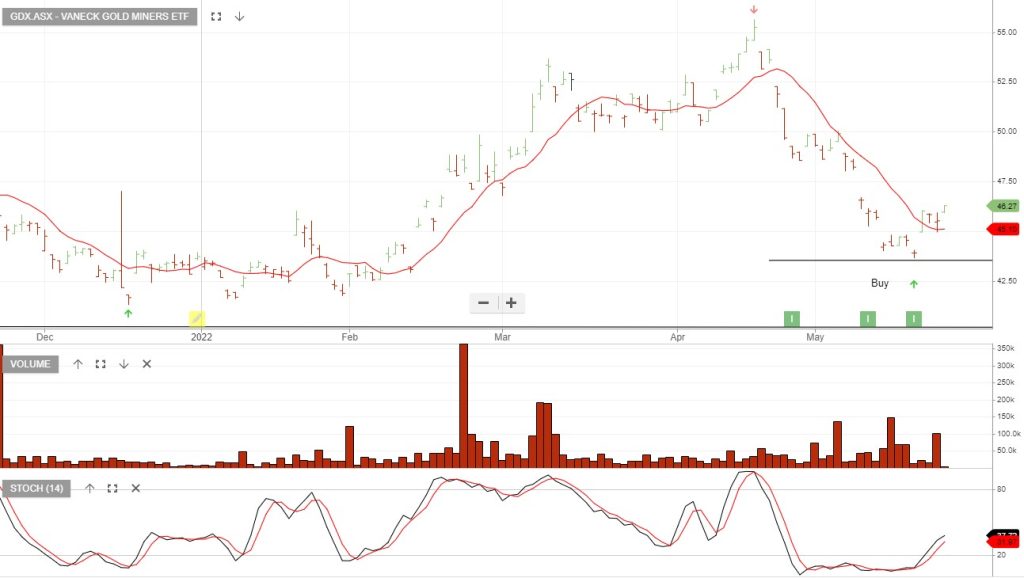

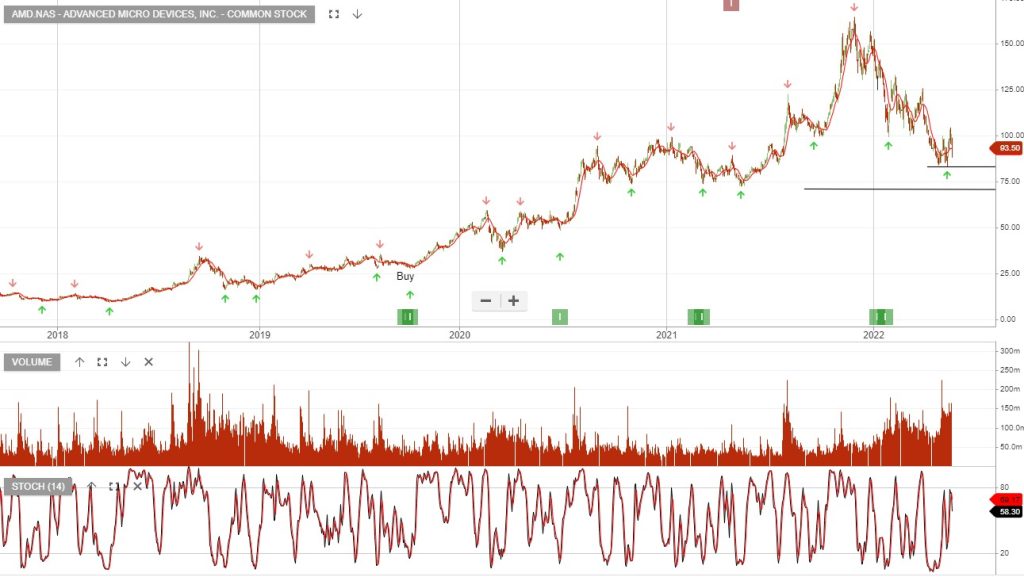

GDX Gold ETF – Buy

Vaneck Vectors Gold Miners is under Algo Engine buy conditions. GDX provides broad exposure to the leading global gold producers.

Vaneck Vectors Gold Miners is under Algo Engine buy conditions. GDX provides broad exposure to the leading global gold producers.

