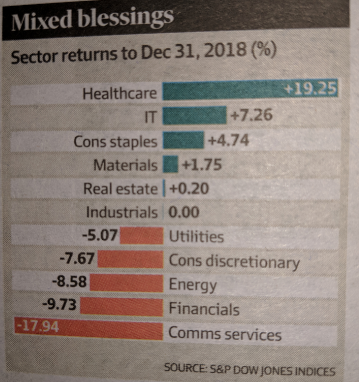

Treasury Wines Confirms 25% EBIT Growth

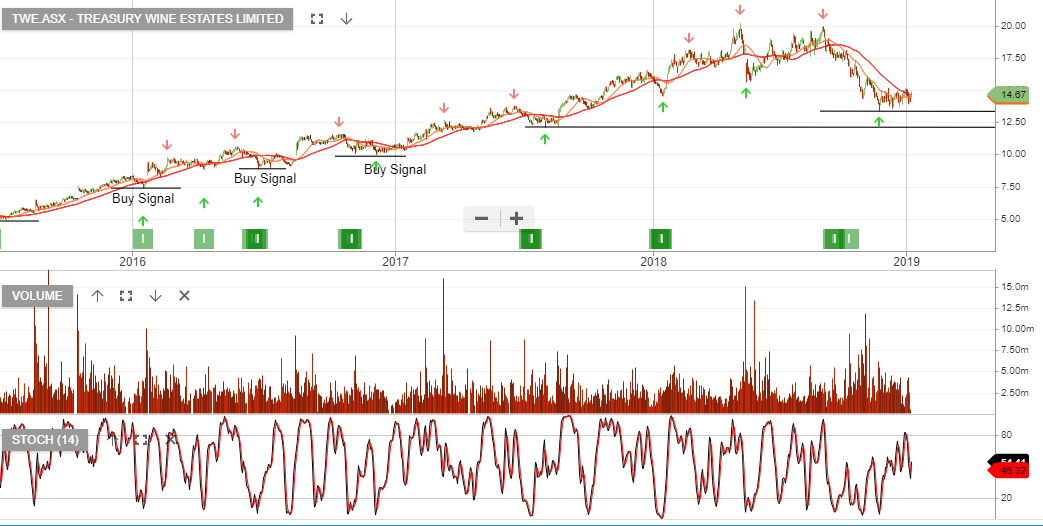

The post below is from the 11th of December. A review of the real-time charts will show TWE, SEK & ALL finding support at our forecast range.

All three names are now trading higher.

This week, TWE reiterated its forecast for 25% EBIT growth in FY19. This is in-line with market consensus and is positive for the share price. TWE is up 5% today on the back of the announcement.

We recommend running a buy write strategy with TWE.

Below post is from 11th Dec

TWE, ALL and SEK are current holdings in the ASX 100 model portfolio.

The graphs below show the current price action finding support at the top of the forecast consolidation channel.

TWE – Buy at $14

ALL – Buy at $21.80

SEK – Buy at $16.50

QBE chart from the 10th Dec.

QBE chart from the 10th Dec.