NHF – Buy

NIB Holdings is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The share price is supported by a 4%+ dividend yield and mid-single-digit earnings growth.

Buy $6.50

NIB Holdings is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The share price is supported by a 4%+ dividend yield and mid-single-digit earnings growth.

Buy $6.50

Telstra Corporation is under Algo Engine buy conditions and is a current holding in ASX 100 model portfolio.

We see value at $3.58

Aurizon Holdings is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see buying support building at $5.30 and expect the share price to soon trade into the $5.50 to $5.75 range.

AZJ goes ex-div $0.114 on the 25th February.

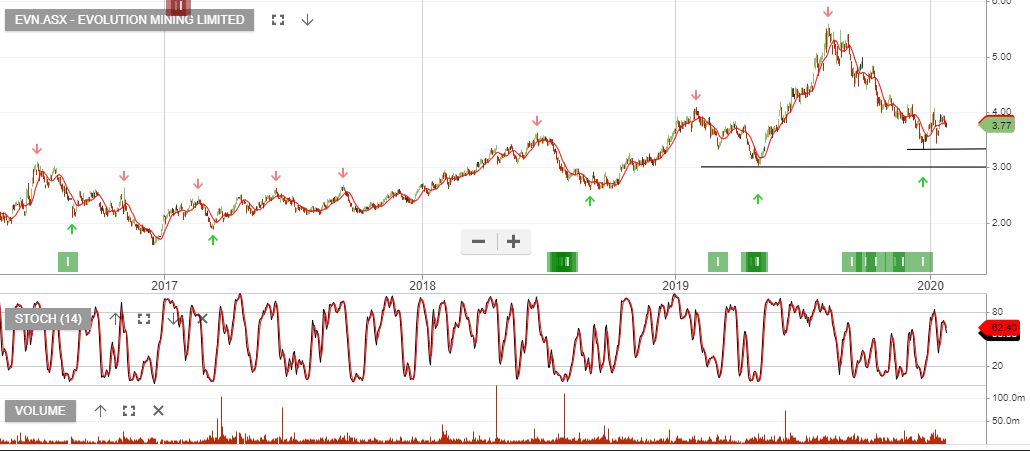

EVN is a current holding in our ASX100 model portfolio and the share price looks like it will retest the $4.550 price level.

We recommend investors begin building a long position in the stock.

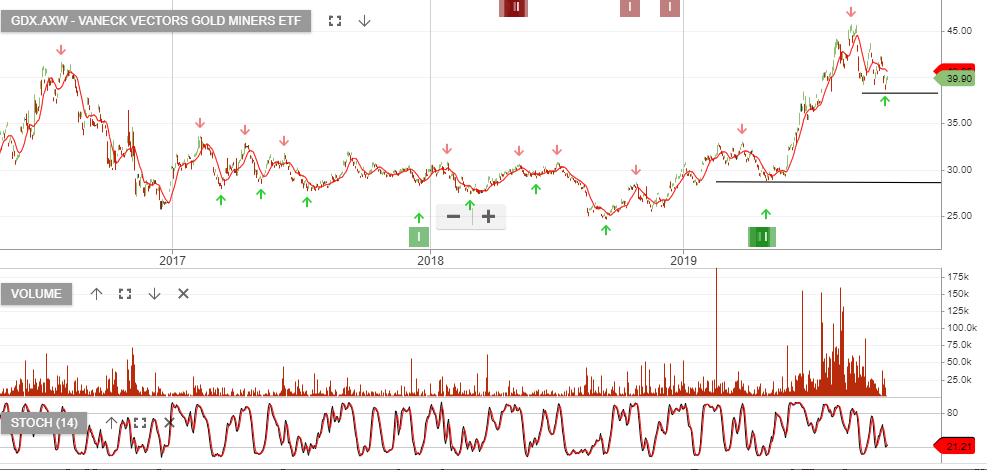

The below post is a copy of a publication on the 18th of October. Since making the post, gold stocks have performed well and we now look to trim the gains and rotate into oversold industrial & REIT names.

Vaneck Vectors Gold Miners is under Algo Engine buy conditions following the entry condition earlier this year at $30. It is a current holding in our ALL ASX ETF model portfolio.

GDX ETF has corrected from $45 to $38 over the past 8 weeks. We feel buying support will now begin to increase.

Individual names are also now appearing on the radar, such as Newcrest Mining Northern Star Resources, Evolution Mining, OceanaGold and Gold Road Resources.

Uber Technologies is under Algo Engine sell conditions following a series of lower high formations since listing in May 2019.

The stock enters our radar as a potential for a short-covering rally. We expect weaker trading in the near-term but have set an alert to review the stock again should we see it trade below $25 per share.

Our call for NIB Holdings to find support and trade higher into the February earnings result is now gaining traction.

The price action found support at $6.60 and we expect to soon see a test of the $7.00 – $7.50 range.

{ASX:WPL) has recently shifted from buy to sell conditions.

Risks are now to the downside and we add WPL to the “short list” and begin to focus on the short-term momentum indicators, looking for a reversal lower.

APA is under Algo Engine buy conditions and is a current holding in ASX 100 model portfolio.

NOTE: APA has now rallied over $1.00 and investors can consider taking profit.

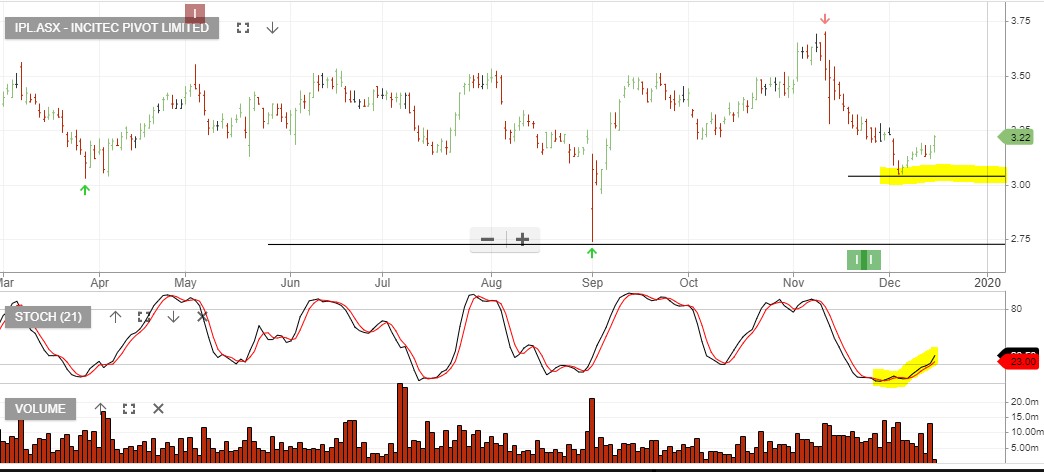

We’ve been tracking IPL for a turn higher in the short-term momentum indicators. It now appears that buying interest is increasing and we’ve seen the price action find support at $3.00.

Or start a free thirty day trial for our full service, which includes our ASX Research.