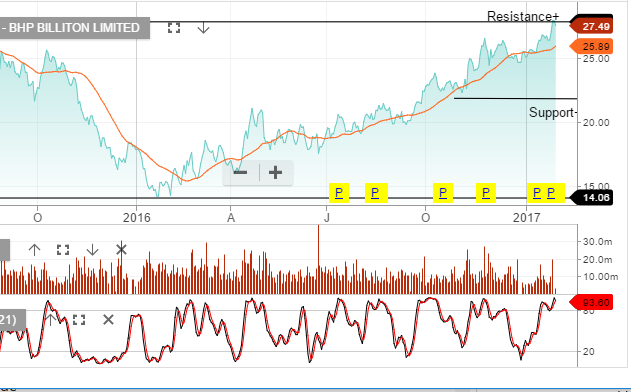

BHP Production Results

BHP’s recent production results were on the weak side, with lowered expectations in metallurgical coal, energy coal and copper.

The firm has cut its guidance for copper production by 2%, but has maintained their FY 2017 production guidance for other commodities. Copper and energy coal were the weakest spots, with those numbers missing analysis’ forecasts by 11% for both commodities.

Metallurgical coal output was 7% weaker than forecast, while Iron-ore and petroleum production was broadly inline with expectations.

Based on these numbers, BHP will need to deliver a significant uplift in production rates during the 2nd half of 2017 for copper and coal if the upper-end of their guidance is to be achieved.

We believe that BHP is up for the task. At current prices, shares are trading on +11% free cash flow and have a positive chart pattern over the last 12 months. Despite the weaker production result, we see scope for a move to $28.00 in the medium-term.