US Labor Day Preview

During yesterday’s Asian session and into the London time frame, investors were anxious about North Korea’s provocative missile launch, the flooding disaster in Texas, and the looming US debt ceiling debate.

However, once the US session opened, investor’s attenton turned to preparing for the Labor Day long weekend, which marks the end of the Northern Summer.

The NYSE will close early on Friday and will remain closed all day next Monday.

Volume on the Dow Jones 30 was barely 220 million, down 25% from the 3 month rolling average of 310 million per day.

As the chart below illustrates, the SP 500 remains below the 30-day moving average with a downward bias.

S&P 500 Index

Spot Gold

Spot Gold Newcrest Mining

Newcrest Mining Evolution Mining

Evolution Mining

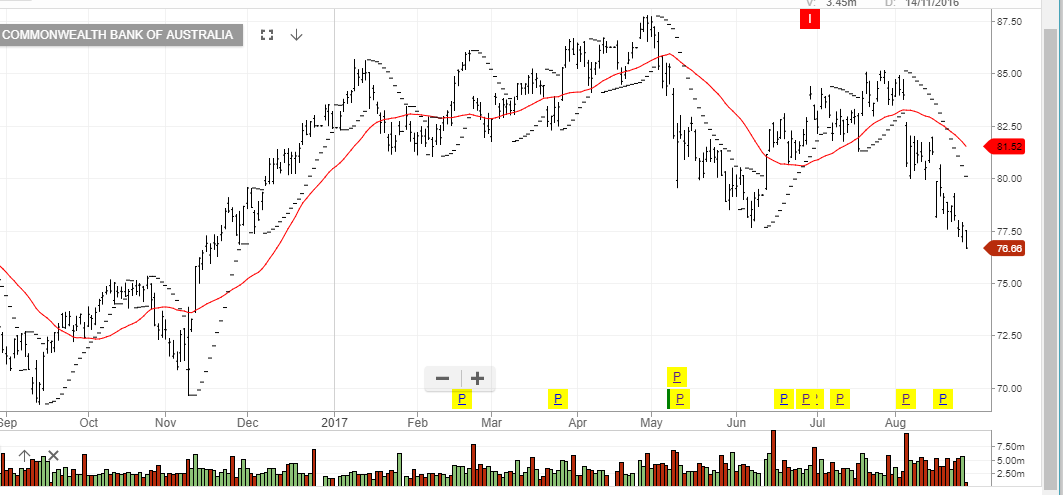

Commonwealth Bank

Commonwealth Bank