Big Week Ahead For The Aussie Dollar

The AUD/USD ended the week with a softer tone at .7450, as S&P lowered the credit scores of 23 Australian financial institutions and Moody’s downgraded China’s sovereign credit rating.

This week’s retail sales and manufacturing data will have an impact on the next move in the Aussie.

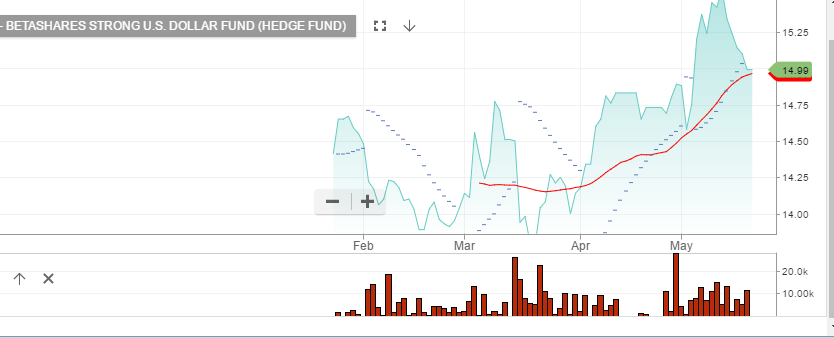

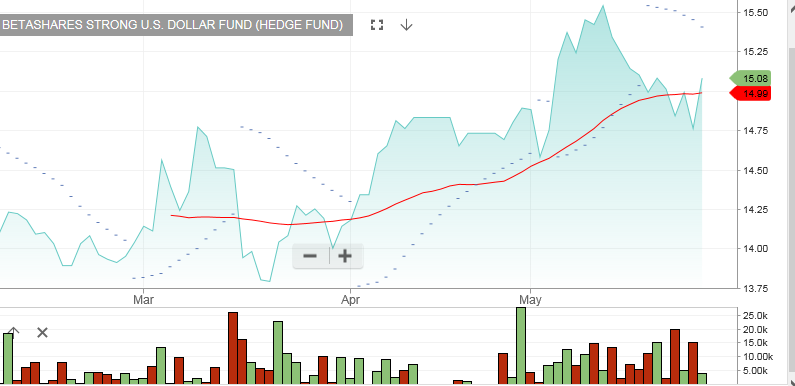

Investors looking to profit from a lower AUD/USD can buy the BetaShare inverse ETF with the symbol: YANK.

The current price of YANK is $15.08. When the AUD/USD fell to .7330 on May 9th, the price was $15.55.

We estimate that when the AUD/USD trades down to the January low of .7160, the unit price for YANK will be approximately $16.50.

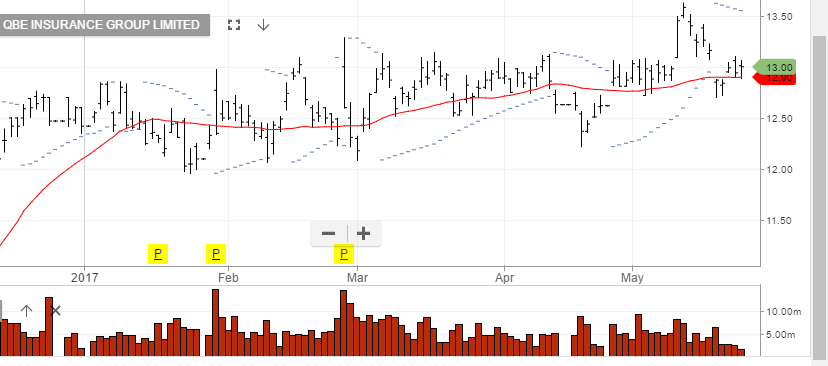

BetaShare YANK ETF

BetaShare YANK ETF

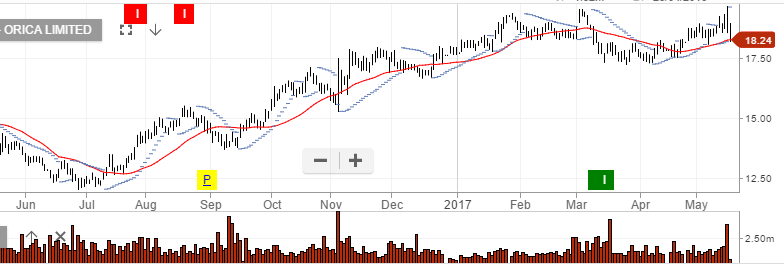

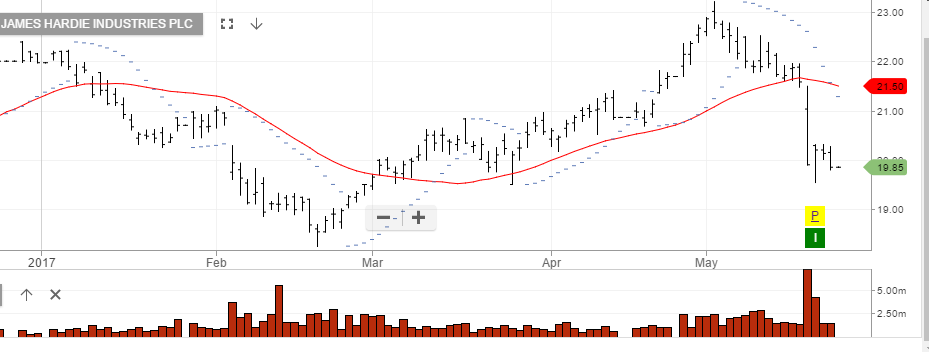

James Hardie

James Hardie