Wesfarmers 1H19 earnings show declines of 8% in the Kmart division and in Bunnings, margins are resilient, however, growth is difficult to achieve.

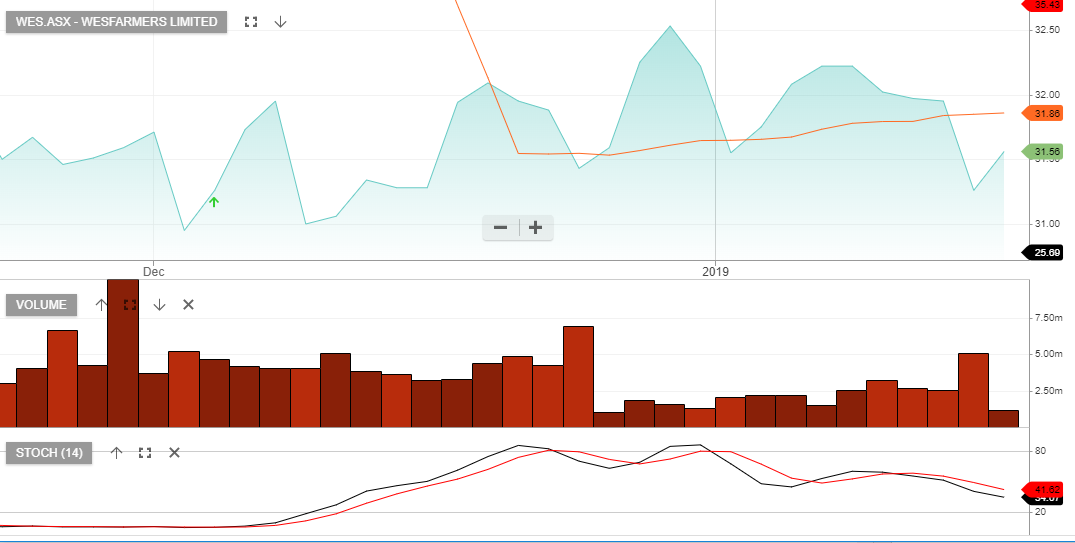

We consider Wesfarmers near full value at the current 18x FY20 earnings per share multiple.

Based on FY20 earnings, we have WES trading on a 4.8% yield and we see some price support on the likelihood of a large scale share buy back in the range of $2.5bn +

We recommend selling out of the money calls to enhance the income, whilst staying exposed to the Feb dividend.