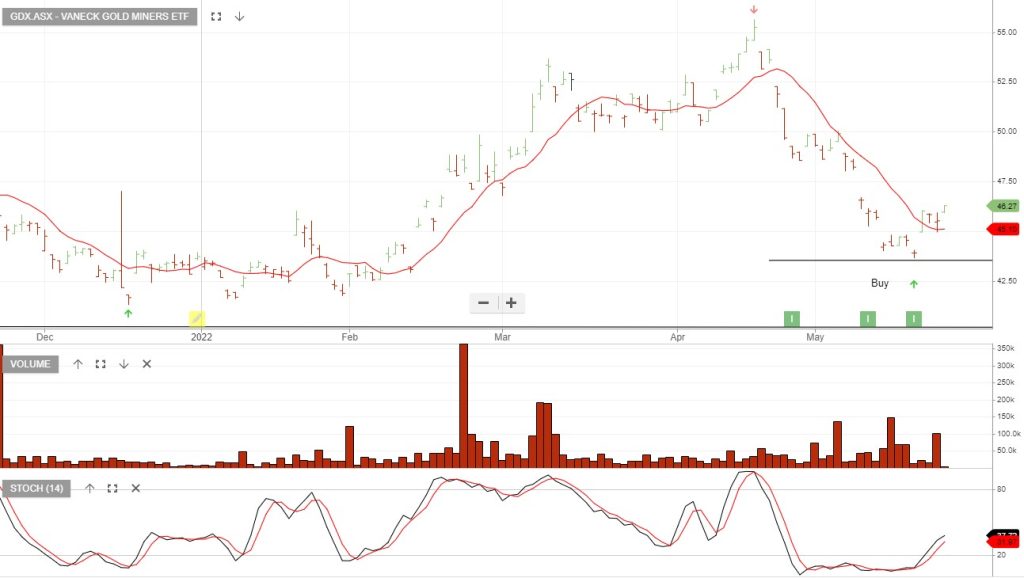

Newcrest Mining is under Algo Engine buy conditions.

For our Members, please find below the latest list of signals.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Crypto Weekly Review 23/5

Crypto Weekly Review 10/5

Crypto Weekly Review 29/4

Crypto Weekly Review 20/4

Crypto weekly review 10/4

Crypto weekly review video 27/3

Crypto weekly review: 17/3

For our Members, please find below the latest list of signals.

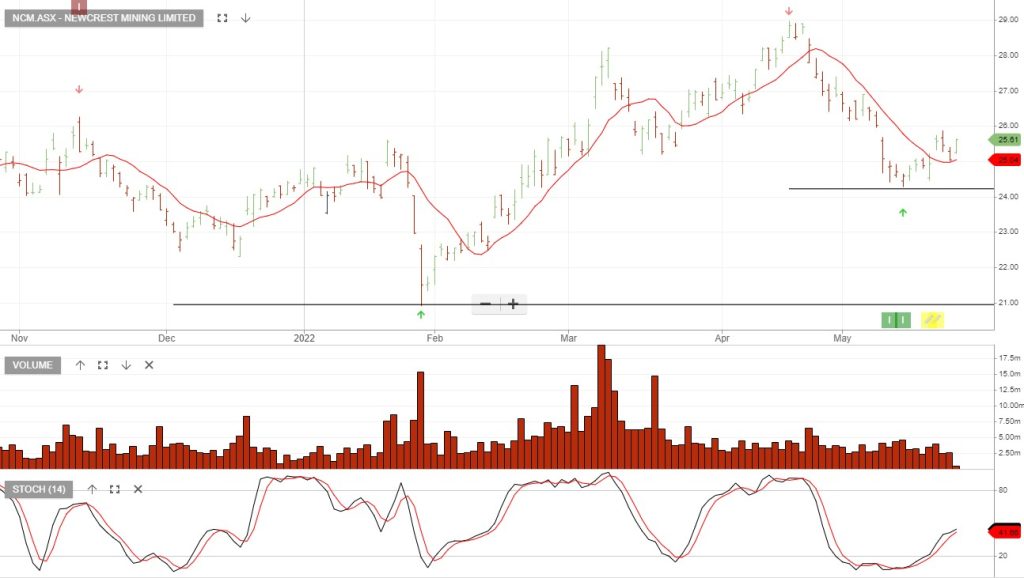

In Q1 AMD delivered a 71% increase in revenue to $5.9bn on EPS of $1.13, beating consensus estimates. The Q2 outlook is for revenue to increase further to $6.5 billion.

For the full year, 2022 management expects $26bn, or 60% growth compared to 2021.

AMD’s acquisitions of Xilinx and Pensando should see expanded revenue growth from new industries.

