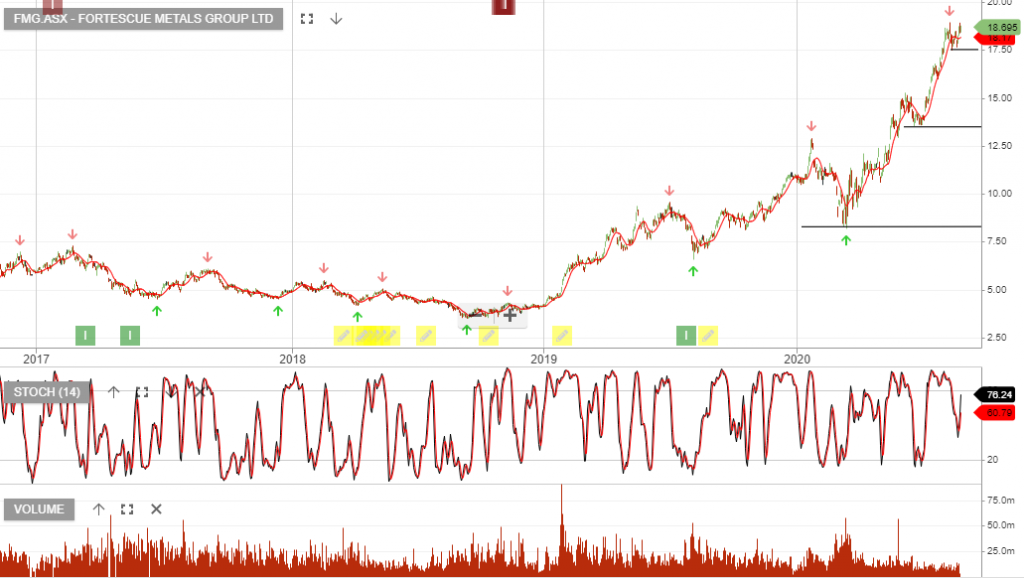

Fortescue – FY20 Earnings

Fortescue Metals Group is under Algo Engine buy conditions and is among the best-performing holdings within our ASX 100 model portfolio.

FY20 revenue was up 27% to $13bn and EBIT was in line with consensus at US$8.3bn, up 38% on the same time last year.

Forward dividend yield is 4.8%, plus any special dividends announced in FY21.