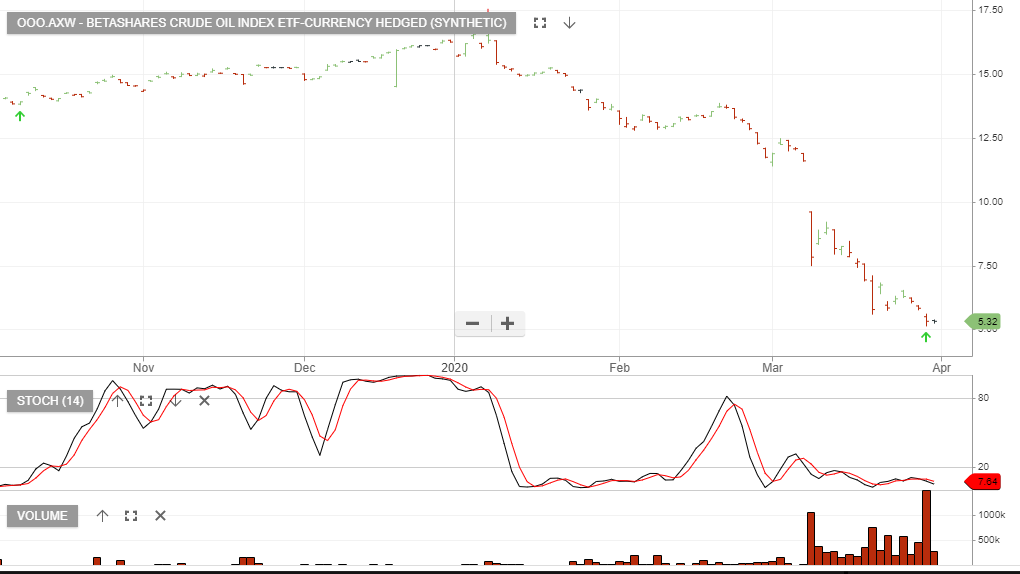

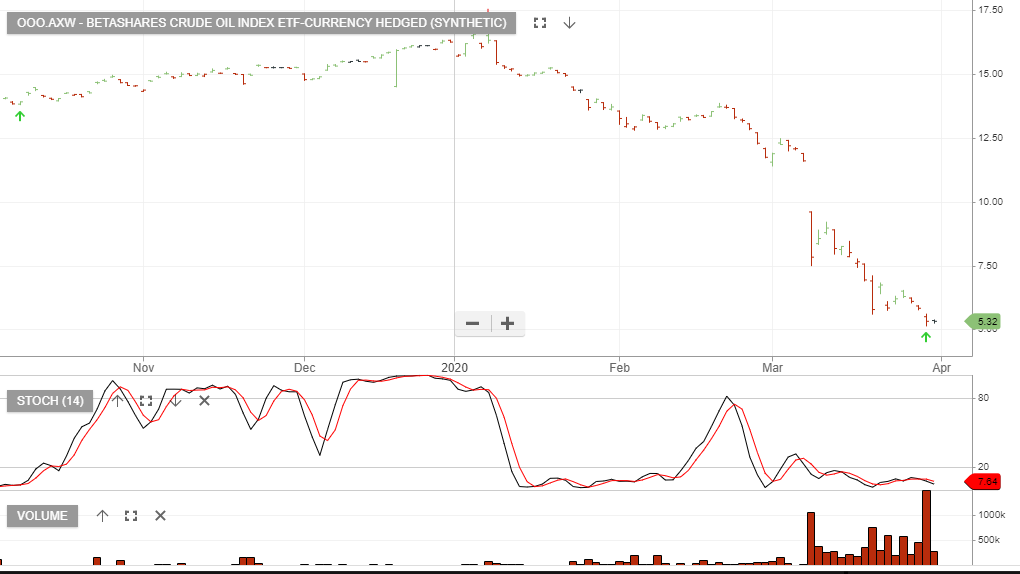

Oil ETF – Buy

We see value in the Betashares Crude Oil Index ETF-Currency Hedged for investors willing to take a longer-term view.

We see value in the Betashares Crude Oil Index ETF-Currency Hedged for investors willing to take a longer-term view.

Cleanaway Waste Management is now under Algo Engine buy conditions and we see buying support building at $1.50

As an essential service, CWY offers a degree of safety, and the company maintains a strong balance sheet and liquidity.

S&P/ASX has run into resistance at 5250 points. Portfolios should be positioned defensively until we see a break back above this level.

The list below highlights the themes we will be focusing on in the coming weeks.

Keep an eye out for our “Opportunities in Review” webinar invitation and feel free to call our office on 1300 614 002 to discuss our preferred strategies in the current market.

REA Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The share price has corrected over 40% due to the impact of COVID-19. Earnings will decline over the coming months as restrictions impacting open homes and slower vendor listings bite in the short-term.

In the medium term, we see scope for a full recovery in the business and therefore, the current share price at 20x forward earnings looks attractive.

Carsales.Com is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see value emerging and suggest buying at market and running a stop loss at $9.50.

Ramsay Health Care is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see value emerging and suggest accumulating within the $50 – $52 price range.

Cochlear is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see value emerging and suggest buying at $171 and running a stop loss at $164.50.

Note: COH went ex div $1.60 today.

The recording from Monday’s webinar is available below:

Sonic Healthcare rallied 10% higher from today’s open price.

Although Sonic has withdrawn its FY20 earnings guidance, (EBITDA

growth 6-8% cc) due to COVID-19, the company has a strong balance sheet with $1bn of cash and committed credit facilities available with no debt facilities maturing until 2021.

After trading out of the ‘long” Woolworths and Coles positions at higher levels, we again begin tracking the approaching entry-level in these names.

Both have started to correct lower and we expect to see an appealing entry-level present this week.

laches

laches

Or start a free thirty day trial for our full service, which includes our ASX Research.