Cleanaway – Buy

Cleanaway Waste Management is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

.

Cleanaway Waste Management is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

.

Week 2.

Monday, July 19th: IBM.

Tuesday, July 20th: Travelers, UBS, Philip Morris International United Airlines and Netflix.

Wednesday, July 21st: Verizon, Johnson & Johnson, Coca-Cola, Texas Instruments and Kinder Morgan.

Thursday, July 22nd: AT&T, Dow, Abbott Labs, American Airlines, Intel, Twitter, Snap, VeriSign, Domino’s Pizza, and Las Vegas Sands.

Friday, July 23rd: American Express and Honeywell.

Week 1.

Tuesday, July 13th: PepsiCo, JPMorgan Chase and Goldman Sachs.

Wednesday, July 14th: Bank of America, Citigroup, and Wells Fargo

Thursday, July 15th: Morgan Stanley, Charles Schwab, U.S. Bancorp, Taiwan Semi, UnitedHealth, and Alcoa.

Friday, July 16th: Ericsson and State Street.

Netflix, Inc. – Common is now under Algo Engine sell conditions. NFLX was in our NASDAQ and S&P model portfolios since June 2019. The recent switch to sell signals resulted in the holding being sold for a 53% gain after a 752-day holding period.

Netflix is due to report earnings on July 20. Our sector preference is Disney.

Disney was added to the S&P model in February 2018 and has since increased 72%.

CIM:ASX is likely to see improved earnings in FY22 and we expect to soon see a recovery in the share price.

CIMIC is a high-risk counter trend investment with the prospect of a multi-year recovery, once earnings hit an inflection point.

Buy Dec $20 call options as a stock replacement strategy. For more detail, please call 1300 614 002.

BetaShares Australian Equities Bear Hedge

The inverse ETF’s over the ASX200 are performing well. BEAR (single inverse ETF) and BBOZ (double inverse ETF) are both trading higher as the ASX200 XJO index retreats from the recent highs.

These instruments act as a hedge against existing long equity holdings or as an outright trading position in portfolios.

Chart – BEAR ETF

Apply a stop loss, should the XJO index reverse and trade up through the highlighted range.

Northern Star Resources is under Algo Engine buy conditions. NST & GOR remain our preferred gold stocks.

Cleanaway Waste Management is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

.

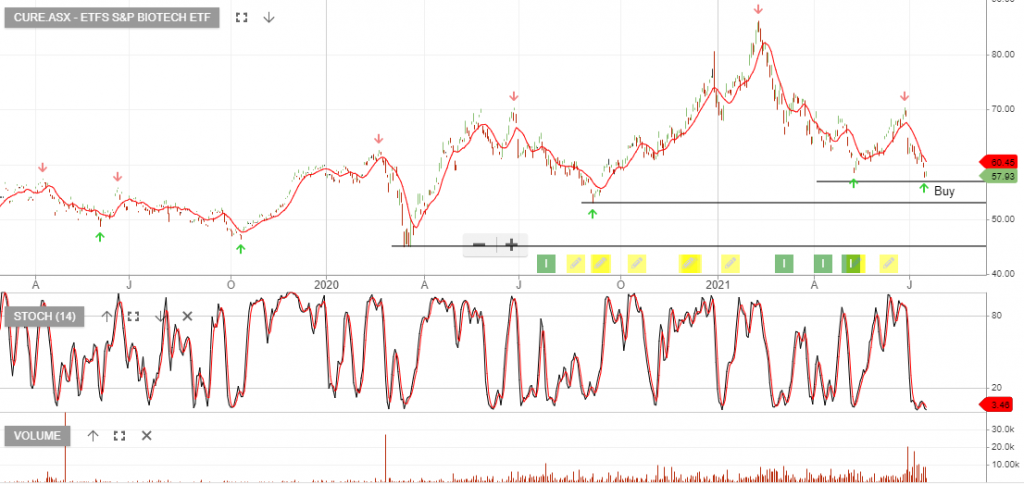

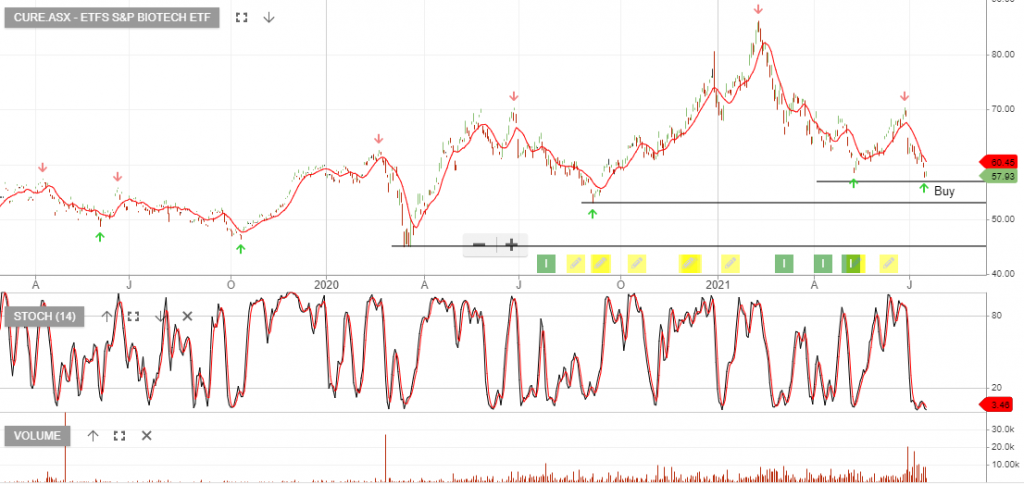

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.

Or start a free thirty day trial for our full service, which includes our ASX Research.