There are new Signals.

For our Members, please find below the latest list of signals.

For our Members, please find below the latest list of signals.

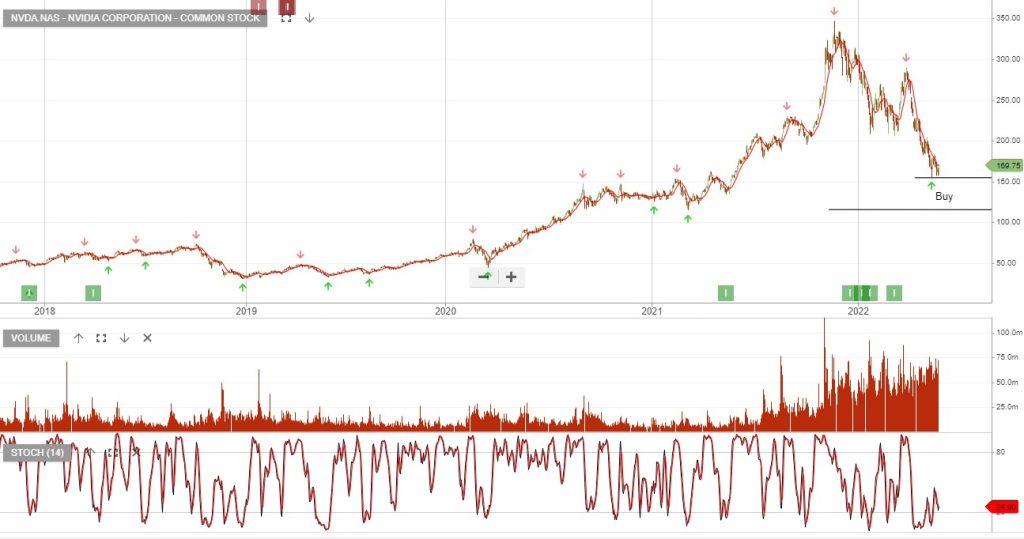

Nvidia will slow down its hiring pace and control expenses as the company deals with a challenging macroeconomic environment. Revenue for the March quarter came in at $8.29bn on EPS of $1.36.

Forecast revenue for the June quarter is expected to be $8.1 billion.

The company’s operating expenses increased 35% year-over-year. On the positive side, demand for its graphics processors used for gaming and artificial intelligence helped support sales growth of 46% year-over-year. Nvidia’s data center business, which sells chips for cloud computing companies and enterprises, grew 83% annually to $3.75 billion.

Nvidia said its board has authorized an additional $15 billion in share buybacks through the end of next year.

Rebasing investor expectations for BHP without the contribution from its petroleum business places the stock on a forward yield of 6% with flat to lower adjusted EPS into FY23.

Iron ore now represents around 50%, Copper 25%, with Coal and Nickel remaining other key exposures. We expect the eventual divestment of its remaining thermal coal assets.

Fisher & Paykel Healthcare Corporation is under Algo Engine buy conditions and we expect FY22 to be the low point in earnings, with FY23 and FY24 returning to double-digit EPS growth.

Tabcorp split into two businesses yesterday:

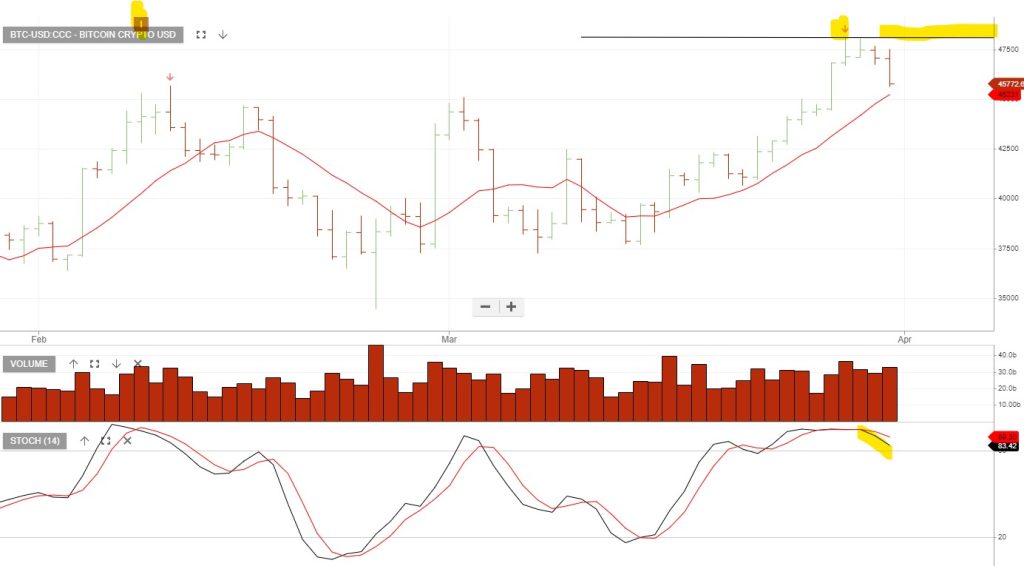

The rebound in the NASDAQ has been sharp and it’s possible we’re now looking at a level of overhead resistance. For crypto investors, this provides an opportunity to consider hedging or an outright short position.

