Qube Holdings – Review

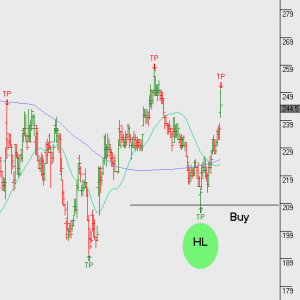

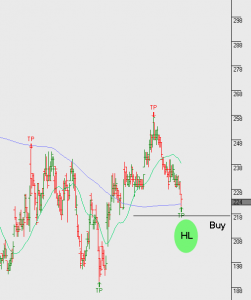

Qube Holdings is now under Algo Engine buy conditions and as part of the review, we take a closer look at the FY20 earnings results.

COVID has had a negative impact on overall volumes and we expect to see a gradual improvement over FY21 and FY22.

About

Qube is Australia’s largest integrated provider of import and export logistics services with a market capitalisation in excess of $4.88 billion as at 30 June 2019.

We operate in over 130 locations across Australia, New Zealand and South East Asia with a workforce of over 6,500 employees.

Qube is comprised of three business units including Ports, Bulk and Logistics division, Infrastructure and Property division and Strategic Assets division. We also hold a 50 percent interest in Patrick Terminals, Australia’s leading container terminal operator.

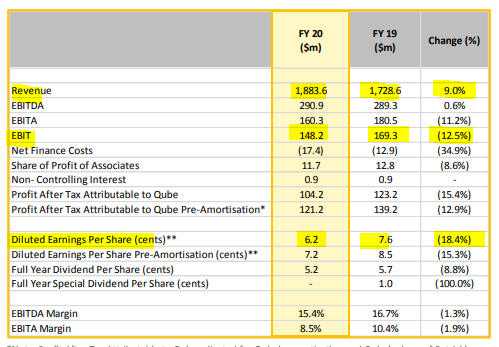

FY20 Earnings