Bega Cheese

Bega Cheese remains under Algo Engine buy conditions and we highlight the recent higher low formed at $4.40.

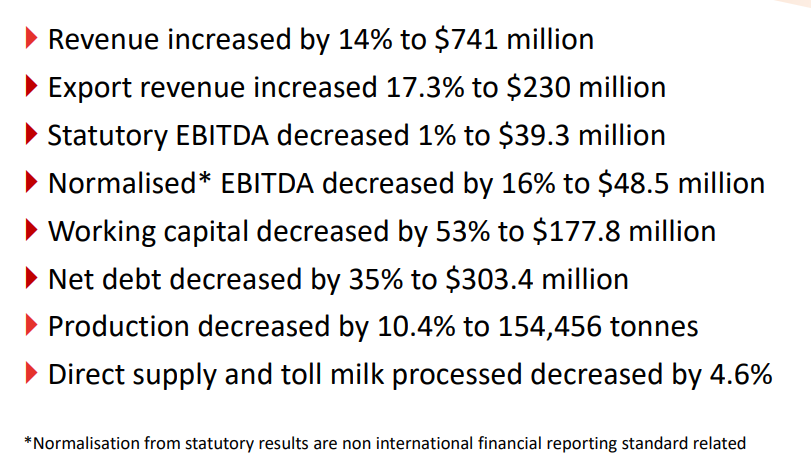

1H20 earnings are posted below and we’d expect to see improvement in the 2H20 numbers.

Bega Cheese remains under Algo Engine buy conditions and we highlight the recent higher low formed at $4.40.

1H20 earnings are posted below and we’d expect to see improvement in the 2H20 numbers.

ETFS S&P Biotech is now under Algo Engine buy conditions.

CURE ETF offers investors exposure to US biotechnology companies. These are companies engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering. Examples include the development of immunotherapy treatments and vaccines to treat human diseases.

CURE aims to provide investors with a return that, (before fees and expenses), tracks the performance of the S&P Biotechnology Select Industry Index. CURE uses a full-replication strategy to track the index, meaning that it holds all of the shares that make up the index. It is equal-weighted, meaning each holding makes up the same portion of the portfolio and therefore, contributes equally to the overall performance.

Brambles is now under Algo Engine buy conditions and has been added into our ASX 20, 50 & 100 model portfolios.

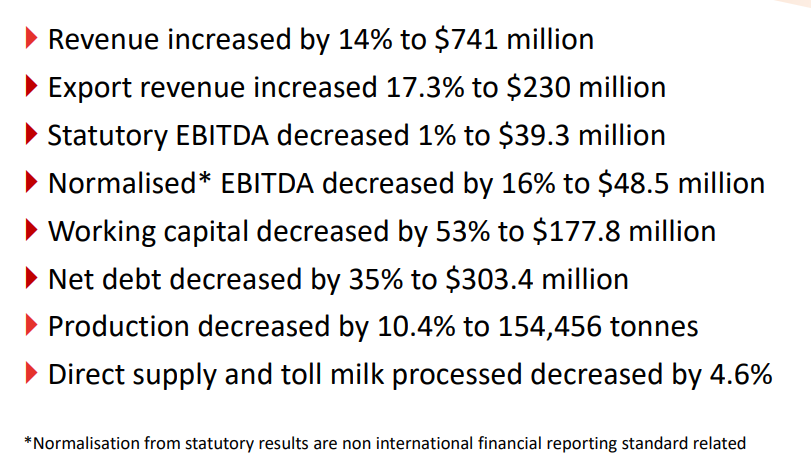

Commonwealth Bank of remains under Algo Engine sell conditions and we see resistance building near the $74 price level.

CBA reports FY20 earnings on 12 August, at which time the market will focus on CBA’s dividend and any capital management commentary. Consensus expectations are for earnings to be $7.8bn, (down 10% on 2019 numbers), and the 2H20 dividend to be cut by 50%.

We remain on the short side of the CBA trade.

If you missed last night’s webinar, then you can catch up by watching it here.

Register here to be notified of the link for tonight’s webinar, which starts at 7pm NSW time.

