Banking Sector Outlook

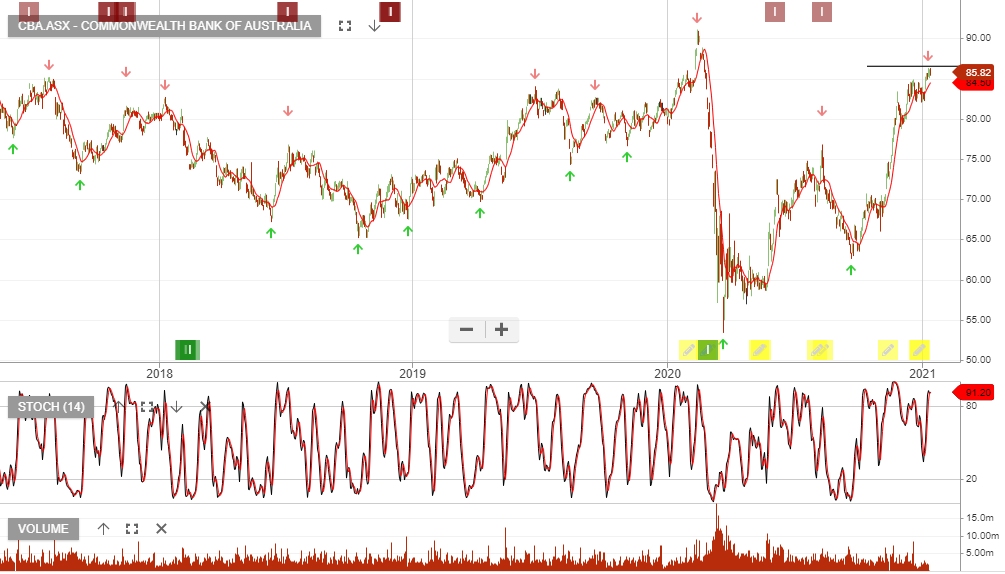

Retail banking profit margins will struggle as a reduction in interest rates, results in lower profits, due to lower net interest income.

This week the Reserve Bank warned that banks face fresh risks of business insolvencies and tighter margins from record low interest rates.

“The resilience of the banking system up to now doesn’t mean that risks have passed,” Mr Kearns said.

“We’ve had the largest contraction in global output since the Great Depression. And as that impairs some households’ and businesses’ ability to repay their loans, the liquidity phase of the crisis is giving way to a solvency phase.”

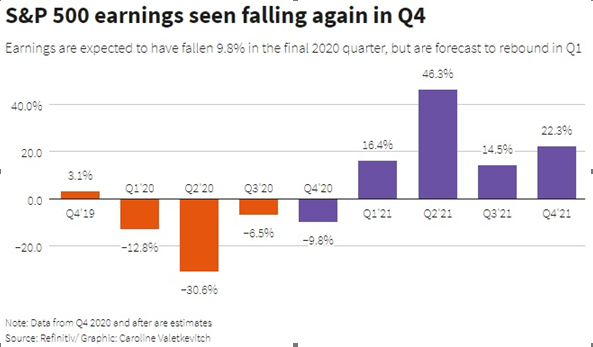

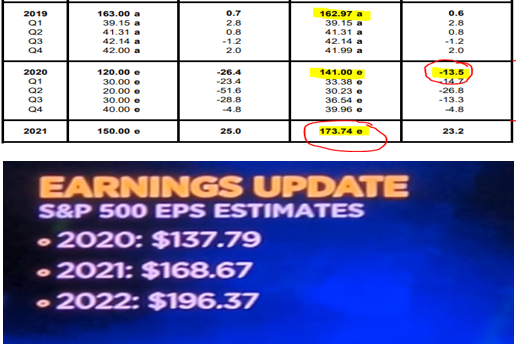

US banks report earnings tonight and we’ll analyze the breakdown in profits from investment activities versus retail banking. This will be a key determinant in global fund managers deciding to sell into this result or hold existing long exposure within the sector.

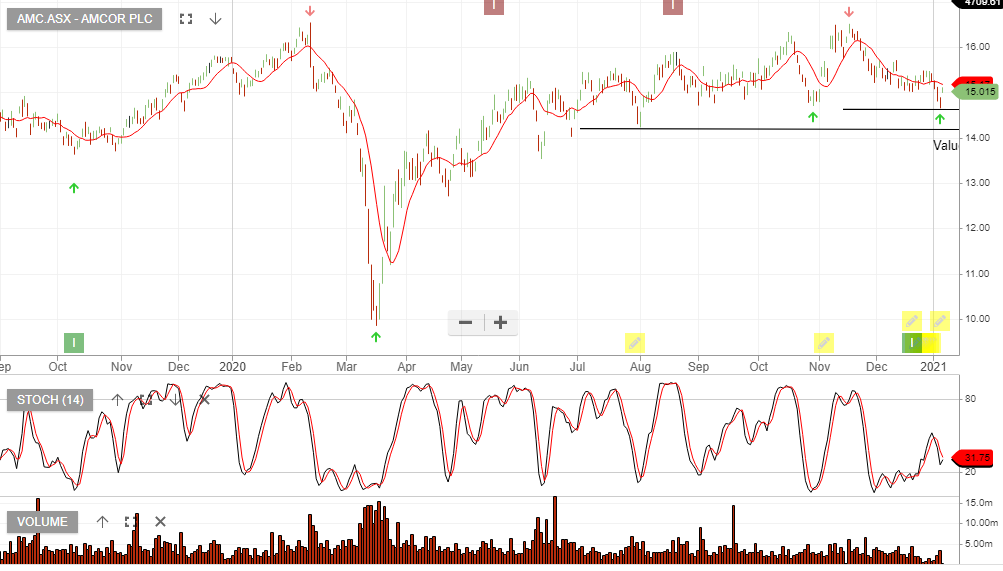

A reference point to consider will be tracking the ASX listed MVB ETF. The suggested approach is to stay long the sector but re-evaluate, should we see the price action trade below the 10-day average.

Further updates will be provided following tonight’s US bank results.