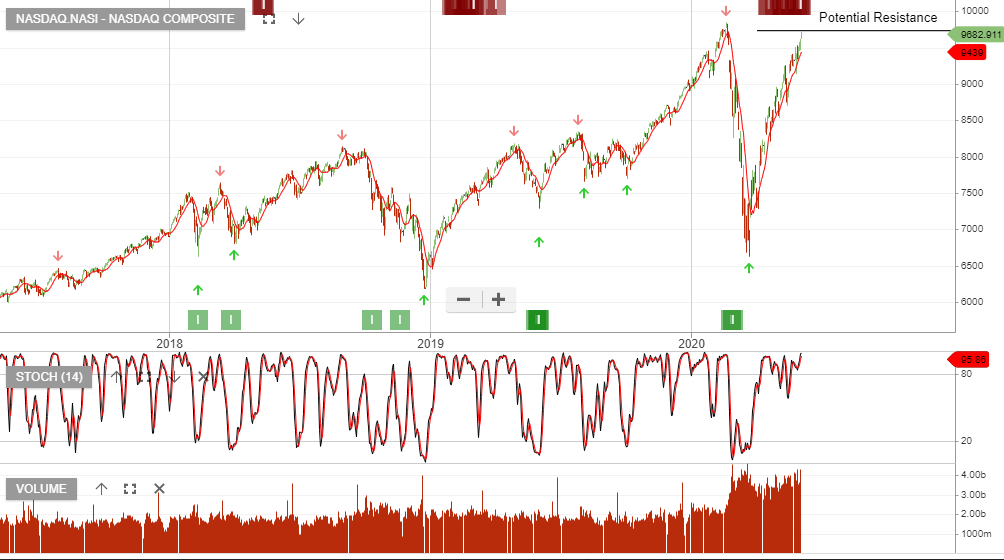

Global Equity Markets

Investors remain overly optimistic that corporate earnings and profits will catch up with elevated asset prices.

Given the massive interventions into markets by the Federal Reserve, the added liquidity has been successful in fostering a lift in equity prices. Unfortunately, there will be little translation into higher wages, full-time employment, or corporate profits.

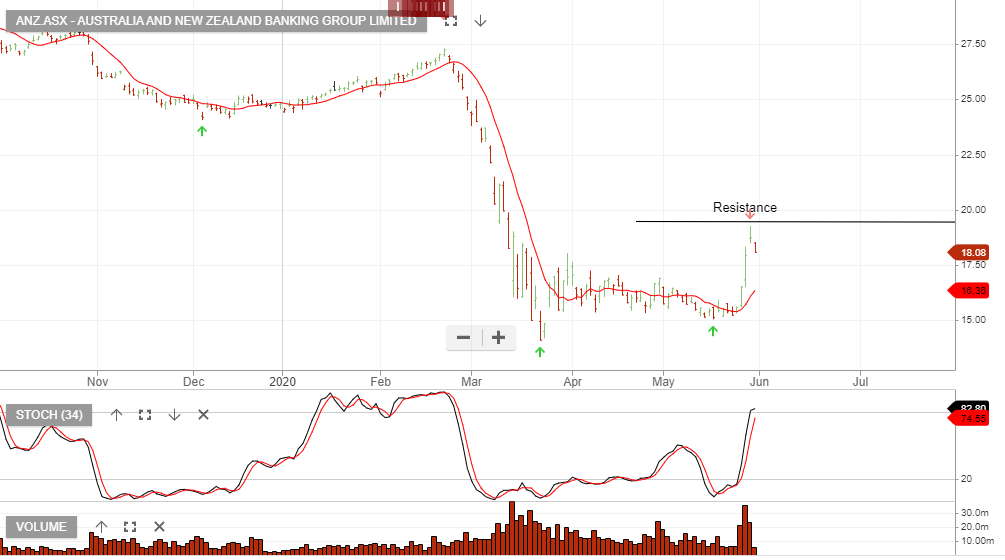

A broadening of the rally into industrial and financials is continuing to propel the indices higher. However, the prospect of the economy catching up to market expectations in the next 12 months, is very low.

Investors should apply the following “rule” as a form of portfolio protection.

A break below the 10 day moving average will be a sign that market momentum is stalling.