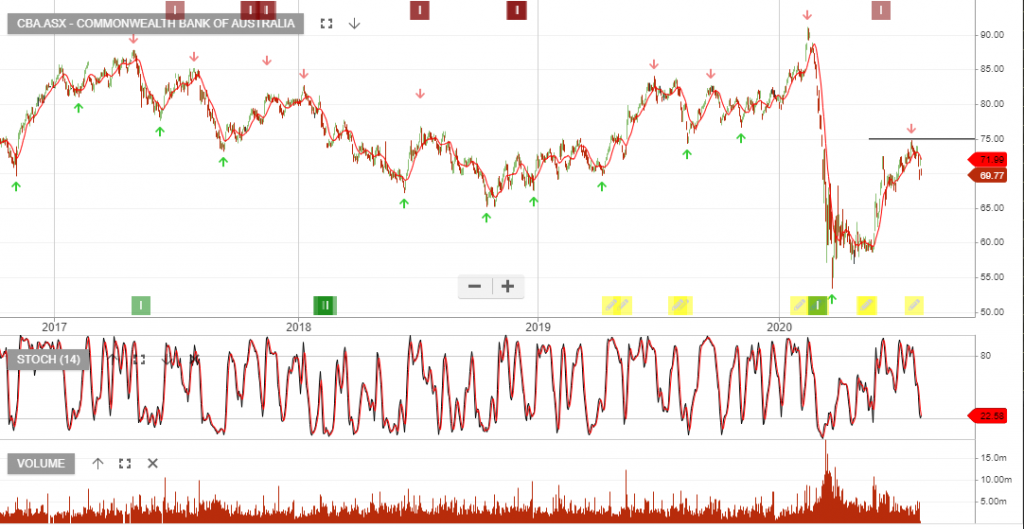

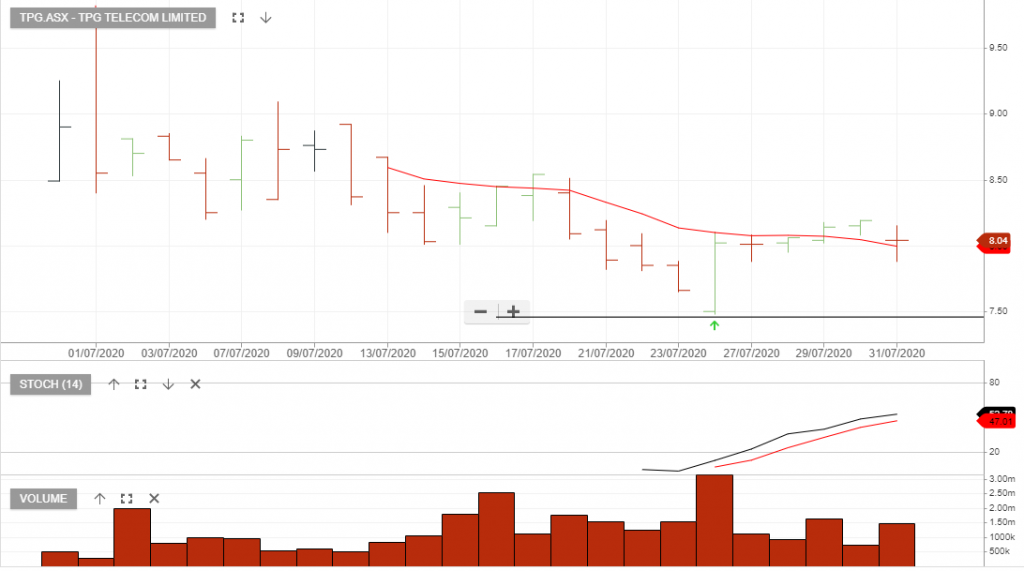

TPG Telecom has traded down to $7.50 following a research report published by a leading investment bank this week, which highlighted a series of risks facing the business.

Despite the report, we see value in TPG and expect the stock to trade higher from the current level.

Since making the above post on 23 July, TPG has rallied to $8.20 and closed near $8.00 on Friday. We continue to see value in TPG and suggest investors watch for another entry opportunity below $8.00.

