CIMIC – Buy

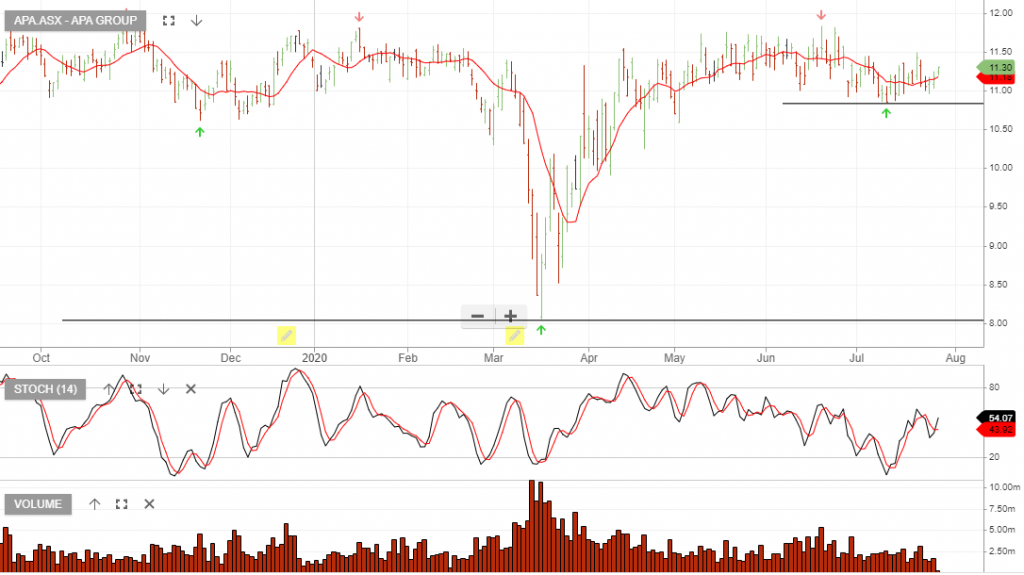

Cimic Group we are often cautious buying stocks that are under primary Algo Engine sell conditions. However, CIMIC may have found support at $21 and the short-term interim indicators have turned positive.

CIMIC focuses on infrastructure projects in Australia, New Zealand, and Asia. The balance sheet has been repaired following the restructuring and exit of their middle eastern businesses.

In general, governments are pushing through infrastructure projects with greater priority, as a way of stimulating the economy.

CIMIC reports earnings on 30 July.