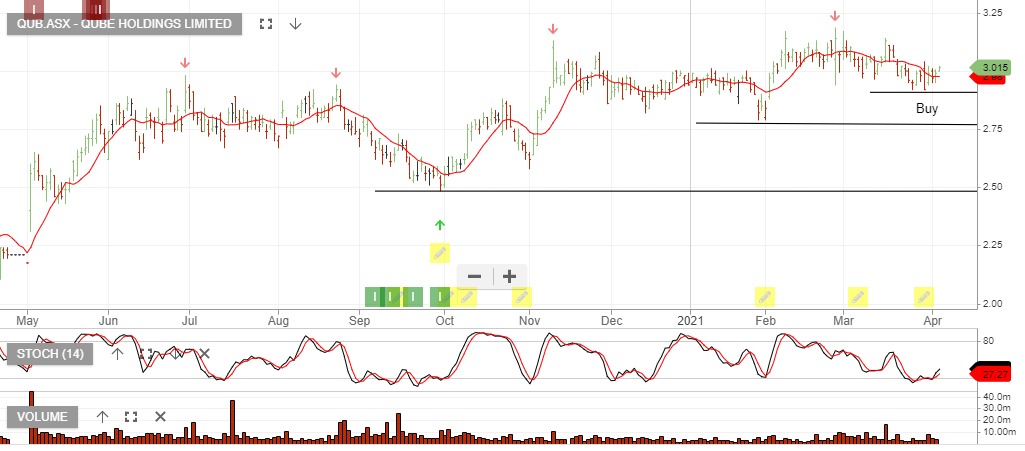

Qube Holdings – Algo Buy

Qube Holdings is under Algo Engine buy conditions, with price support at $2.90. Consider a stop-loss on a break below the support.

In 2021, container port freight volumes are up on average 10 to 20% per month compared to last year.

25/5 Since writing the above post, QUB has found steady buying interest above the $2.90 support and the momentum indicators continue to trend higher.

A number of institutions have upgraded their price targets into the $3.40 to $3.60 range.