Woolworths -How to achieve 12% per annum in cashflow

Woolworths will report their first quarter sales for FY18 on the 31st of October. We expect continued growth of around 5% from the key Food and Liquor business, while Big W is likely to struggle.

FY18 total revenue if forecast to be $58b, EBIT, $2.5b delivering underlying net profit of $1.6b.

EPS $1.35 and DPS of $1.00, places the stock on a forward yield of 3.5%.

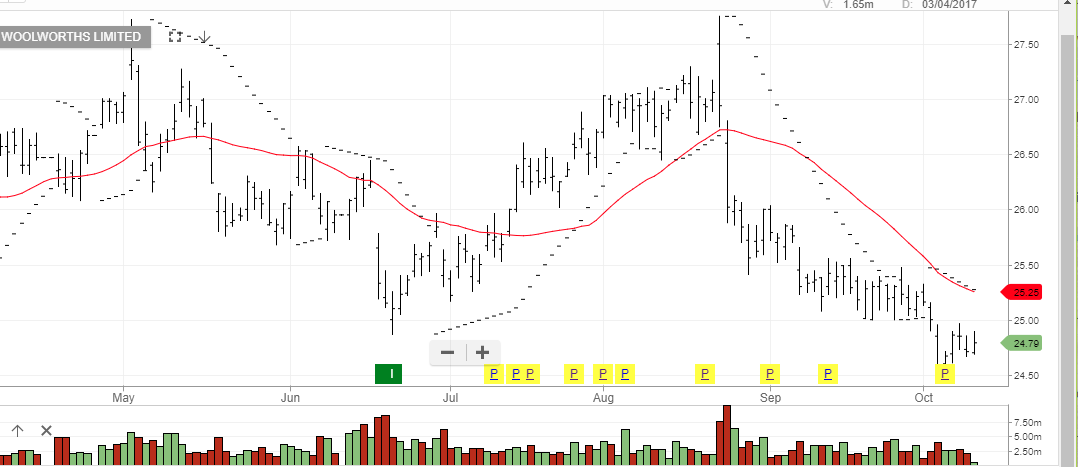

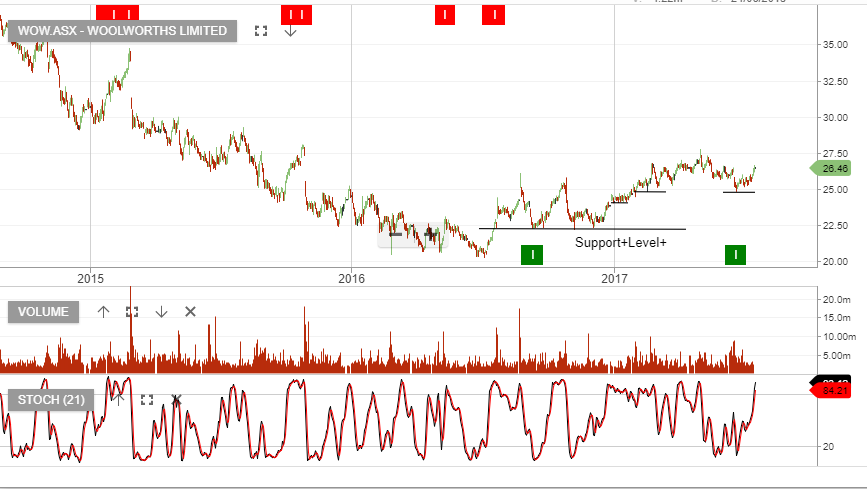

Our Algo Engine generated a buy signal in Woolworths near $25, we see this as fair value and when complimented with a covered call, we’re delivering 10 – 12% per annum in cash flow ASX:WOW

Woolworths