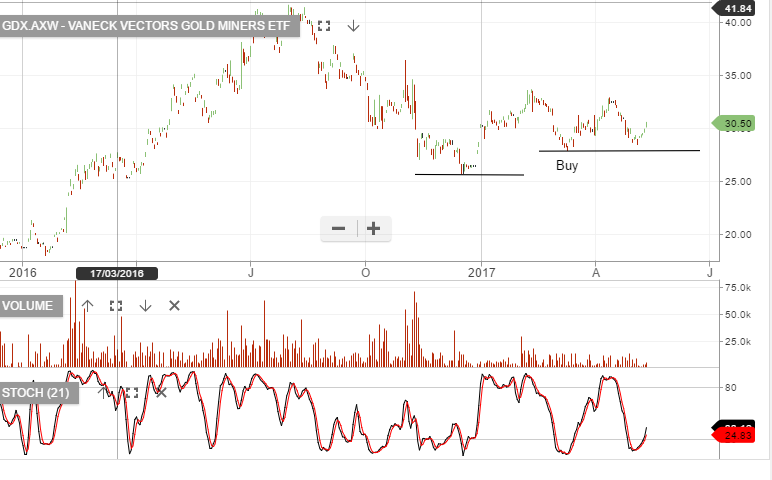

Chart Watch – GDX (Gold ETF)

GDX is creating a higher low formation and we see further upside. Stop loss should be placed at $28.00

GDX is creating a higher low formation and we see further upside. Stop loss should be placed at $28.00

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

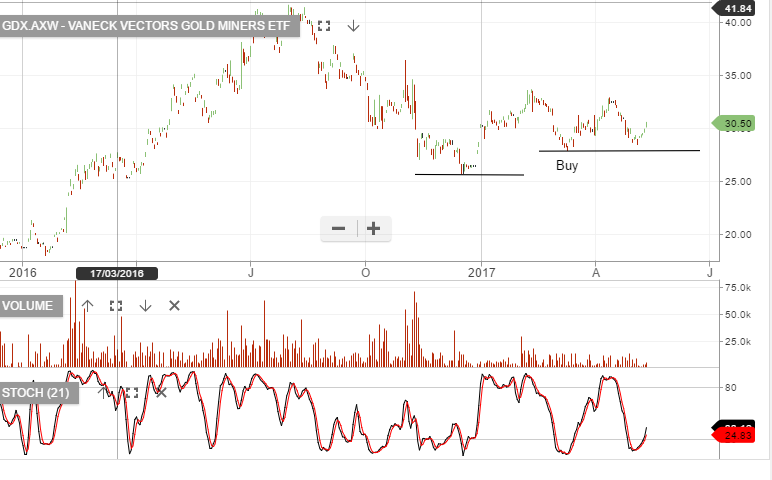

Since posting an intra-day low at $22.50 on May 5th, shares of BHP have lifted over $1.00 to $23.85.

Against a back drop of weakening fundamentals in the Iron Ore and Coal markets, we see this corrective move higher running into resistance in the $24.00 area.

General market downside risk is also adding to our interest in placing orders to exit long positions in BHP at $24.00 going into the weekend.

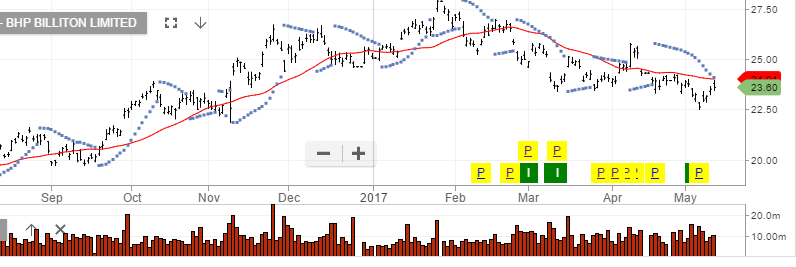

The ALGO engine triggered a sell signal on Brambles at yesterday’s close near 10.50.

We don’t see a tremendous amount of downside in the stock with good price support in the $9.60 area.

Internal momentum indicators on the daily charts confirm the ALGO signal and a near-term overbought condition.

We have been suggesting that clients holding long positions take profits or write covered calls in the $11.00 strike price.