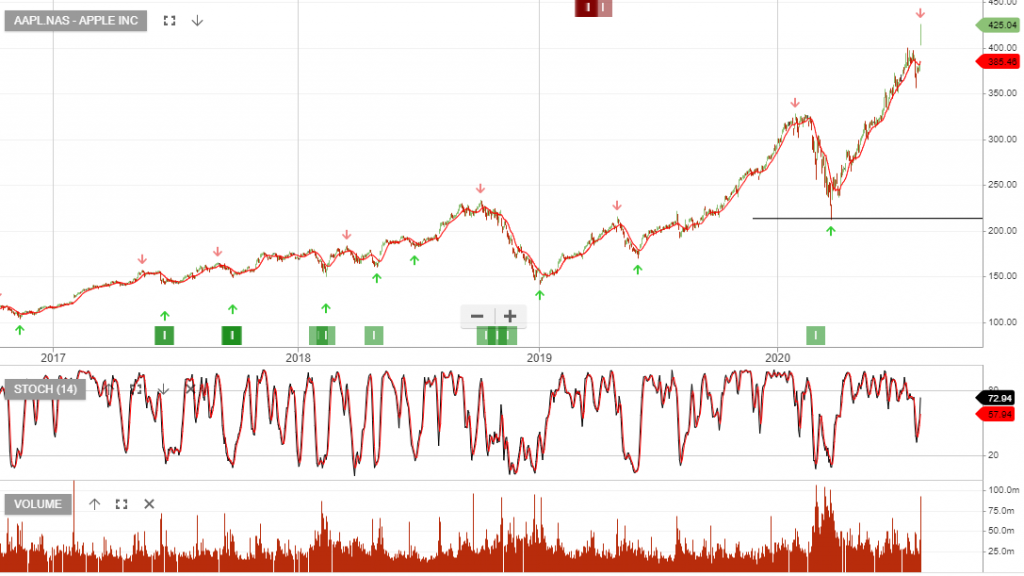

Apple July 30, 2020 — Apple announced financial results for its fiscal 2020 third quarter ended June 27, 2020. The Company posted quarterly revenue of $59.7 billion, an increase of 11 percent from the year-ago quarter, and quarterly earnings per diluted share of $2.58, up 18 percent.

Apple has been under Algo Engine buy conditions since forming a low in March 2020.

The board of directors has also approved a four-for-one stock split to make the stock more accessible to a broader base of investors. Each Apple shareholder of record at the close of business on August 24, 2020 will receive three additional shares for every share held on the record date, and trading will begin on a split-adjusted basis on August 31, 2020.

Apple declared a cash dividend of $0.82 per share of the Company’s common stock. This places Apple on a forward annualized yield of 0.75%.

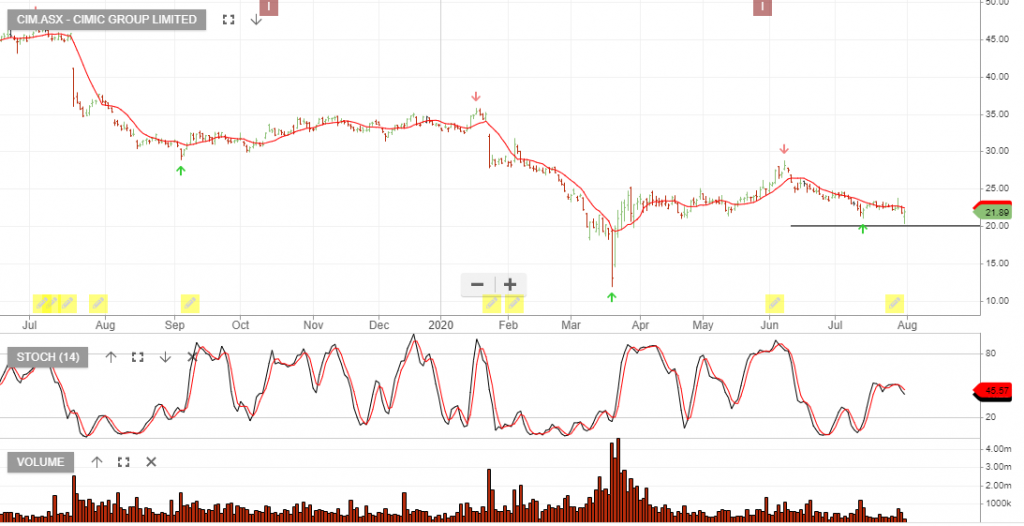

Cimic Group delivered a soft 1H20 result that was below consensus expectations. 1H20 NPAT of A$317mn, down 14% on the same time last year.

Work-in-hand increased to A$38bn and the project pipeline for 2020 and beyond has now increased by 10% to $540bn plus.

CIMIC also announced an agreement with Elliott Advisors (UK) for the sale via a JV for 50% of Thiess, the world’s largest mining services provider. Providing joint control of Thiess to CIMIC and Elliott.

The transaction will help strengthen the CIMIC balance sheet and provide flexibility for CIMIC to resume a share buyback next year.

We see value at $21 – $22 per share.

Santos is our preferred exposure within the energy sector. We highlight the price support at $5.00.

Or start a free thirty day trial for our full service, which includes our ASX Research.