BHP Bumps Dividend As Earnings Slip

BHP’s 1H FY18 earnings result was below market expectations.

Despite the cost pressures, BHP has stepped up cash returns to shareholders, with the US$0.55 interim dividend a positive surprise in the 1H FY18 result.

FY19 revenue and underlying profit is forecast to remain flat, placing the stock on a forward yield of 4.2%.

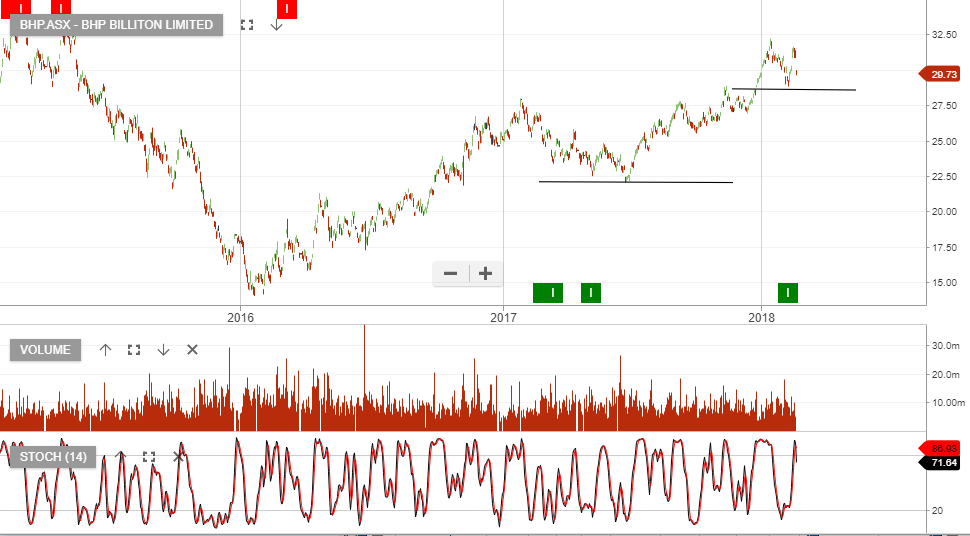

We own BHP at lower levels and sold the $29.50 March calls for a $0.60 credit to enhance the cash flow. We continue to remain exposed to the March dividend.

BHP