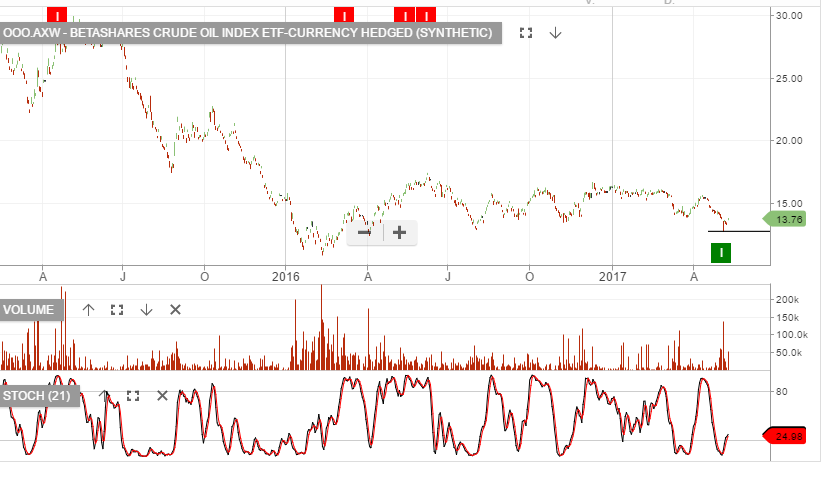

We continue to track the Betashares oil ETF OOO.AXW

Oil prices have rallied from the recent low after this week’s largest inventory drop of 2017. EIA data has revealed U.S. crude stocks fell by 5.2M barrels. In addition, OPEC supply cuts have been agreed to by Iraq and Algeria joined Saudi Arabia.

Concerns regarding the abundant added supply of US shale oil will keep a lid on any meaningful rally, but we may see a bounce from the recent low. Investors should run stop losses under the trend low on both ETF and individual stock names.

Our best performing energy trade has been the long ORG position. However, due to the extended price rally since the Algo Engine buy signal, we’re now inclined to take profit in ORG and consider the OOO.AXW ETF as a replacement.

US Banks have under performed in the last 3 months. With the S&P500 up almost 4% and the banks up on average around 1.5%.

Q1 bank earning reports showed bank loans shrinking since late 2016.

This is likely caused by the first-quarter 2017 GDP growth that was anemic at .7%. Investors are expecting GDP to grow 3% or better during the remainder of 2017, we’re not so sure.

Bank earnings will do well in a environment of 2.5 to 3% plus GDP, anything less than 1% is likely to be problematic. While improving unemployment rates and the Fed’s intentions to raise rates this year, suggest the US economy is doing okay, the slowdown in lending, slowing GDP, rising loan defaults, tighter lending standards may suggest otherwise.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

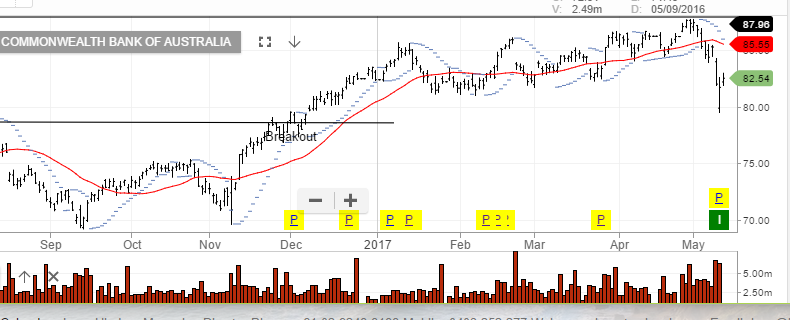

Shares of the major banks dropped sharply at yesterday’s open as budget-related fears triggered intra-day volatility rates not seen in the banking names for over 2 years.

Prices rebounded throughout the trading session in what we consider technical , value-related buying, which substantially pared the early losses.

The strong reversal in share prices triggered the ALGO engine to give buy signals in ANZ, CBA, WBC .

Given the murky outlook for earnings growth, and increased bad-loan provisions across the banking sector, we only expect the recent price action to form a 50% retracement of the recent losses, at best.

Commonwealth Bank

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.