SPDR Property Fund ETF – Approaching Support

SPDR S&P/ASX 200 Listed Property is under Algo Engine buy conditions and is a current holding in ASX 100 model portfolio.

We anticipate buying support will build within the $13 to $13.50 price range.

SPDR S&P/ASX 200 Listed Property is under Algo Engine buy conditions and is a current holding in ASX 100 model portfolio.

We anticipate buying support will build within the $13 to $13.50 price range.

QBE Insurance Group is under Algo Engine buy conditions and is a current holding in ASX 100 model portfolio.

Support at $12.00

Evolution Mining is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The backdrop should now support a rally in gold prices and EVN offers upside from the current $3.80 level.

The Star Entertainment Group is now under Algo Engine buy conditions following a recent high low formation at $4.55.

We’re attracted to the longer-term fundamentals for Star but have been reluctant to hold the position whilst the stock was under sell conditions. The recent break higher in price and the shift to Algo buy conditions, means we’ve added Star back into our model portfolio.

The February earnings result will be a key catalyst, where the market will be looking for earnings growth beyond just cost control.

Lendlease is under Algo Engine buy conditions and the recent retracement in price from $20 to $18 provides another entry opportunity.

We expect buying interest to increase between $16.50 – $18.00.

Insurance Australia Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support for IAG at $7.50

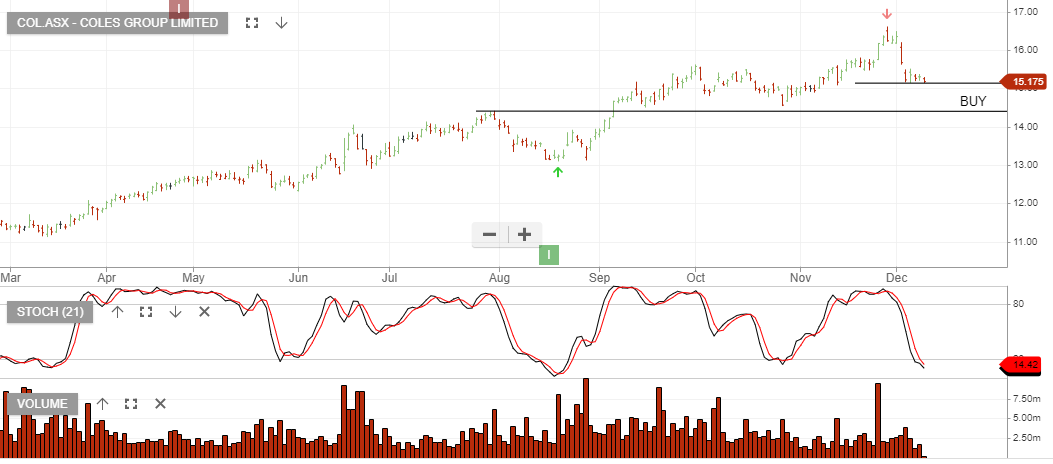

Coles Group is under Algo Engine buy conditions following the August buy signal at $13.00.

Since then Coles has rallied to $16, supported by investor enthusiasm for the aggressive cost-cutting program. As the stock price settles back we highlight the $14.50 level, as an area where value will again re-emerge.

Buy Coles within the $14.00 to $15.00 price range.

ASX is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support for ASX at $78.00

InvoCare is under Algo Engine buy conditions and the short-term indicators are now turning positive.

We see buying support building near $12.50

FY20 EPS growth should be 6%+ and we have the stock on a forward yield of 3.2%.

Treasury Wine Estates is under Algo Engine sell conditions and we highlight the recent softness in US sales data as a concern.

Sales within Asia continue to offset the US related weakness, however, we expect the TWE share price to remain under pressure.

Based on FY20 & FY21 EPS growth remaining in the 10 – 15% range, we have TWE EBIT growing from $660mn in FY19 to $850mn in FY21. This supports a forward yield of 3%.

We’re not holding TWE in our portfolio at present and we prepared today’s post on TWE as a reminder of the opportunity that lies ahead when the stock switches to buy conditions. We expect to see this in the first quarter of the New Year.

Downside target $15.50 – $16.50

Or start a free thirty day trial for our full service, which includes our ASX Research.