ASX 200 & BBOZ

Betashares Australian Equities is up 5% from the recent low as the XJO rolls over below the overhead resistance, which has built up at the 6200 level.

We expect a similar pattern to develop in the S&P500 equivalent BBUS.

Betashares Australian Equities is up 5% from the recent low as the XJO rolls over below the overhead resistance, which has built up at the 6200 level.

We expect a similar pattern to develop in the S&P500 equivalent BBUS.

Crown Resorts is under Algo Engine sell conditions and we see increasing selling pressure due to a weak earnings outlook.

Risks remain elevated coming into the next earnings release.

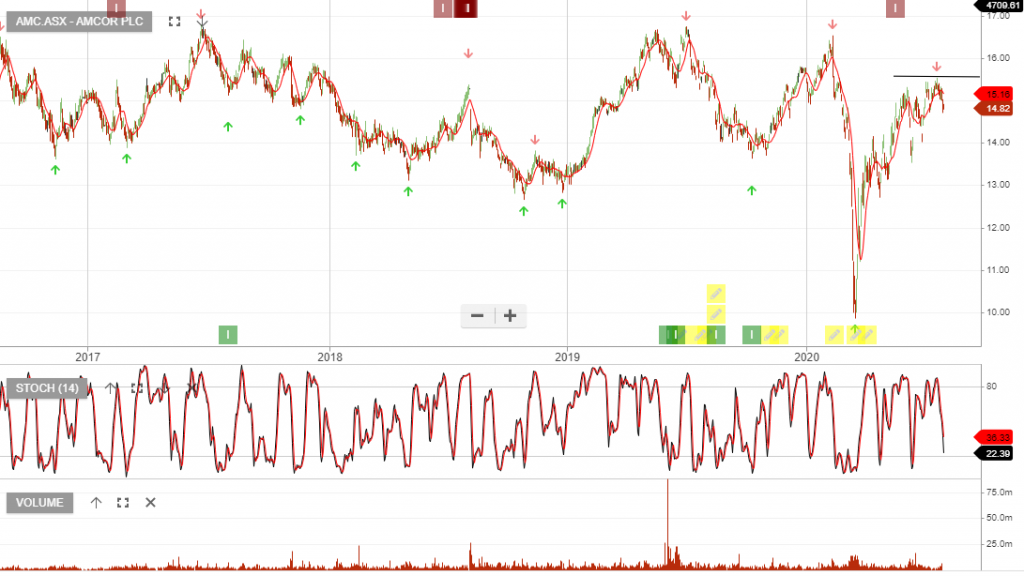

Amcor is under Algo Engine sell conditions and we see increasing selling pressure due to a weak earnings outlook.

Risks remain elevated coming into the next earnings release.

Aurizon Holdings has been under Algo Engine sell conditions following the lower high formation at $5.00

Further downside price action is likely and yield support will build at $4.00 – $4.25. We’ll revisit AZJ once it trades into this range.

Worley is under Algo Engine sell conditions and we see increasing selling pressure due to a weak earnings outlook.

Risks remain elevated coming into the next earnings release.

