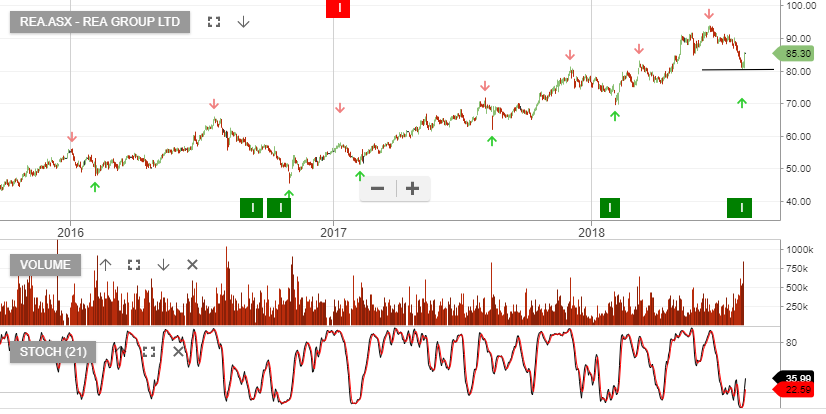

REA Group – Value Has Emerged

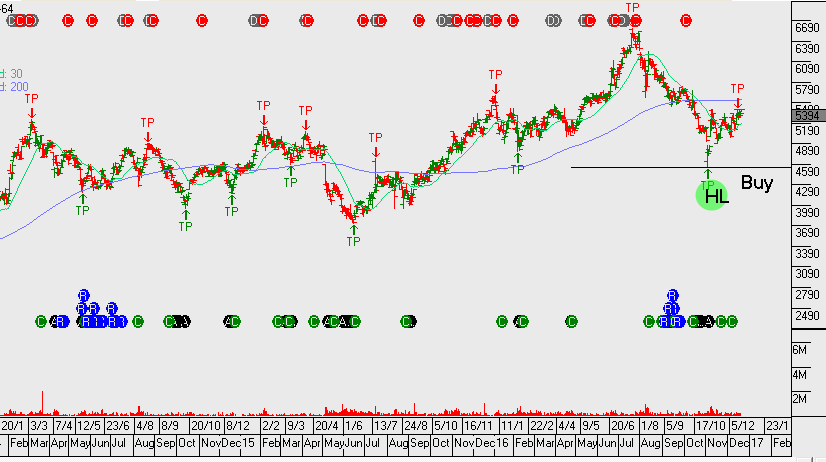

REA Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The share price has corrected over 40% due to the impact of COVID-19. Earnings will decline over the coming months as restrictions impacting open homes and slower vendor listings bite in the short-term.

In the medium term, we see scope for a full recovery in the business and therefore, the current share price at 20x forward earnings looks attractive.