BHP & RIO – Iron Ore Prices Reviewed

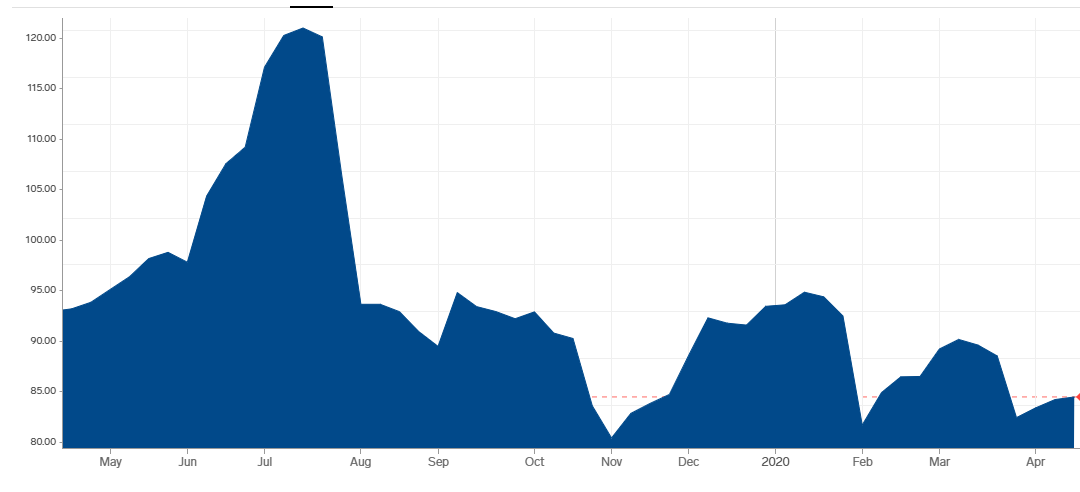

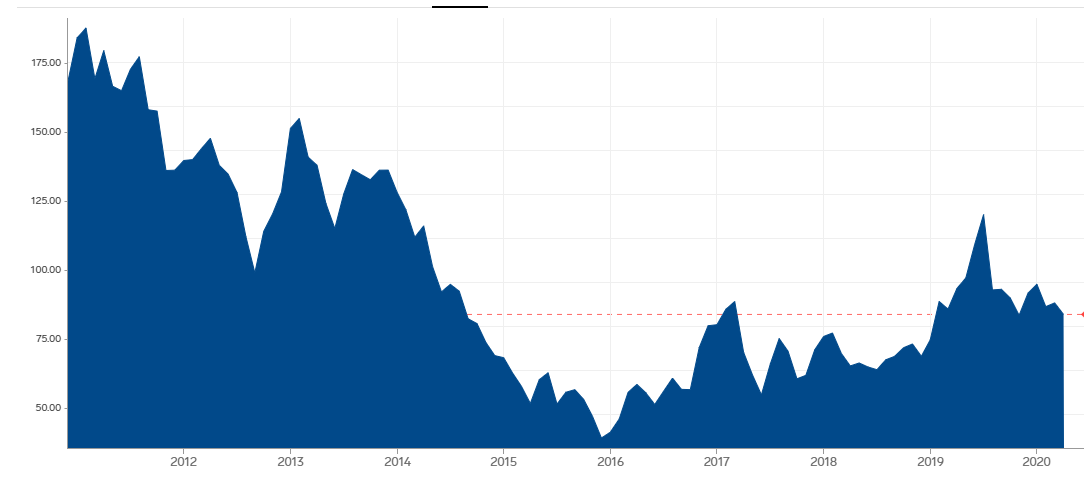

The following graph displays the long term trend in Iron Ore prices and below that is the 1-year price history.

Iron Ore prices have held up surprisingly well during the early stages of the market sell-off. We do have some concerns that resistance remains in the high USD$80 per tonne range and the pressure is now to the downside.

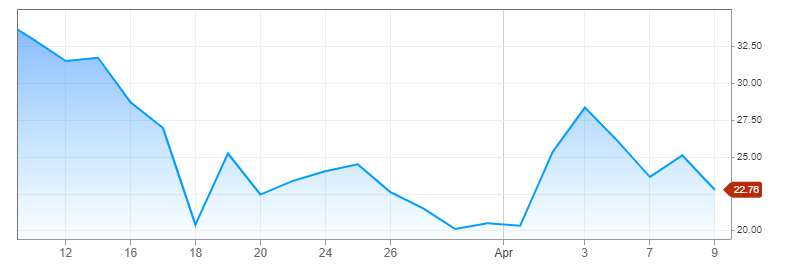

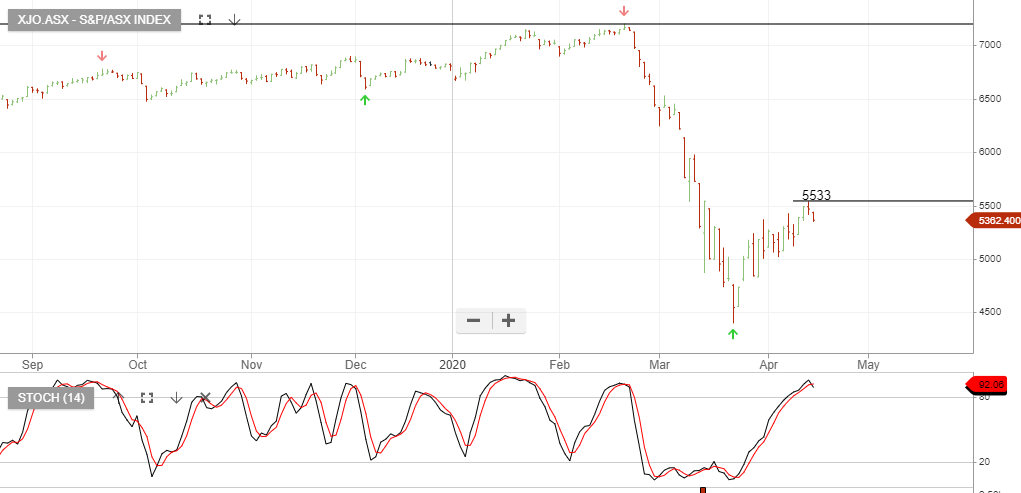

This forecast feeds through to our forecast for BHP & RIO, where we feel investors are best served by waiting for entry levels at lower prices.

9-year history

1-year history