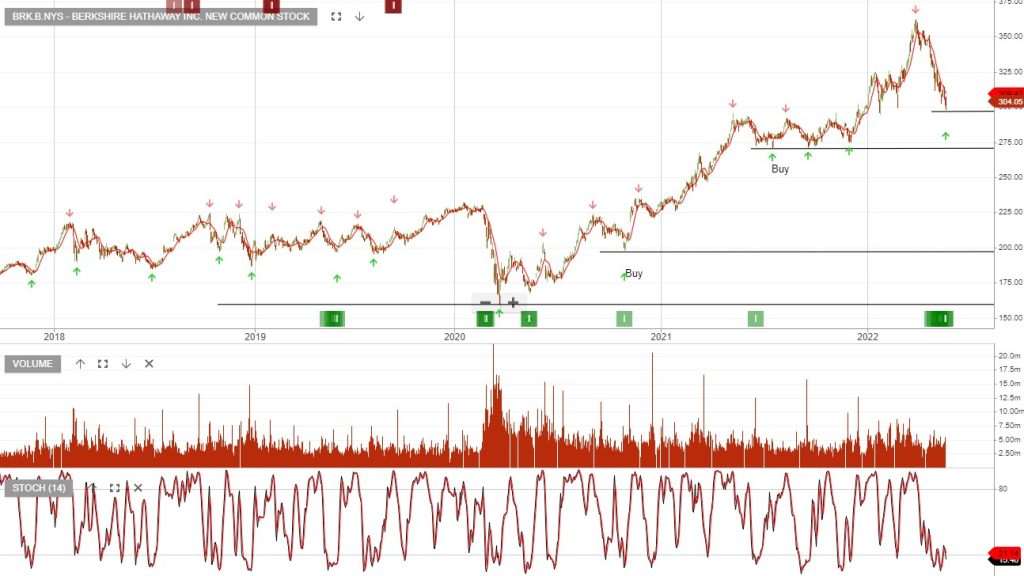

Berkshire is now betting on Citigroup as new management takes over.

Berkshire has spent recent years revamping its bank bets. It reduced JPMorgan and Goldman Sachs investments while maintaining Bank of America and US Bancorp. The long-term holding in Wells Fargo has been cut.

The company also added a $US2.61 billion exposure to Paramount.

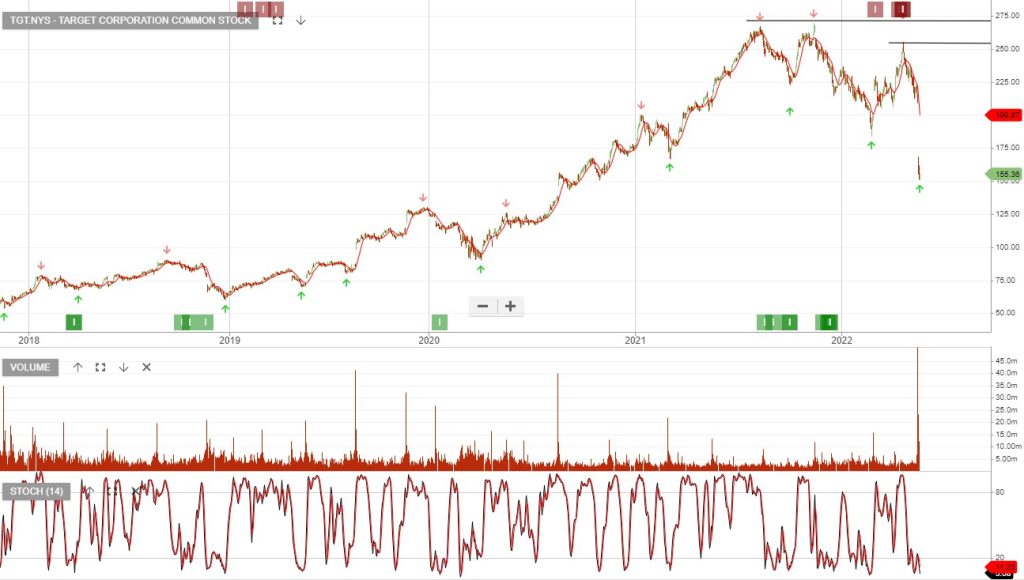

Investors will be watching the retail earnings following the weak results last week from Target and Walmart.

This week sees Costco, Best Buy, Advance Auto Parts, Nordstrom, Dick’s Sporting Goods and Macy’s as consumer-facing companies.

Nvidia’s results are due after market close on May 25. Revenue growth is anticipated to be 40%+ on the same time last year at $8.1bn.

Datacenter revenue should surpass the gaming segment revenue for the first time, driven by strong demand from hyper-scale data centers and AI.

The stock now trades 25x 2023 earnings.

Or start a free thirty day trial for our full service, which includes our ASX Research.