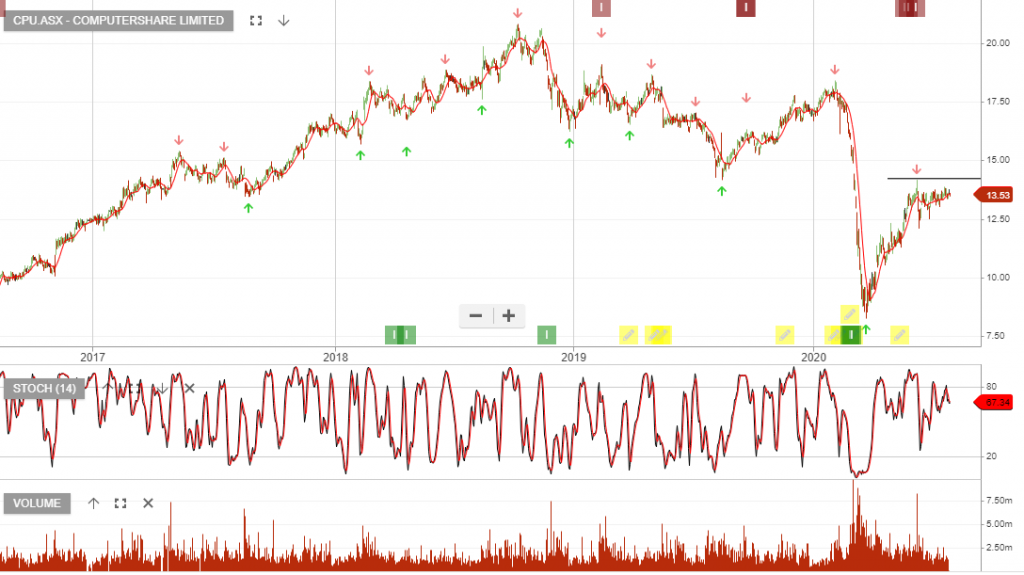

Computershare is under Algo Engine sell conditions and we see increasing selling pressure due to a weak earnings outlook.

Risks remain elevated coming into the next earnings release.

Aristocrat Leisure is under Algo Engine sell conditions and we see increasing selling pressure due to a weak earnings outlook.

Risks remain elevated coming into the next earnings release.

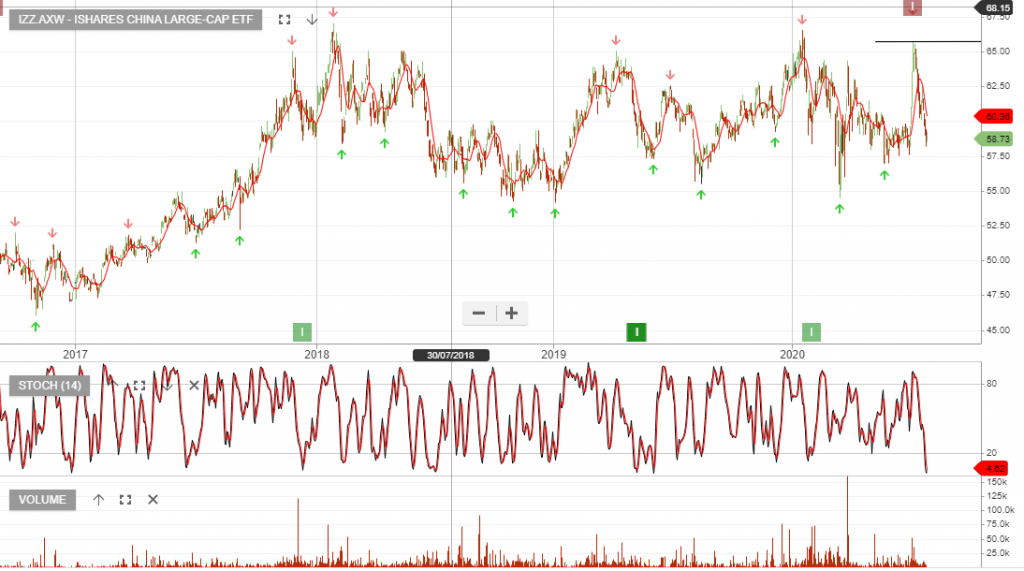

ASX:IZZ is under Algo Engine sell conditions following the lower high formation at $65 back on 7 July. Since then, the ETF has corrected lower and is now trading at $58.

For the past 2.5 years the ETF has tracked sideways within the $54 to $65 consolidation band.

We expect to see the IZZ retest the lower level and we’ll revisit the trade closer to $54, in the weeks ahead.

