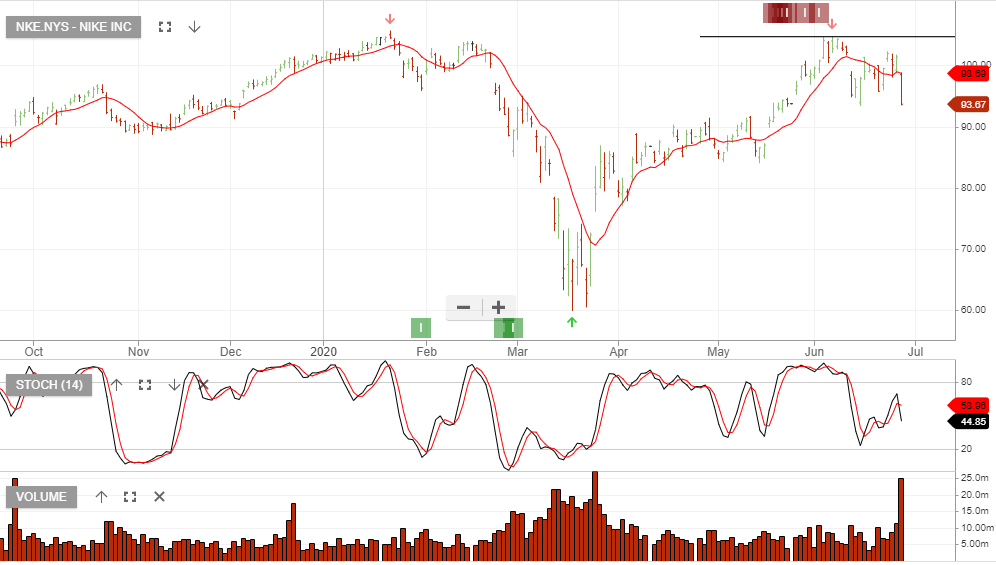

Nike – 38% Sales Decline

Nike reported a quarterly net loss and a sales decline of 38% year-over-year.

Business operations were hurt from stores being shut temporarily, and online revenue was not enough to make up for that.

Nike reported a loss of $790 million, or 51 cents per share during the period ended May 31, compared with net income of $989 million or earnings of 62 cents per share, a year ago.

Total revenue was down 38% to $6.31 billion from $10.18 billion a year ago.

We remain on the short side of the Nike trade.