Buy Tabcorp – Value @ $4.25

We recommend buying Tabcorp at $4.25 and holding the investment through to the February reporting result. We feel the market is underestimating the earnings strength in the December half.

We recommend buying Tabcorp at $4.25 and holding the investment through to the February reporting result. We feel the market is underestimating the earnings strength in the December half.

S32 is under Algo Engine buy conditions and with the stock finding support at $3.25, we recommend investors buy the stock.

S32 goes ex-div 8 cents on the 8th of March. Adding a $3.56 March call generates an additional 10 cents per share of income.

Our Algo Engine generated a buy signal in Flight Centre and the stock is a current holding in the ASX 100 model portfolio.

We add this to our watch list, as buying interest builds around the $42 level.

FLT pays a $0.60 dividend on the 22nd of March.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Our Algo Engine has WPL, STO & OSH under current buy conditions and all three names are holdings in the ASX 100 model portfolio.

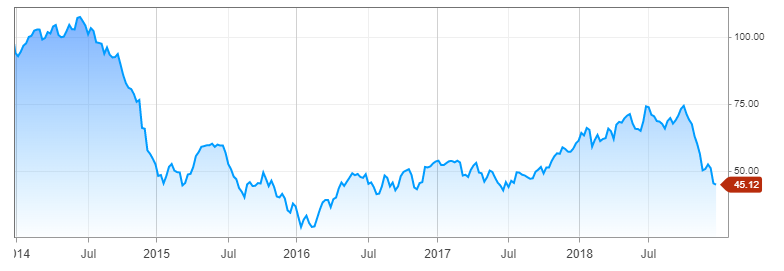

The following 5YR graph of Crude puts into perspective the 45% sell off we’ve seen in the past 12 weeks. Should Crude continue to find support, as we expect, WPL, STO & OSH are our preferred exposures.

OOO, the Betashares Oil ETF is another alternative for investors to consider.

Since we started buying the OOO on the 2nd of Jan, investors are now up 7%+

Chart: Betashares Crude Oil ETF.

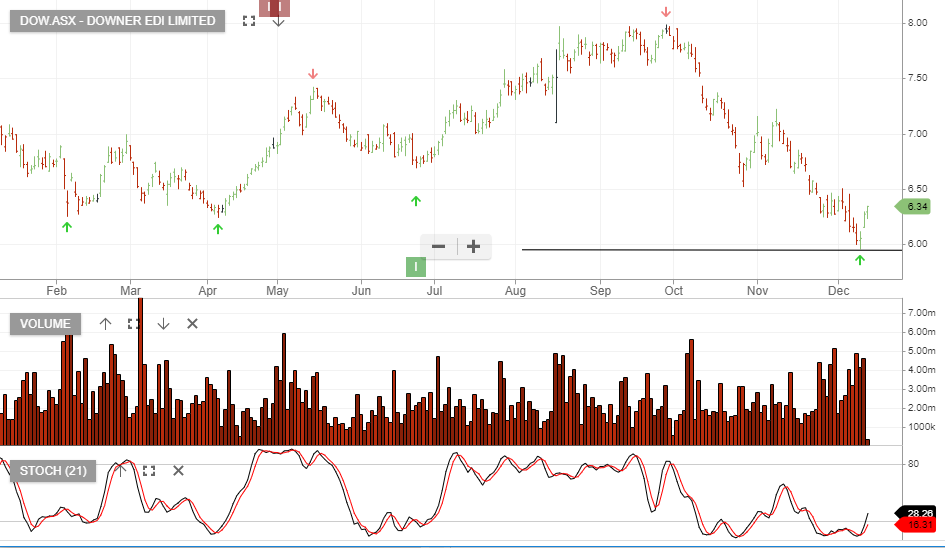

The below post is from 14th December and a check of the latest charts will show the rally which is now occurring in both names.

Both Downer and CIMIC are current holdings in the ASX 100 model portfolio.

The graphs below show the price action finding recent buying support.

We see a supportive backdrop with increased infrastructure spending, likely to underpin earnings growth in both businesses for the next 3 – 5 years.

NOTE: Today CIMIC Group has announced an on-market buy back of up to 10% of the shares on issue.

Brambles is under Algo Engine buy conditions and is a current holding in ASX 100 model portfolio.

We see value at $11.60

The XJO Index has been under Algo Buy conditions since forming a higher low back in June 2016, at 5000 points. With the Index building a base around 5500, (over the past few weeks), we’ve again used the “dip” to buy the index.

Replacing individual stocks in favor of the STW, (an ETF covering all ASX200 shares), will likely provide better investor returns.

For more detail on the STW and how to add call options to enhance the income, please call our office on 1300 614 002.

Our Algo Engine generated a buy signal in MQG recently and with the price forming a higher low at $103, we have been accumulating the stock.

Macquarie is likely to grow earnings at 10%+ in FY19 and is supported by a 5% dividend yield.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Or start a free thirty day trial for our full service, which includes our ASX Research.