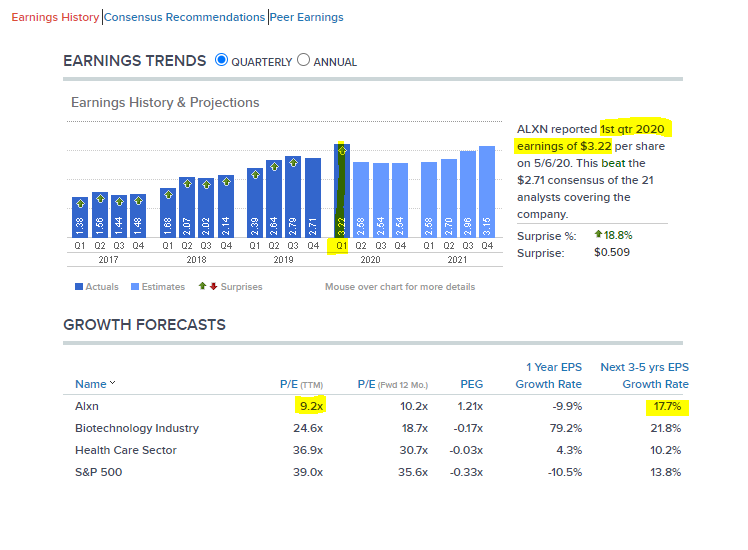

Alexion Pharmaceuticals today announced that the company will report its financial results for the second quarter ended June 30, 2020, before the US financial markets open on July 30, 2020.

Alexion is a recent Algo Engine buy signal from the NASDAQ top 100 group of companies. We’ve added this to our portfolio and will review the upcoming result with close interest.

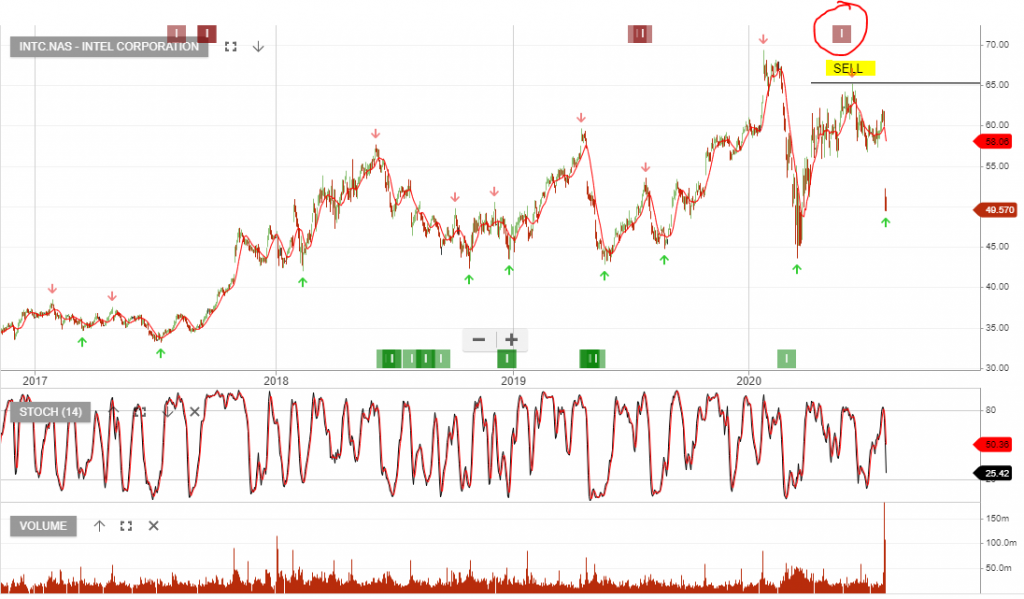

NAS:INTL disappointed the market on Friday when it’s earnings fell short of consensus and delays in new chip technology were announced.

When we review the Algo Engine signals we can see Advanced Micro Devices is under buy conditions and has rallied from $48 to $69, whereas, Intel was under sell signals, (since making a lower high at $65) and has now collapsed to $49.

We’re inclined to take profit on the AMD trade and look to soon take advantage of Intel falling into oversold levels.

Or start a free thirty day trial for our full service, which includes our ASX Research.