share price relative to the other Big 4 banks.

We don’t have ALGO buy signals for any of the domestic banks and we’re not holding any banking names in our ASX Top 100 portfolio. However, we will look for signals as the share prices approach the June lows.

The NAB result was subdued with revenue growth deteriorating. 1H18 NPAT $2.75bn down 17%, EPS 99cps and Div 99cps.

“looks like a dividend cut is imminent”

1H18 revenue rose just 0.7%, whilst Net Interest Income fell and loan growth was anemic at +1%.

In both the ANZ and NAB results, we’ve seen early signs of bad and doubtful debts, (for 90 days+), beginning to rise from very low historical levels.

Lower loan growth, no revenue growth, increased costs associated with restructuring, competition from technology disruptions, increasing bad debts, wafer-thin bad loan provisioning are reasons to “sell the rally” in the banking shares.

6100 – 6200 on the XJO Index should be a level to review bank holdings.

NAB

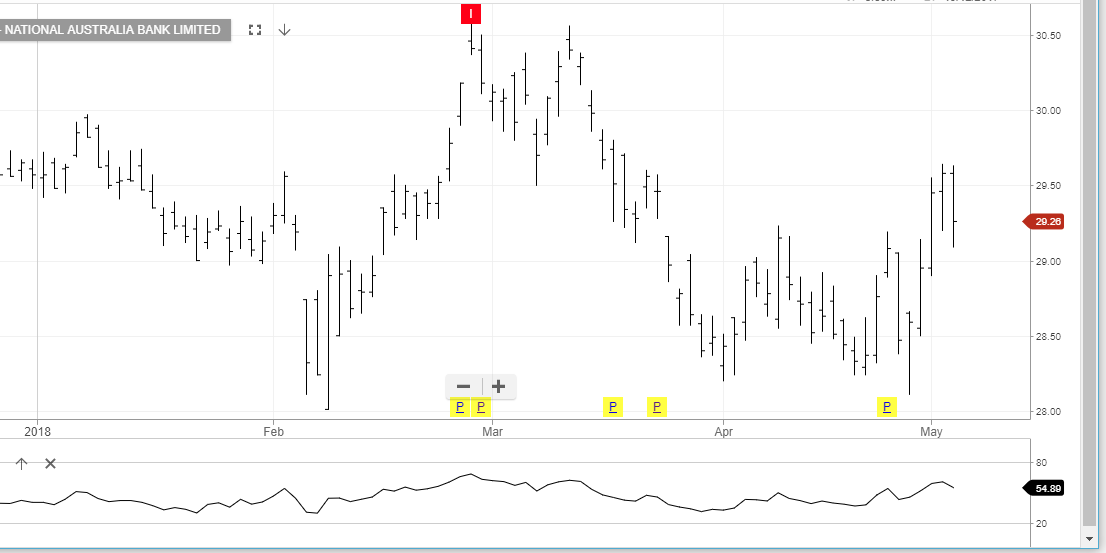

Shares of NAB are down over 1.5% in early trade as the bank reported a 16% drop in half-year cash profit as it booked a restructuring-linked costs related to workforce reduction.

The bank posted cash earnings, that excludes one-offs and non-cash accounting items, of $2.76 billion for the six months ended March 31, compared with $3.29 billion last year.

NAB bank maintained its interim dividend at 99 cents per share, which puts it on 13.2 times earnings.

Our ALGO engine triggered a sell signal for NAB on February 27th at $30.40.

The technical picture is fairly neutral, and with NAB going ex-dividend on May 16th, we see initial support in the $28.50 area.

NAB