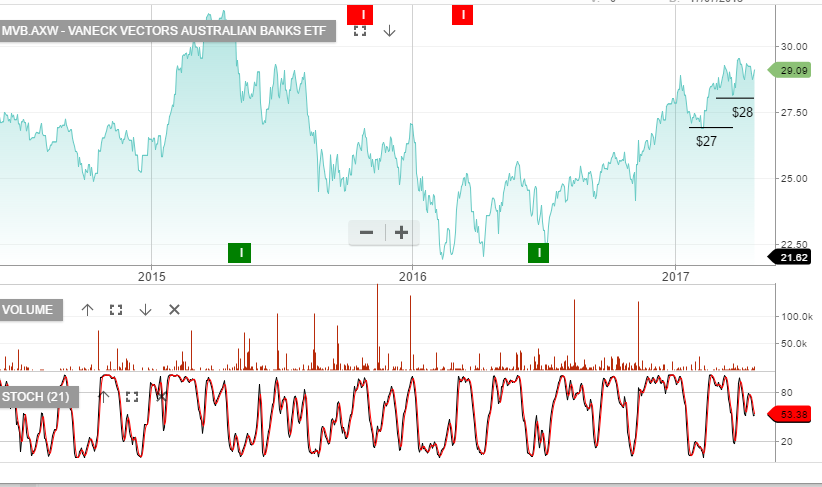

Higher Funding Costs Weigh On The Banks

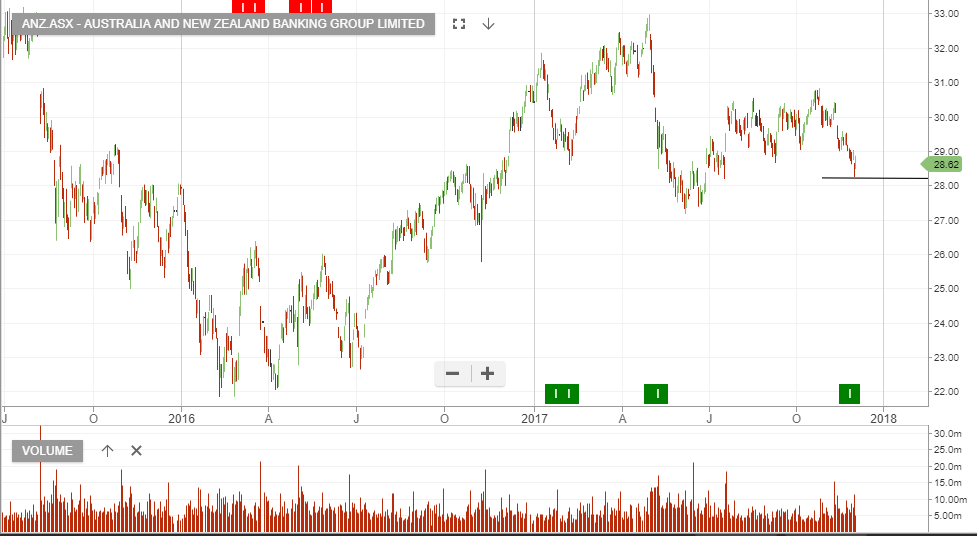

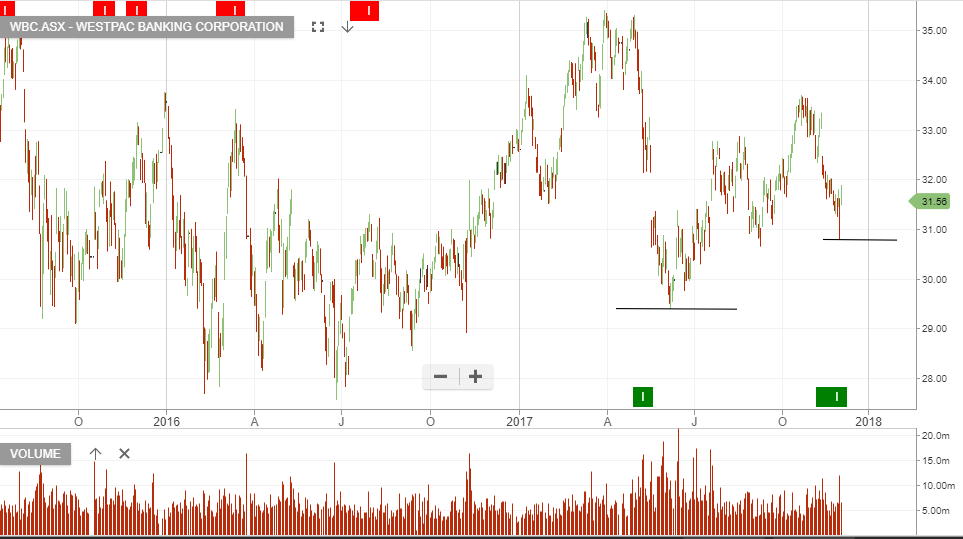

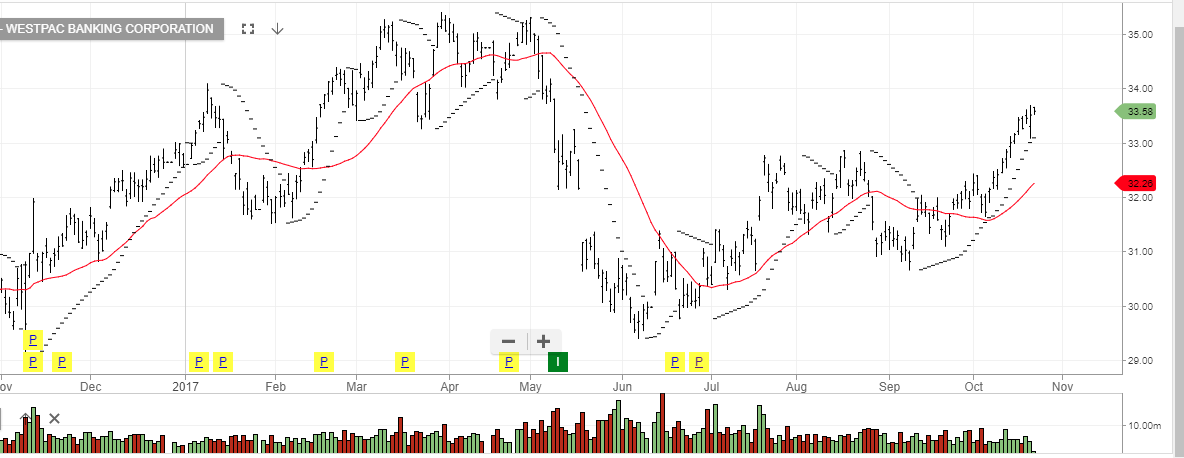

Shares of the major banks have traded on both side of the ledger since the announcement of the Banking Royal Commission last week.

There’s been plenty of articles written about what the impact will be and what investors can expect from the share price and dividends from these blue-chip companies.

However, one of the areas of the banking business which has not received much press is the negative impact from increased funding costs for the banks from overseas lenders.

