Carsales.com – Buy Signal

Carsales.Com is under Algo Engine buy conditions and we suggest members add the stock to their watch lists and look for support to develop within the $11.00 to $12:00 price range.

Carsales.Com is under Algo Engine buy conditions and we suggest members add the stock to their watch lists and look for support to develop within the $11.00 to $12:00 price range.

REA Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Add REA to your watchlist and look for support to develop within the $65 – $75 price range.

For our next Live Webinar, I will review high conviction ASX and US buy and sell opportunities from the recent algo engine and model portfolio signals.

To be sent the invitation, you must register your details here.

Take profit on RMD following the 20% rally from yesterday’s buy recommendation.

Woolworths and Coles are two buy recs we’ve focused on over the last week. We bought both names on recent weakness and earlier this week we sold out of Coles and today we suggest closing the Woolworths position.

Woolworths rallied between 10 – 20% from the entry signal.

Amcor is a leading company within the global packaging space. Their business is directly impacted by slower global consumption and it’s understandable their share price has been hit with a 30% sell-off.

However, if you believe the sun will rise again and people will go out to play, Amcor is a market recovery opportunity that’s worth considering at these levels.

High Volatility – buy

ASX is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Accumulate within the $64 – $68 price range.

NOTE: It was reported on mainstream media that NYSE volume is up over 50% in March, (based on the same time last year).

It seems reasonable to assume that the ASX will be benefiting from a similar pick up in order flows, across both equities and derivatives.

ResMed is under Algo Engine buy conditions and we see buying support building.

Accumulate RMD within the $22 – $23 price range.

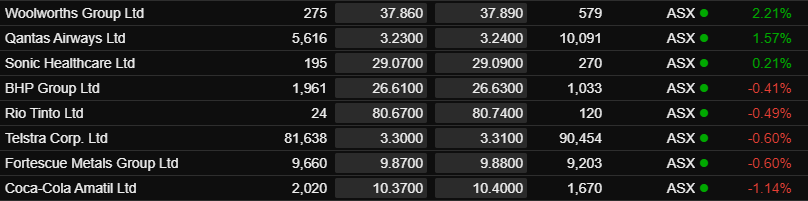

The following table highlights the stocks that are favoured as safe harbours within the current market sell-off.

Out of the below list, Qantas is the exception.

It’s interesting to note the outperformance of QAN relative to the ASX200 index, which is down 5% at the time of writing this post.

Healthcare is an obvious sector for investors to allocate capital. SHL, RMD and CSL are good examples.

Coles Group has rallied over 15% from the recent Algo Engine buy signal. Investors should consider taking profit and reallocating into other oversold opportunities.

Or start a free thirty day trial for our full service, which includes our ASX Research.