The strategy requires a stop loss which means any short exposure is closed out if the market rally continues.

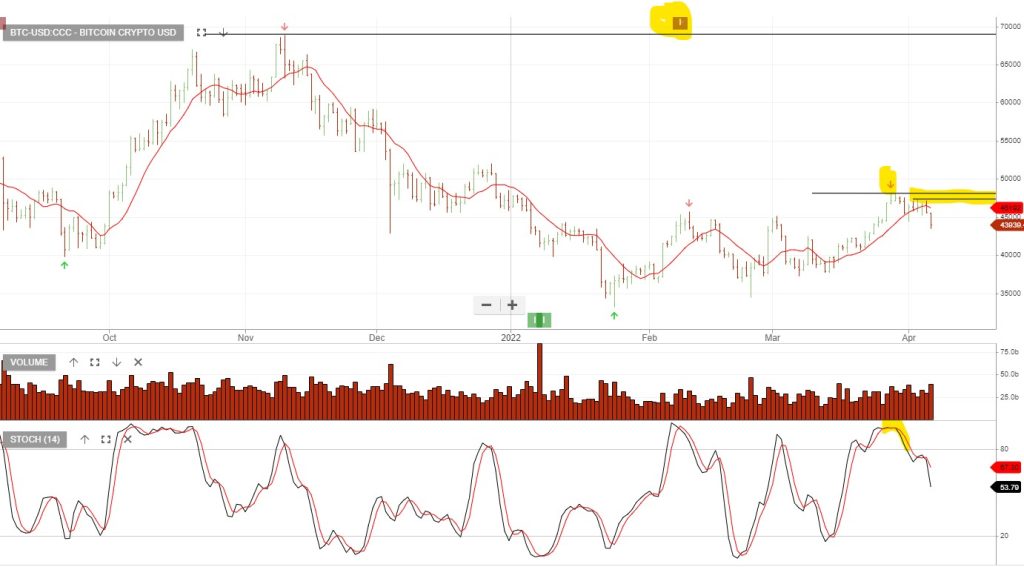

7/4/22 update: BTC-USD has rolled over and the technical setup remains negative.

23/4/22 update: The NASDAQ continues to move lower reflecting a risk-off sentiment, which is also impacting Bitcoin. BTC is under Algo Engine sell conditions and we remain short Bitcoin futures as an open trade.

26/5 update: Bitcoin has continued to trade lower and we now identify the overhead resistance at 30590 as the first level to watch for a potential price reversal. Since flagging the “short” setup in Bitcoin on 7 April, the crypto has lost 15,000 in the move from 45,000 down to 30,000.

For our Members, please find below the latest list of signals.

For our Members, please find below the latest list of signals.

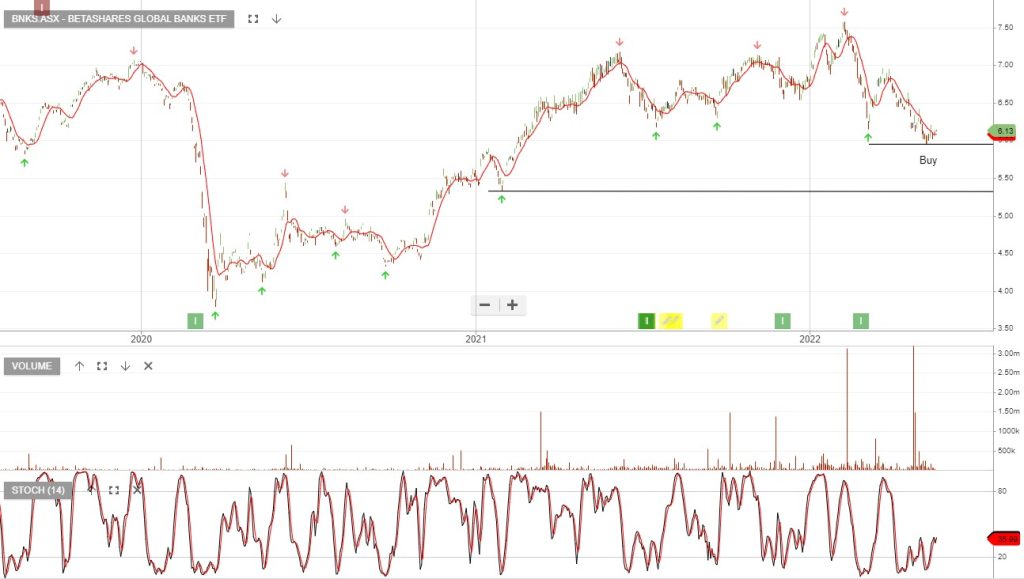

BetaShares Global Banks offers exposure to a recovery in global bank shares.

Gold Road Resources is under Algo Engine buy conditions.

Or start a free thirty day trial for our full service, which includes our ASX Research.