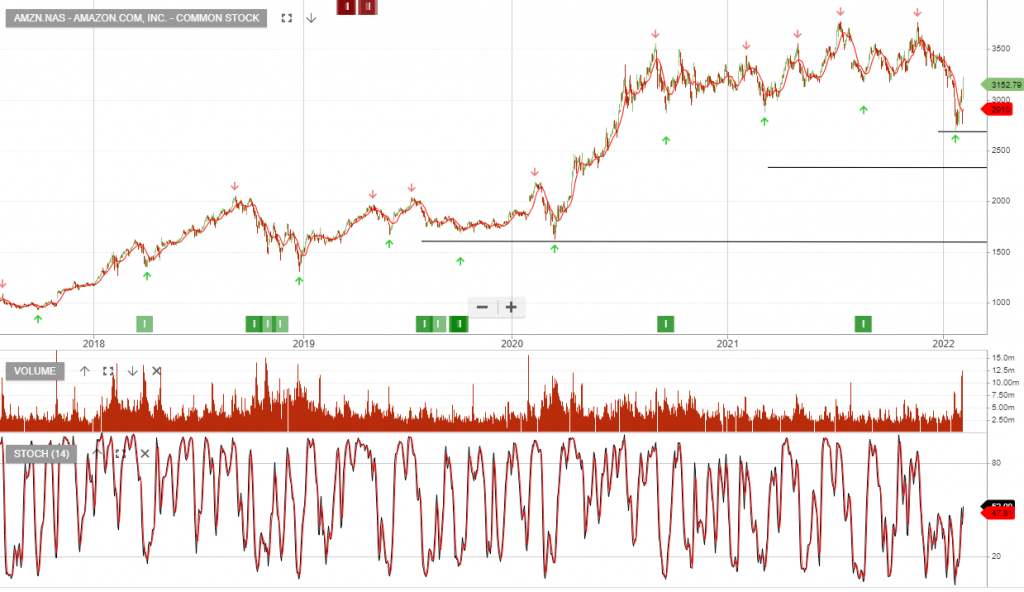

Amazon – Earnings

Amazon.com, Inc. – Common is under Algo Engine buy conditions and has been in our US S&P100 model portfolio since Aug 2019. The stock is up 70% after 919 days.

Amazon delivered 9% revenue growth in Q4.

- Earnings per share (adjusted): $5.80 vs $3.57 expected, according to a Refinitiv survey of analysts

- Revenue: $137.4 billion vs $137.6 billion expected, according to a Refinitiv survey of analysts

- AWS revenue: $17.8 billion vs $17.37 billion expected, according to StreetAccount

Amazon guided for first quarter revenue of between $112 billion and $117 billion