Over the last two years, CBA, WBC and the NAB have issued over $145 billion in long-term wholesale debt to overseas lenders.

This is up from just under $110 billion in FY 2015 and reflects the increased reliance that the local banks have on overseas lenders

We would expect the increased in funding costs, combined with lower domestic loan margins, to cap any protracted rallies in the local banks over the next 12 months.

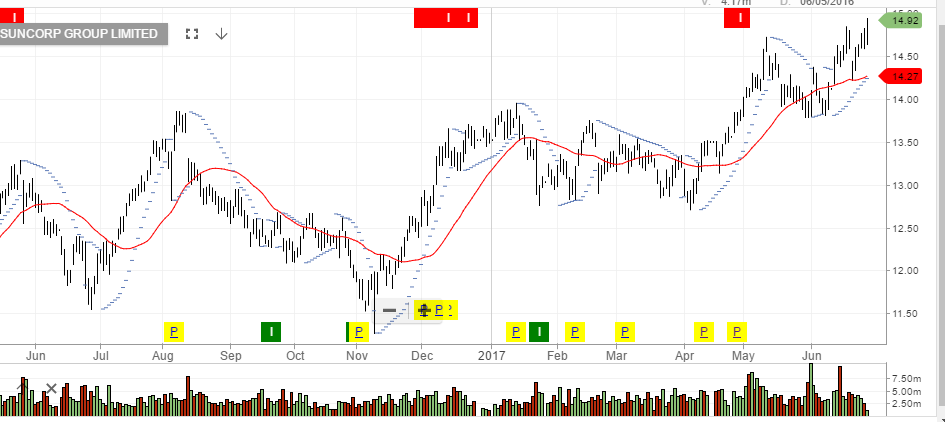

Our ALGO engine triggered a sell signal for the CBA on November 10th at $80.90. This is in addition to the ALGO sell signals in SUN at $14.20 and BEN at $12.30.

CBA

SunCorp

Bendigo BAnk